- United Kingdom

- /

- Commercial Services

- /

- AIM:FIH

3 UK Penny Stocks With Market Caps Under £300M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index dipping due to weak trade data from China, highlighting global economic uncertainties. In such conditions, investors often explore opportunities in smaller companies that offer potential value and growth. Penny stocks, despite their old-fashioned name, continue to represent a segment of the market where financially sound companies can provide unique investment prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £527.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.27 | £183.39M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.985 | £14.87M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.675 | £96.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £73.12M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.904 | £719.19M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Afentra (AIM:AET)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Afentra plc, along with its subsidiaries, is an upstream oil and gas company focused on operations primarily in Africa, with a market capitalization of £108.55 million.

Operations: The company's revenue is derived entirely from its Oil & Gas - Exploration & Production segment, amounting to $157.22 million.

Market Cap: £108.55M

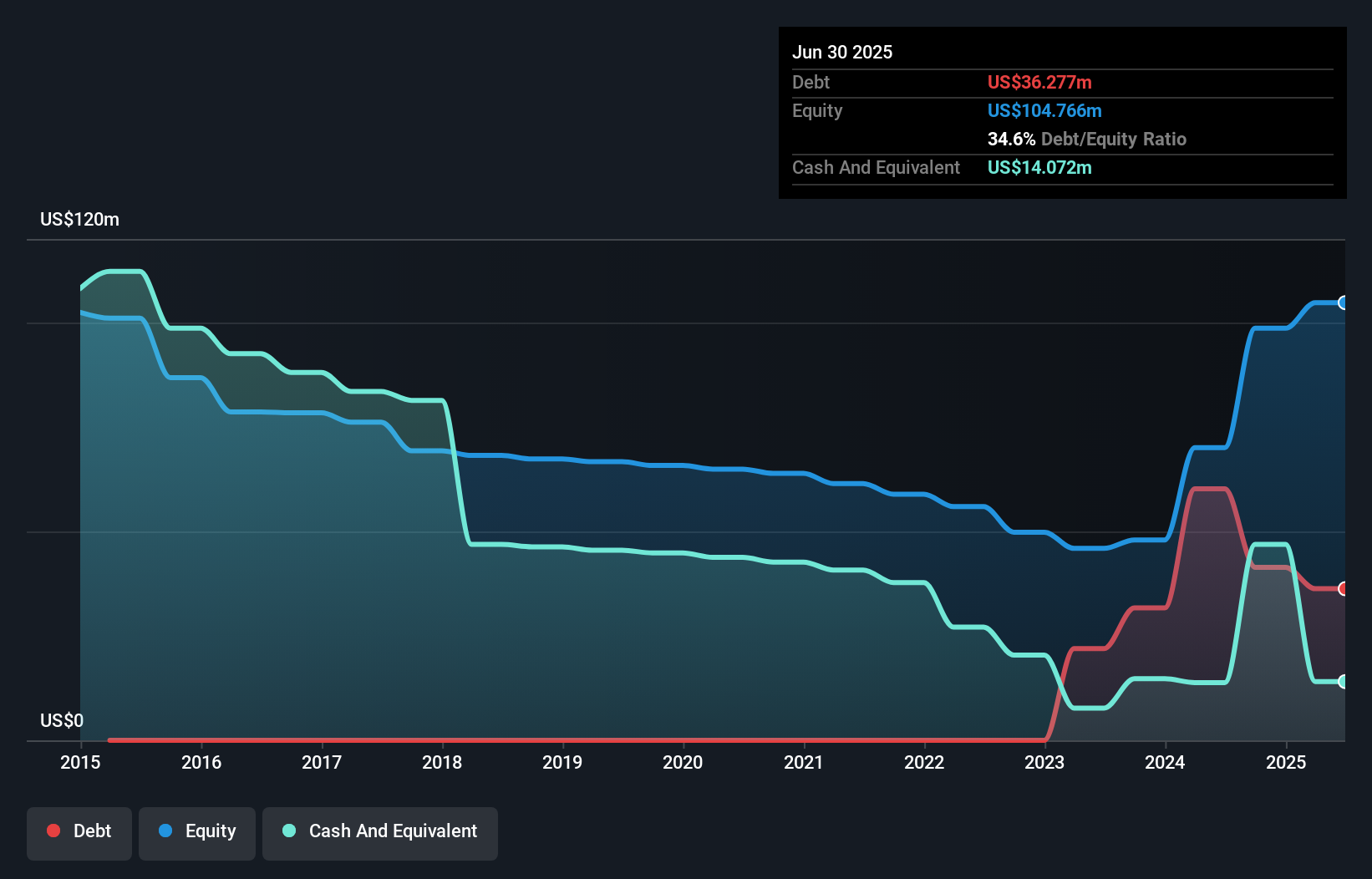

Afentra plc's market capitalization stands at £108.55 million, with significant revenue from its Oil & Gas - Exploration & Production segment totaling US$157.22 million. The company is trading at a substantial discount to its estimated fair value and boasts high-quality earnings, with a strong Return on Equity of 34.2%. Despite short-term liabilities exceeding assets by US$11.5 million, Afentra's debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT. Recent developments include an acreage expansion in Angola through the signing of Heads of Terms for offshore Block 3/24, enhancing exploration prospects and operational capacity.

- Click to explore a detailed breakdown of our findings in Afentra's financial health report.

- Learn about Afentra's future growth trajectory here.

Concurrent Technologies (AIM:CNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Concurrent Technologies Plc, with a market cap of £208.30 million, designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers.

Operations: The company generates revenue of £44.57 million from the design, manufacture, and supply of high-end embedded computer products.

Market Cap: £208.3M

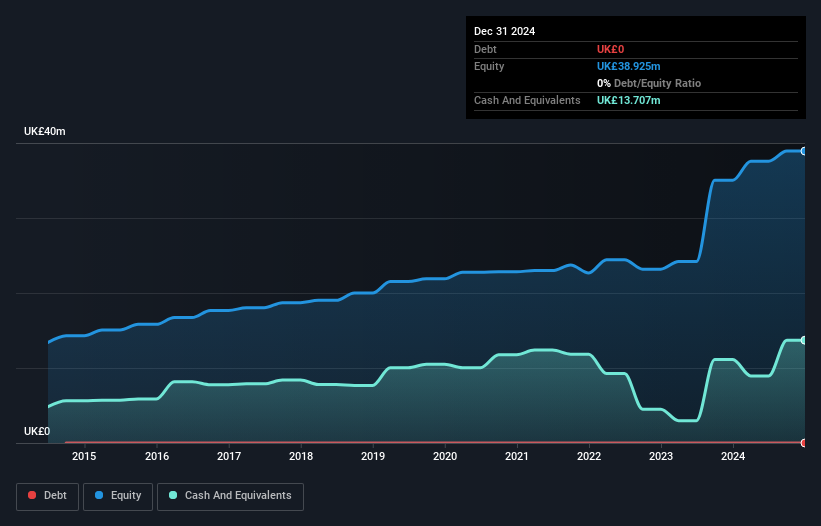

Concurrent Technologies Plc, with a market cap of £208.30 million, is debt-free and boasts solid financial health, as its short-term assets (£31.5M) surpass both short-term (£6.9M) and long-term liabilities (£3.2M). Recent earnings reports show growth in sales to £21.06 million for the half-year ending June 2025, up from £16.81 million the previous year, alongside steady net income increases. The company secured significant contracts in the defense sector, including a $5.25 million design services deal with a US-based contractor and a €4 million equipment program with a UK defense prime contractor, indicating strong industry positioning and potential revenue streams through 2028 and beyond.

- Get an in-depth perspective on Concurrent Technologies' performance by reading our balance sheet health report here.

- Explore Concurrent Technologies' analyst forecasts in our growth report.

FIH group (AIM:FIH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIH group plc operates through its subsidiaries to offer retailing, property, automotive, insurance, tourism shipping, and fishing agency services in the Falkland Islands and the United Kingdom with a market cap of £29.80 million.

Operations: The company's revenue streams include £4.28 million from ferry services in Portsmouth, £17.00 million from general trading activities in the Falkland Islands, and £19.57 million from art logistics and storage operations in the United Kingdom.

Market Cap: £29.8M

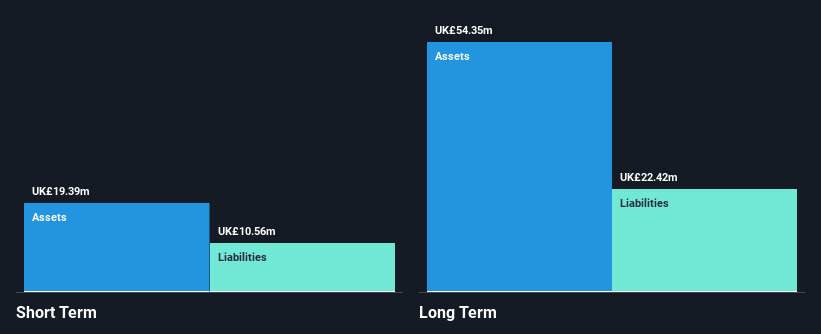

FIH Group, with a market cap of £29.80 million, operates across diverse sectors including retail and logistics. Despite being unprofitable, it has reduced losses by 17.3% annually over the past five years and maintains a satisfactory net debt to equity ratio of 9.7%. The company’s short-term assets (£20.1M) exceed both its long-term (£19.2M) and short-term liabilities (£14.6M), indicating solid balance sheet management despite high share price volatility recently observed in UK markets. Recent announcements include a special dividend of 70 pence per share alongside regular dividends, reflecting shareholder value focus amidst ongoing financial challenges.

- Navigate through the intricacies of FIH group with our comprehensive balance sheet health report here.

- Examine FIH group's past performance report to understand how it has performed in prior years.

Summing It All Up

- Embark on your investment journey to our 293 UK Penny Stocks selection here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FIH

FIH group

Through its subsidiaries, provides retailing, property, automotive, insurance, tourism shipping, and fishing agency services in the Falkland Islands and the United Kingdom.

Excellent balance sheet with low risk.

Market Insights

Community Narratives