As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors are taking a closer look at alternative opportunities within the UK market. Penny stocks, while often seen as relics of past market eras, still hold potential for those seeking affordable entry points into companies with growth prospects. By identifying penny stocks with strong financial foundations and clear growth strategies, investors may uncover promising opportunities amidst broader market challenges.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.02 | £452.42M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.575 | £369.6M | ✅ 5 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.838 | £1.14B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.34 | £169.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.44 | £428.07M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.81 | £290.33M | ✅ 5 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.025 | £163.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.305 | £72.18M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 399 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Solid State plc, with a market cap of £104.83 million, designs, manufactures, and supplies electronic equipment across the United Kingdom, Europe, Asia, North America, and internationally.

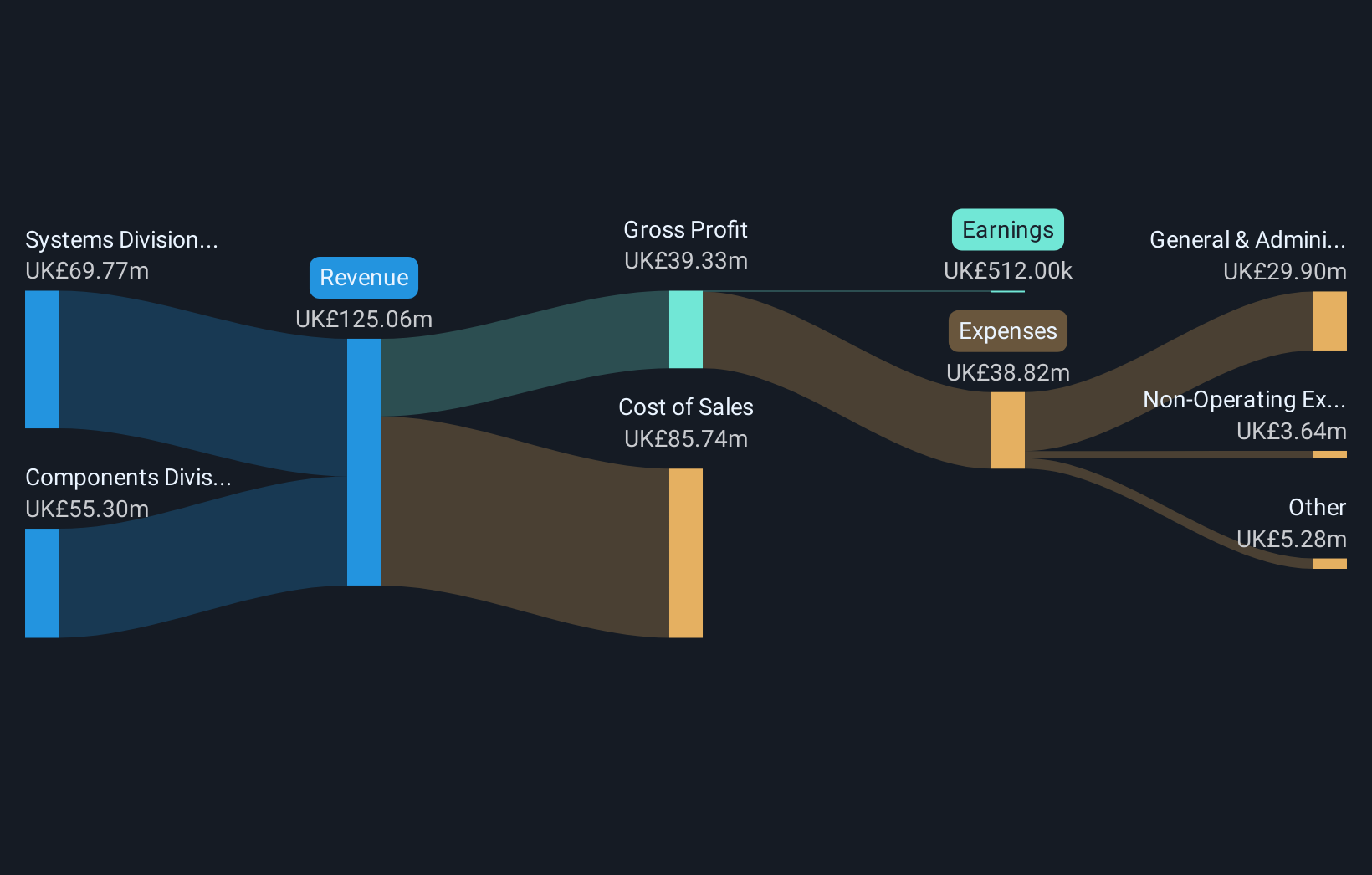

Operations: The company generates revenue through its Systems Division, which accounts for £81.69 million, and its Components Division, contributing £55.26 million.

Market Cap: £104.83M

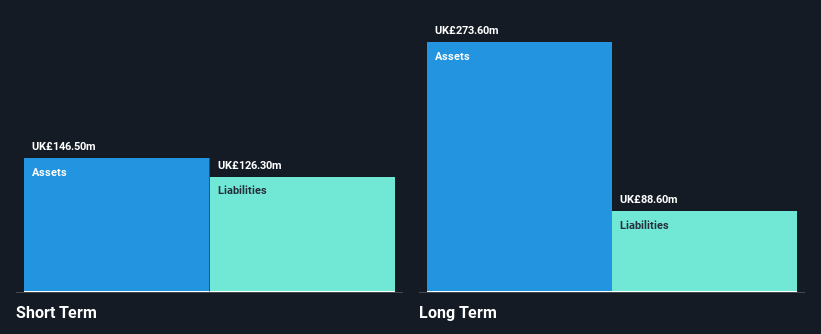

Solid State plc, with a market cap of £104.83 million, has shown resilience despite recent challenges. The company recently secured a follow-on order for IoT technology from a US customer and a $25 million defence communications contract, indicating strong demand for its offerings. While revenue is projected to grow modestly, earnings are expected to decline significantly over the next three years. The company's financial health is supported by short-term assets exceeding liabilities and manageable debt levels covered by cash flow. However, negative earnings growth and high share price volatility remain concerns for potential investors in this penny stock.

- Unlock comprehensive insights into our analysis of Solid State stock in this financial health report.

- Learn about Solid State's future growth trajectory here.

Centaur Media (LSE:CAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaur Media Plc provides business information, learning, and specialist consultancy services to professional and commercial markets globally, with a market cap of £48.93 million.

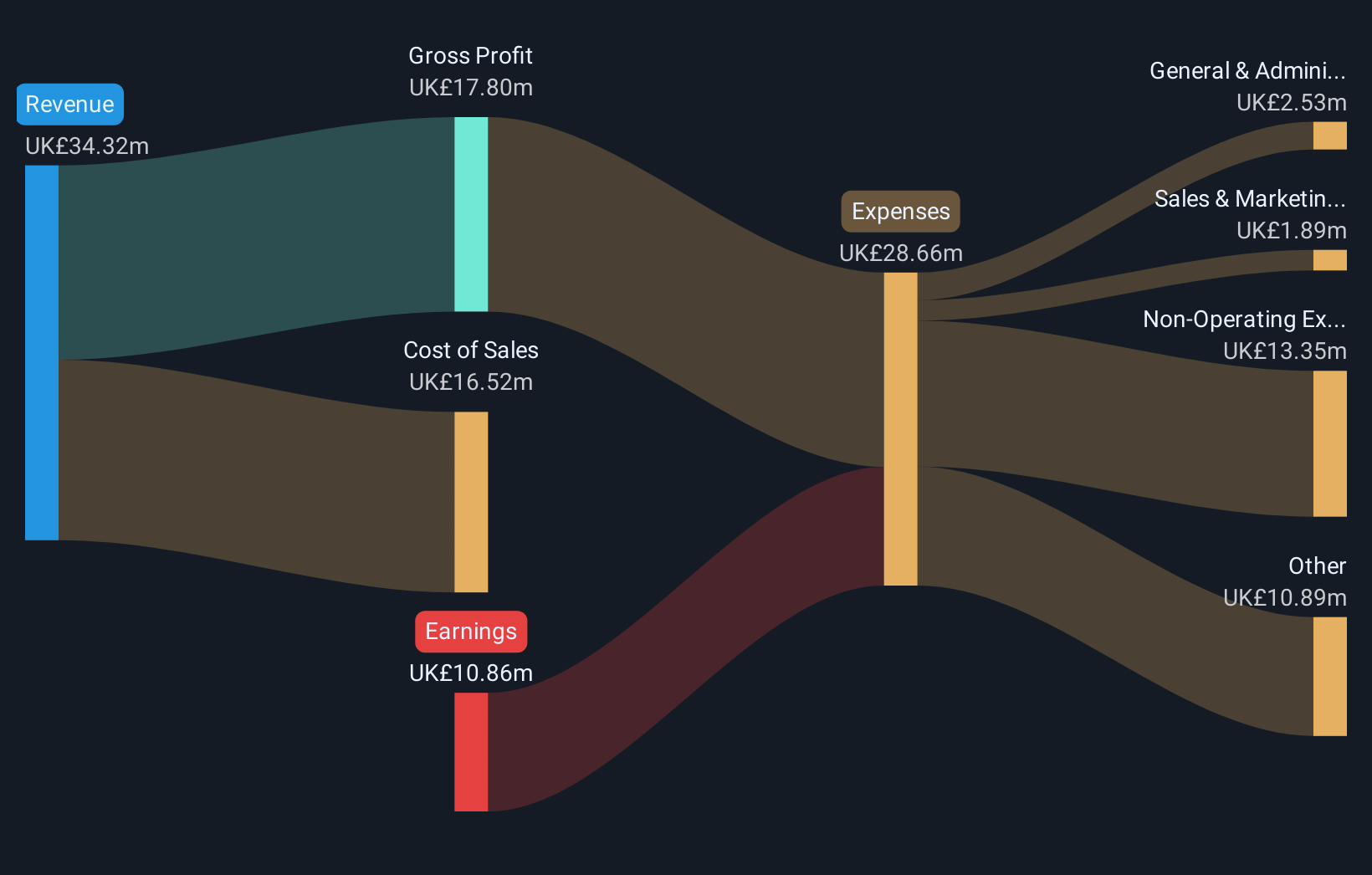

Operations: The company's revenue is primarily derived from two segments: Xeim, contributing £26.21 million, and The Lawyer, generating £8.91 million.

Market Cap: £48.93M

Centaur Media Plc, with a market cap of £48.93 million, faces challenges as it remains unprofitable but has reduced losses by 41.8% annually over five years. It trades below estimated fair value and maintains a dividend yield of 5.42%, though not well-covered by earnings or cash flow. Despite sufficient cash runway for over three years, short-term liabilities exceed assets, posing financial risks. Recent discussions about selling MiniMBA to Brave Bison Group for £19 million could impact future operations if concluded successfully, while the board's experience contrasts with a less seasoned management team averaging 1.1 years in tenure.

- Take a closer look at Centaur Media's potential here in our financial health report.

- Review our growth performance report to gain insights into Centaur Media's future.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe, with a market cap of £488.07 million.

Operations: The company's revenue is derived from two main segments: Cyber Security, generating £256.58 million, and Escode, contributing £65.55 million.

Market Cap: £488.07M

NCC Group plc, with a market cap of £488.07 million, operates in the cyber and software resilience sector and is currently unprofitable, with losses increasing by 44.3% annually over five years. Despite this, its debt is well-covered by operating cash flow at 26.4%, and short-term assets exceed liabilities. The company trades slightly below estimated fair value and has not diluted shareholders recently. NCC's strategic review of its Escode division could influence future operations, while a new £120 million revolving credit facility strengthens financial flexibility following the sale of Fox Crypto B.V., leaving net cash at £0.3 million as of March 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of NCC Group.

- Examine NCC Group's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Explore the 399 names from our UK Penny Stocks screener here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOLI

Solid State

Designs, manufactures, distributes and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and Internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives