Solid State (LON:SOLI) Is Increasing Its Dividend To £0.135

Solid State plc's (LON:SOLI) periodic dividend will be increasing on the 29th of September to £0.135, with investors receiving 1.9% more than last year's £0.133. This takes the annual payment to 1.6% of the current stock price, which is about average for the industry.

View our latest analysis for Solid State

Solid State's Payment Has Solid Earnings Coverage

Solid dividend yields are great, but they only really help us if the payment is sustainable. However, Solid State's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to fall by 2.9%. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 38%, which is comfortable for the company to continue in the future.

Solid State Has A Solid Track Record

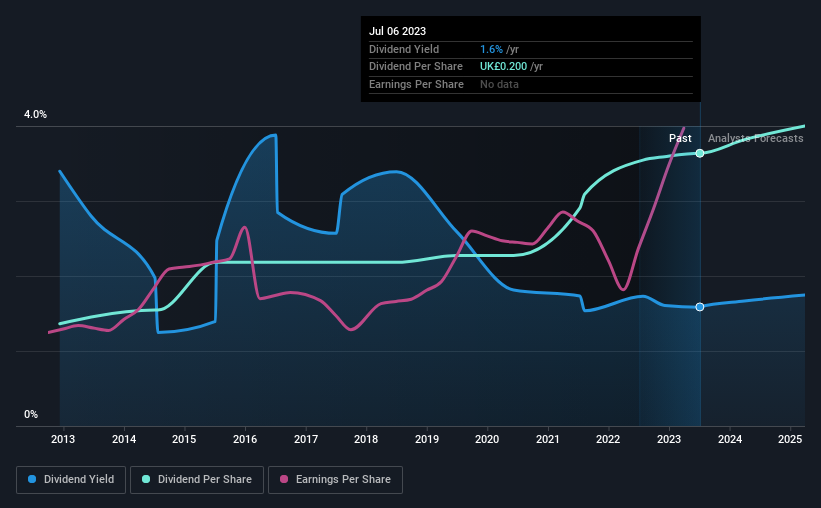

The company has a sustained record of paying dividends with very little fluctuation. Since 2013, the annual payment back then was £0.075, compared to the most recent full-year payment of £0.20. This works out to be a compound annual growth rate (CAGR) of approximately 10% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Solid State has seen EPS rising for the last five years, at 17% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

We should note that Solid State has issued stock equal to 33% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

We Really Like Solid State's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 2 warning signs for Solid State that investors should take into consideration. Is Solid State not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SOLI

Solid State

Designs, manufactures, distributes and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and Internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Airbnb (ABNB): Still one of the most interesting bets in travel

Playing the Long Game in a Soft Market

Nike - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!