- United Kingdom

- /

- Hospitality

- /

- LSE:PPH

UK Growth Stocks With High Insider Ownership And 25% Earnings Growth

Reviewed by Simply Wall St

In the current landscape, the United Kingdom's FTSE 100 index has faced challenges, particularly influenced by weak trade data from China, which has impacted companies with significant ties to Chinese markets. Amidst these fluctuations, investors often seek growth stocks with high insider ownership and robust earnings growth as potential opportunities for stability and long-term value in a volatile market environment.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Taylor Maritime (LSE:TMI) | 20.9% | 65% |

| SRT Marine Systems (AIM:SRT) | 24.3% | 91.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 18.2% | 20.8% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 85.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 24.6% | 62% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| ASA International Group (LSE:ASAI) | 18.4% | 23.3% |

| ActiveOps (AIM:AOM) | 21.6% | 43.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally with a market cap of £1.11 billion.

Operations: The company's revenue is derived from three main segments: Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

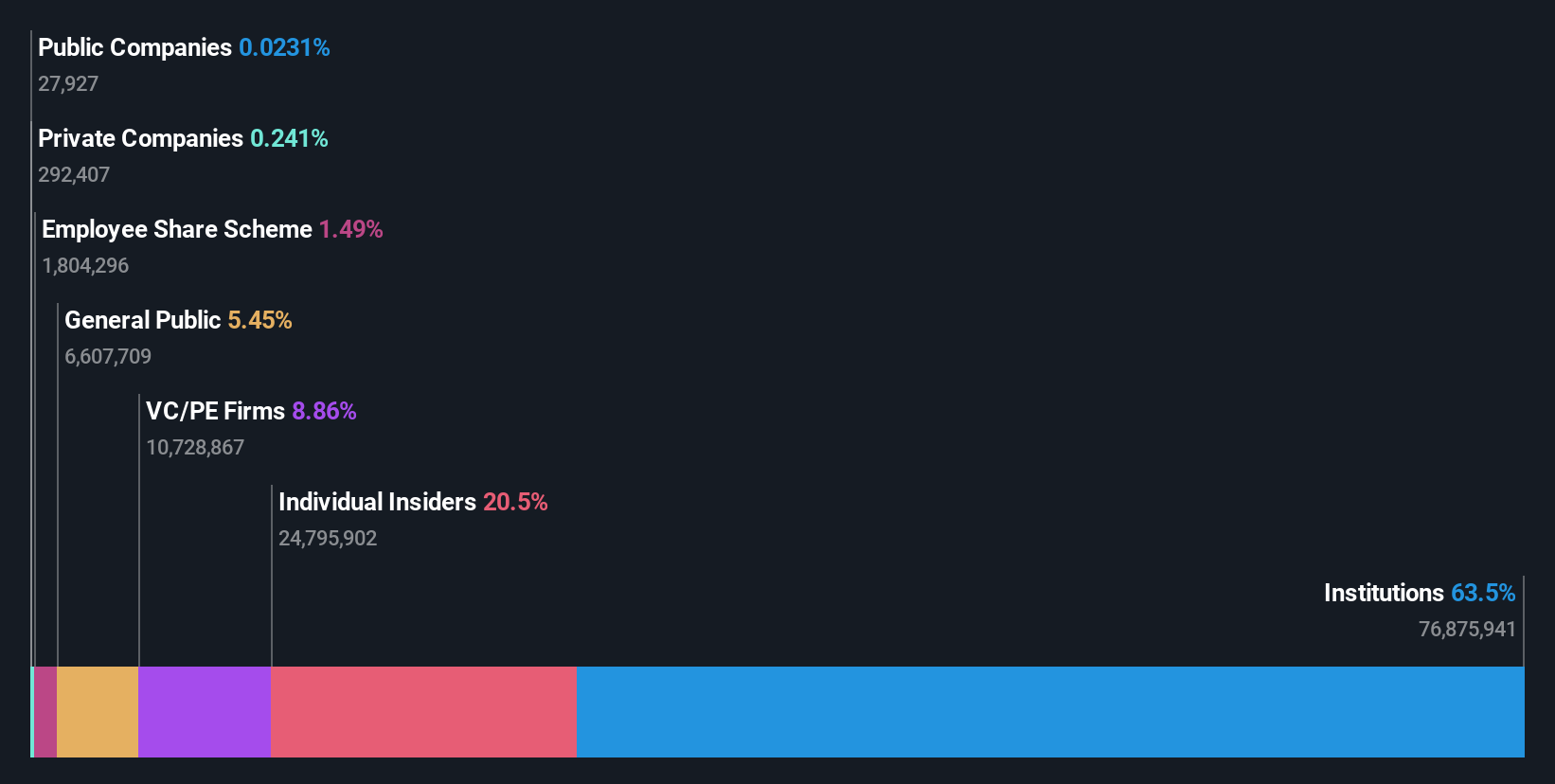

Insider Ownership: 20.6%

Earnings Growth Forecast: 16.8% p.a.

Kainos Group's earnings are projected to grow at 16.84% annually, outpacing the UK market average of 13.8%, although revenue growth is slower at 7.2%. Recent guidance indicates revenues for FY2026 could reach £393.4 million, exceeding consensus estimates due to strong sales performance. Despite a dividend yield of 3.08% not being well-covered by earnings, insider ownership remains substantial with no significant recent insider trading activity noted. The appointment of Shruthi Chindalur as a Non-Executive Director adds valuable tech sector expertise to the board.

- Get an in-depth perspective on Kainos Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Kainos Group's current price could be inflated.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising hospitality real estate across several European countries including the Netherlands and the United Kingdom, with a market cap of £585.85 million.

Operations: The company's revenue segments include Management and Central Services (£56.70 million) and Owned Hotel Operations in Croatia (£85.91 million), Germany (£23.33 million), the United Kingdom (£256.21 million), and the Netherlands (£64.59 million).

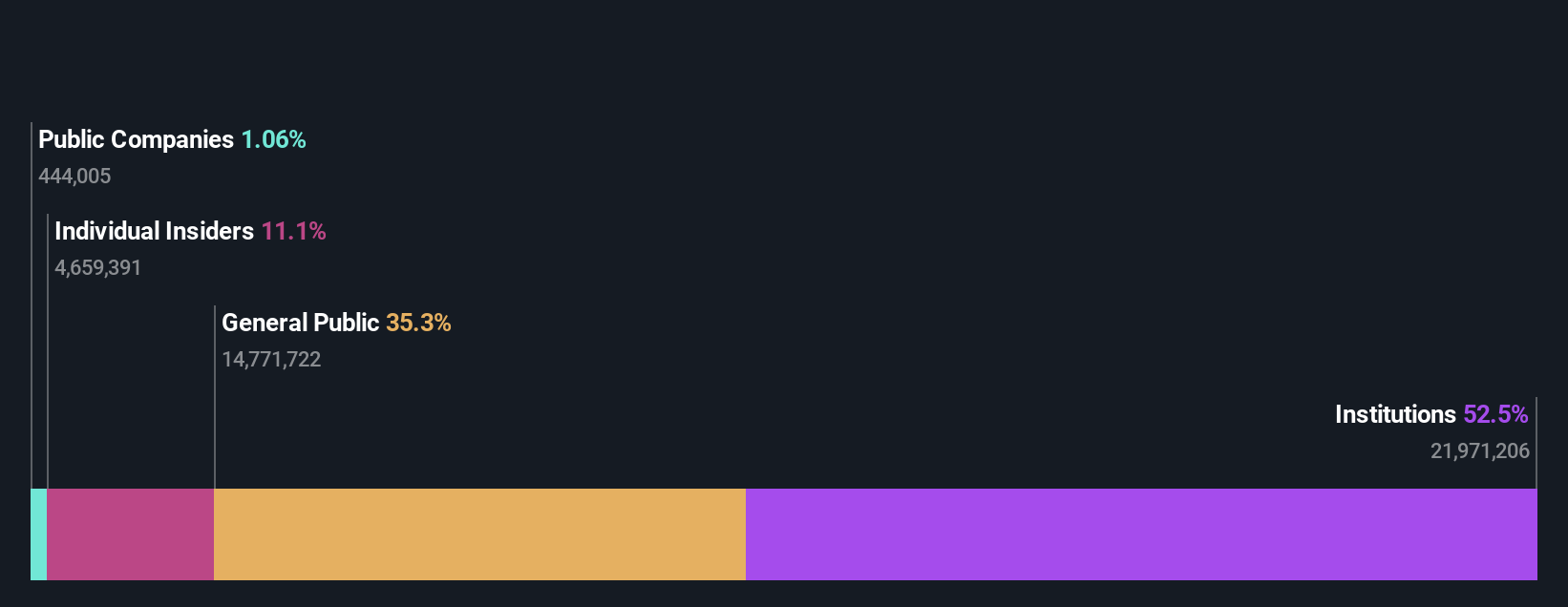

Insider Ownership: 11.1%

Earnings Growth Forecast: 25.7% p.a.

PPHE Hotel Group's earnings are forecast to grow significantly at 25.7% annually, surpassing the UK market average. Despite trading well below estimated fair value, recent financials show a net loss of £2.91 million for H1 2025. Insider activity has been more on the buying side recently, albeit not substantially. The company completed a £17.5 million acquisition near London for a mixed-use development, aligning with its expansion strategy and sustainability goals despite an unstable dividend history.

- Click here and access our complete growth analysis report to understand the dynamics of PPHE Hotel Group.

- Our valuation report here indicates PPHE Hotel Group may be overvalued.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market cap of £2.46 billion.

Operations: The company's revenue segments include Georgian Financial Services generating GEL 2.38 billion and Uzbekistan Operations contributing GEL 408.17 million.

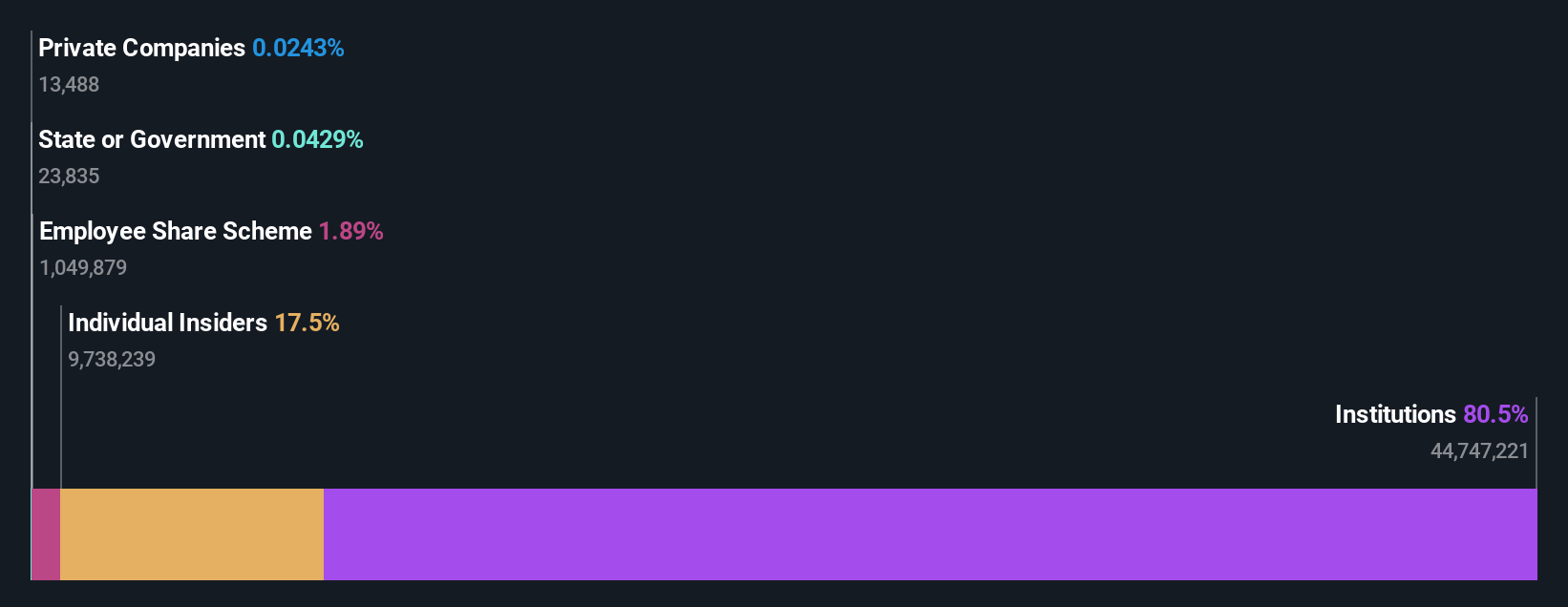

Insider Ownership: 17.9%

Earnings Growth Forecast: 17.4% p.a.

TBC Bank Group's revenue is expected to grow significantly at 22.6% annually, outpacing the UK market. Despite a high level of bad loans at 2.5%, the company trades well below its estimated fair value and has initiated a GEL 75 million share buyback program to return excess capital to shareholders. Recent earnings reports show steady growth in net interest income and net income, although dividend stability remains an issue.

- Take a closer look at TBC Bank Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that TBC Bank Group's current price could be quite moderate.

Key Takeaways

- Investigate our full lineup of 59 Fast Growing UK Companies With High Insider Ownership right here.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PPH

PPHE Hotel Group

Owns, co-owns, develops, leases, operates, and franchises hospitality real estate in the Netherlands, the United Kingdom, Germany, Croatia, Austria, Hungary, Italy, and Serbia.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026