- United Kingdom

- /

- Metals and Mining

- /

- LSE:CAPD

Midwich Group And 2 Other Leading UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently been influenced by weak trade data from China, causing the FTSE 100 and FTSE 250 indices to close lower amid concerns over global economic recovery. In such uncertain times, dividend stocks like Midwich Group offer investors a potential source of steady income, providing an attractive option for those seeking stability in their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.44% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.91% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.67% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.88% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.65% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.78% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.73% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.97% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.99% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.46% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

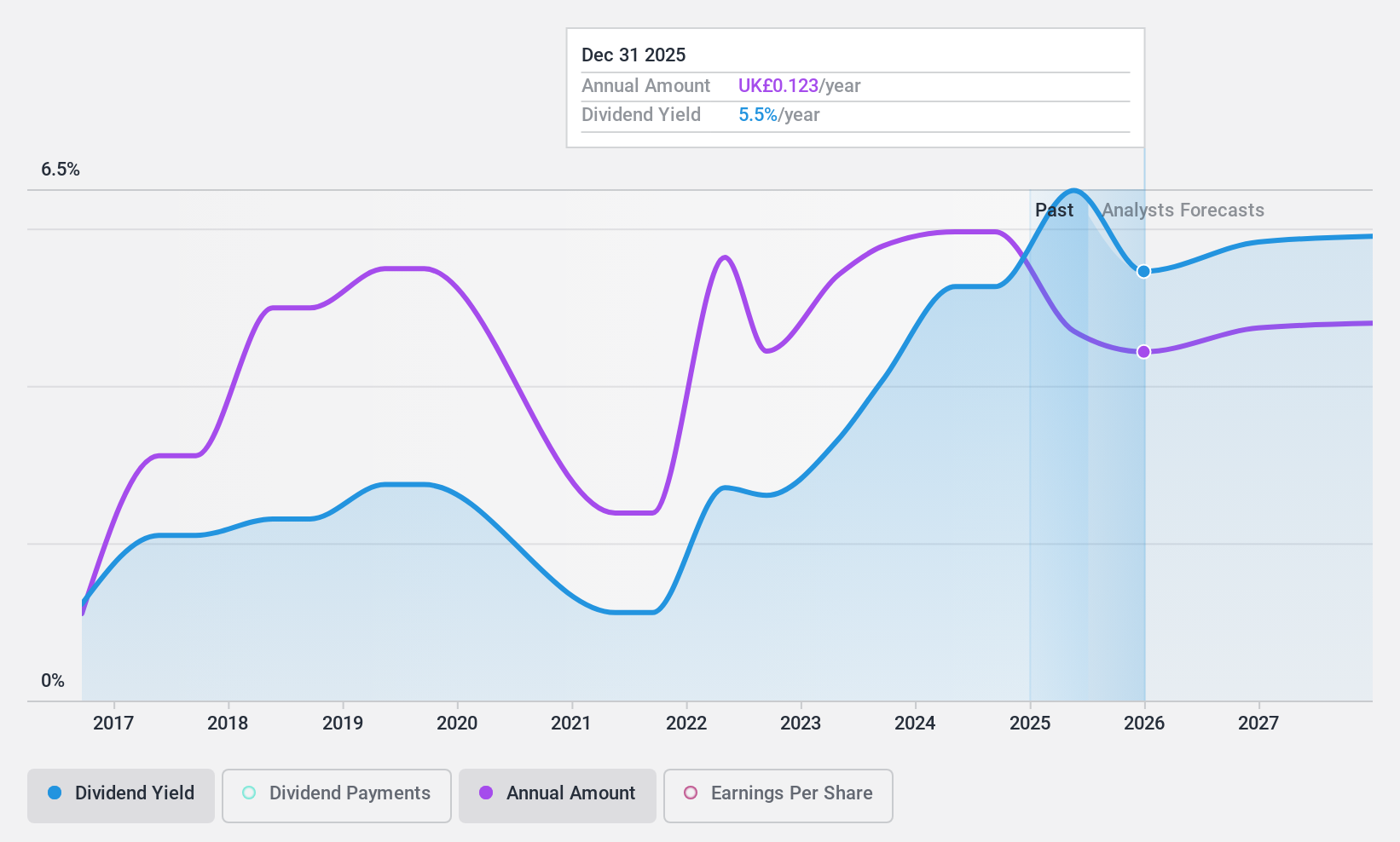

Midwich Group (AIM:MIDW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Midwich Group plc, along with its subsidiaries, is a distributor of audio visual solutions to trade customers across various regions including the United Kingdom, Ireland, Europe, the Middle East, Africa, Asia Pacific, and North America with a market cap of £262.94 million.

Operations: Midwich Group plc generates revenue through its wholesale distribution of computer peripherals, amounting to £1.32 billion.

Dividend Yield: 6.4%

Midwich Group's dividend is well-covered by earnings and cash flows, with payout ratios of 74.6% and 36.3%, respectively. Despite being among the top 25% of UK dividend payers, its dividends have been volatile over the past eight years, reflecting an unstable track record. The company's high debt level raises concerns about financial stability, especially as earnings are forecast to decline slightly over the next three years. However, it trades below estimated fair value compared to peers.

- Take a closer look at Midwich Group's potential here in our dividend report.

- Upon reviewing our latest valuation report, Midwich Group's share price might be too pessimistic.

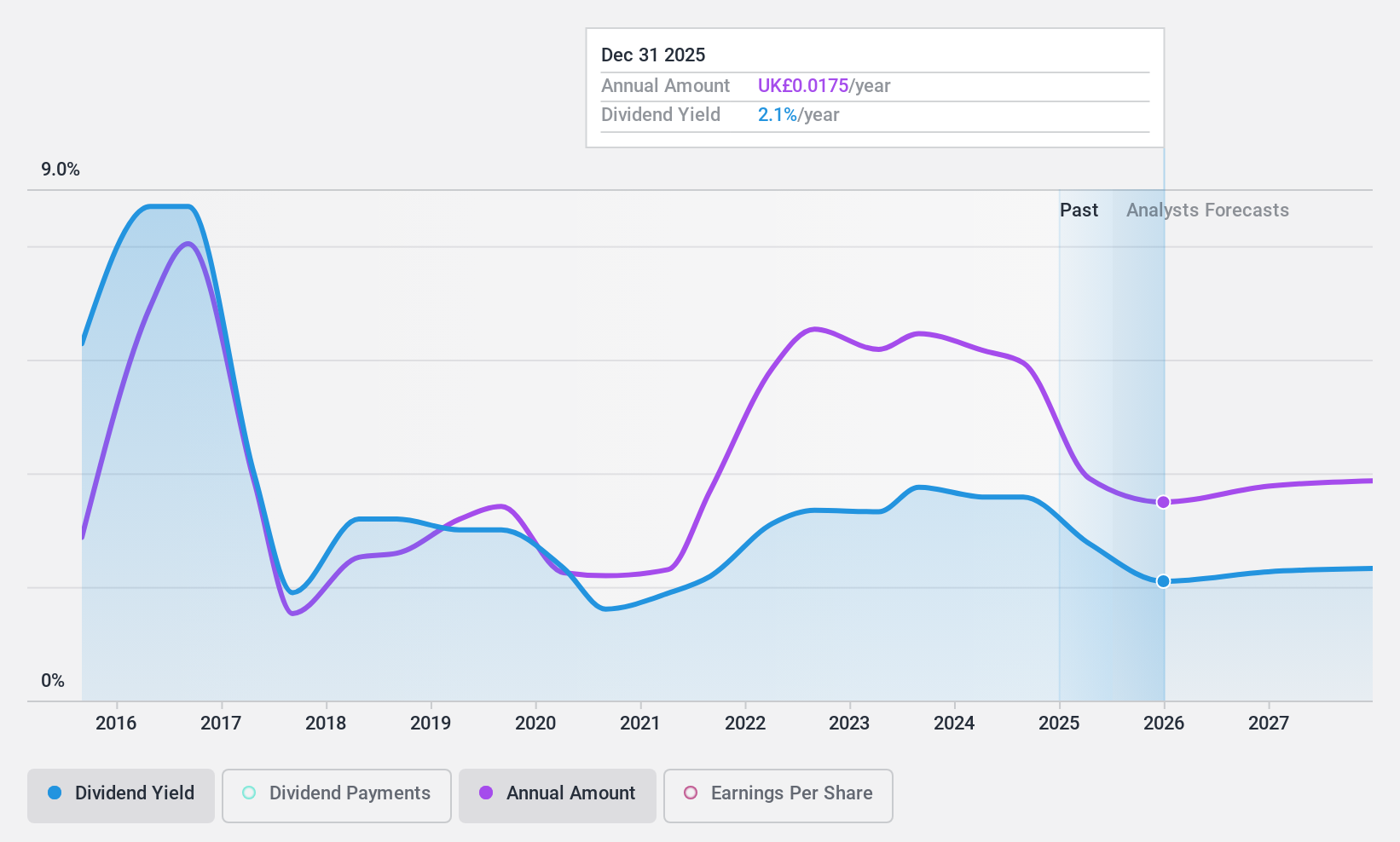

Capital (LSE:CAPD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Capital Limited, along with its subsidiaries, offers a range of drilling solutions to the minerals industry and has a market cap of £149.16 million.

Operations: Capital Limited generates revenue primarily through its Business Services segment, amounting to $333.59 million.

Dividend Yield: 4.1%

Capital Limited's dividends are well-covered by both earnings and cash flows, with low payout ratios of 26.1% and 24%. Despite a history of volatility in dividend payments over the past decade, recent revenue growth to US$348 million suggests potential financial stability. The stock trades significantly below estimated fair value, offering good relative value compared to peers. However, its dividend yield of 4.13% remains lower than the top UK market payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Capital.

- The analysis detailed in our Capital valuation report hints at an deflated share price compared to its estimated value.

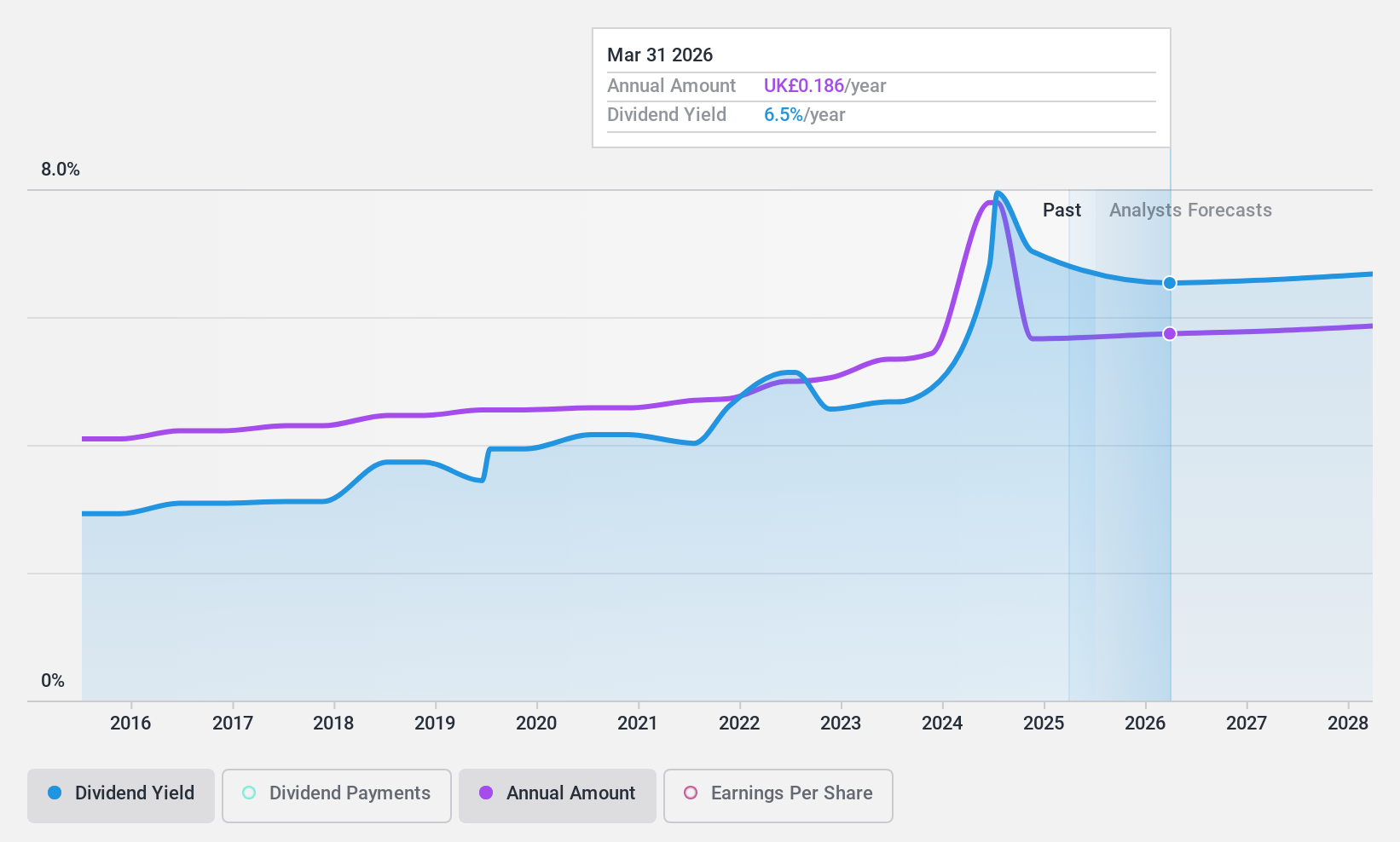

Castings (LSE:CGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Castings P.L.C. is involved in iron casting and machining operations across the UK, Germany, Sweden, the Netherlands, Europe, North and South America, with a market cap of £122.12 million.

Operations: Castings P.L.C.'s revenue is derived from its Foundry Operations, generating £225.67 million, and Machining Operations, contributing £35.57 million.

Dividend Yield: 6.5%

Castings P.L.C. offers a high dividend yield of 6.55%, ranking in the top 25% of UK dividend payers, but faces challenges in sustainability due to lack of free cash flow coverage and declining earnings, which fell to £3.07 million from £7.69 million year-on-year. Despite trading below estimated fair value and increasing dividends slightly to 4.21 pence per share, its history of volatile payments raises concerns about reliability for income-focused investors.

- Click to explore a detailed breakdown of our findings in Castings' dividend report.

- In light of our recent valuation report, it seems possible that Castings is trading beyond its estimated value.

Make It Happen

- Delve into our full catalog of 58 Top UK Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CAPD

Capital

Provides drilling, mining, mineral assaying, and surveying services.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives