What Did Synectics plc's (LON:SNX) CEO Take Home Last Year?

Paul Webb has been the CEO of Synectics plc (LON:SNX) since 2015. First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Synectics

How Does Paul Webb's Compensation Compare With Similar Sized Companies?

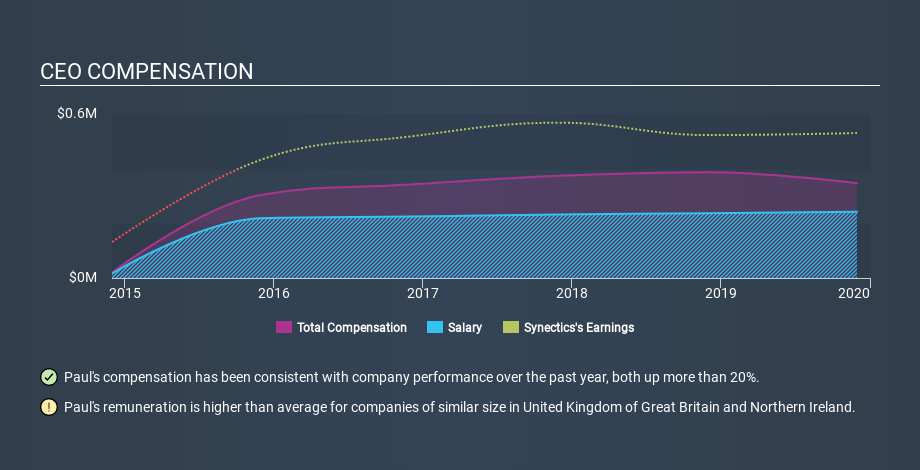

According to our data, Synectics plc has a market capitalization of UK£19m, and paid its CEO total annual compensation worth UK£347k over the year to November 2019. We think total compensation is more important but we note that the CEO salary is lower, at UK£242k. We looked at a group of companies with market capitalizations under UK£157m, and the median CEO total compensation was UK£267k.

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. Speaking on an industry level, we can see that nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. So it seems like there isn't a significant difference between Synectics and the broader market, in terms of salary allocation in the overall compensation package.

Thus we can conclude that Paul Webb receives more in total compensation than the median of a group of companies in the same market, and of similar size to Synectics plc. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance. You can see, below, how CEO compensation at Synectics has changed over time.

Is Synectics plc Growing?

Over the last three years Synectics plc has shrunk its earnings per share by an average of 10.0% per year (measured with a line of best fit). Its revenue is down 3.8% over last year.

Unfortunately, earnings per share have trended lower over the last three years. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Shareholders might be interested in this free visualization of analyst forecasts.

Has Synectics plc Been A Good Investment?

With a three year total loss of 39%, Synectics plc would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared total CEO remuneration at Synectics plc with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us. Arguably worse, investors are without a positive return for the last three years. In our opinion the CEO might be paid too generously! On another note, we've spotted 3 warning signs for Synectics that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:SNX

Synectics

Provides specialist video based electronic surveillance systems and technology for use in security applications, environments, and transport applications in the United Kingdom, rest of Europe, North America, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)