- United Kingdom

- /

- Building

- /

- AIM:ALU

UK Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China impacting global economic sentiment. Despite these broader market pressures, investors may find opportunities in penny stocks—smaller or newer companies that can offer growth potential at lower price points. While the term "penny stocks" might seem outdated, these investments can be appealing when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.77 | £285.64M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.35 | £170.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Warpaint London (AIM:W7L) | £4.75 | £383.74M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.98 | £448.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.385 | £422.77M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.86 | £1.16B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.982 | £156.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 397 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alumasc Group (AIM:ALU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Alumasc Group plc, with a market cap of £138.46 million, manufactures and sells building products, systems, and solutions across the United Kingdom, Europe, North America, the Middle East, the Far East, and other international markets.

Operations: The company's revenue is derived from three main segments: Water Management (£55.87 million), Building Envelope (£39.16 million), and Housebuilding Products (£15.24 million).

Market Cap: £138.46M

The Alumasc Group has demonstrated solid financial performance with a 19.7% earnings growth over the past year, surpassing industry averages. Its net debt to equity ratio stands at a satisfactory 12.2%, and its short-term assets exceed both short and long-term liabilities, indicating strong liquidity management. The company maintains high-quality earnings and its return on equity is robust at 25.5%. Recent investments in expanding manufacturing capabilities at Halstead aim to bolster efficiency and support international sales growth for their Gatic brand, reflecting strategic positioning for future expansion despite an unstable dividend track record.

- Navigate through the intricacies of Alumasc Group with our comprehensive balance sheet health report here.

- Gain insights into Alumasc Group's outlook and expected performance with our report on the company's earnings estimates.

Made Tech Group (AIM:MTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Made Tech Group Plc offers digital, data, and technology services to the UK public sector and has a market cap of £44.89 million.

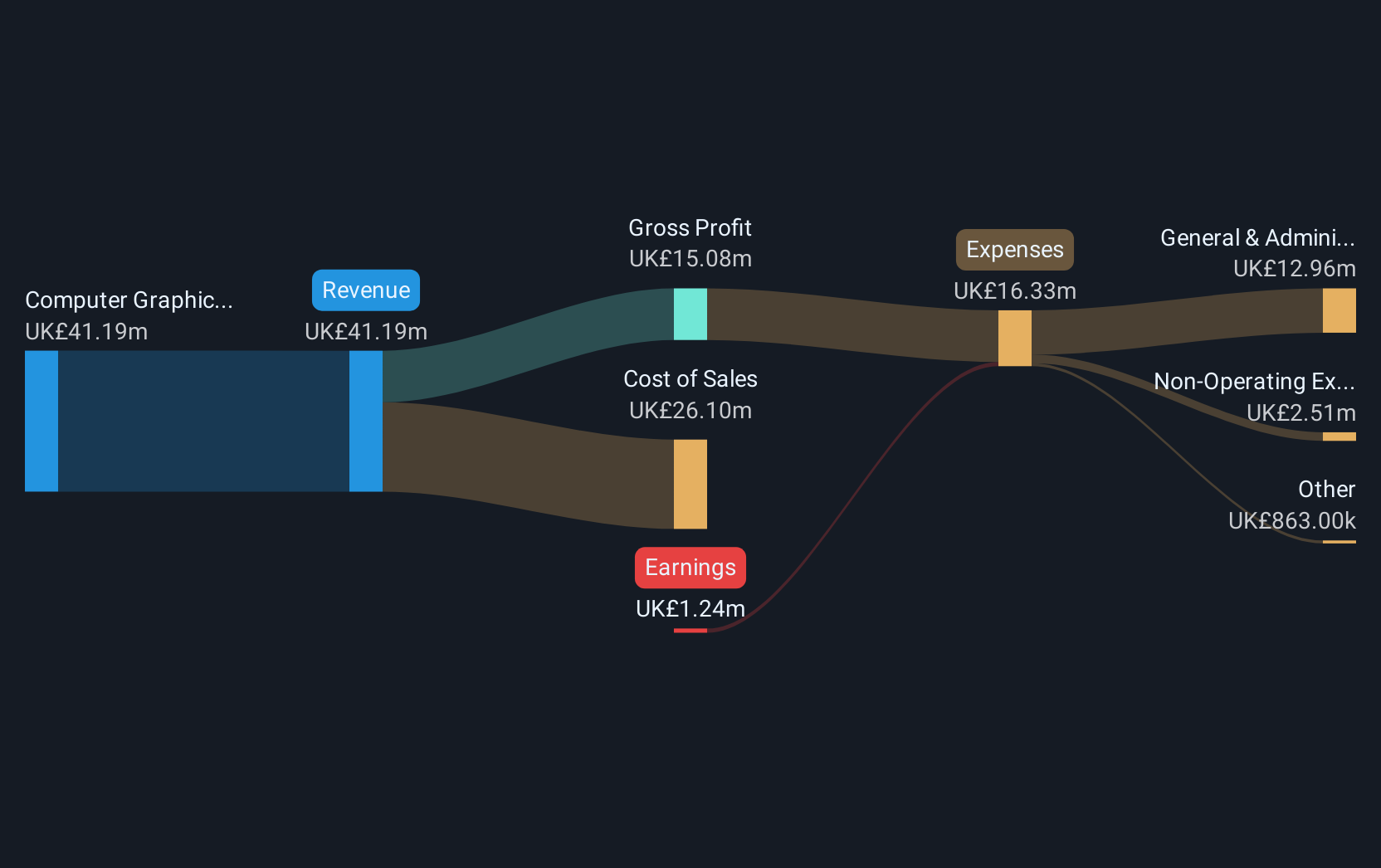

Operations: The company generates revenue of £41.19 million from its Computer Graphics segment.

Market Cap: £44.89M

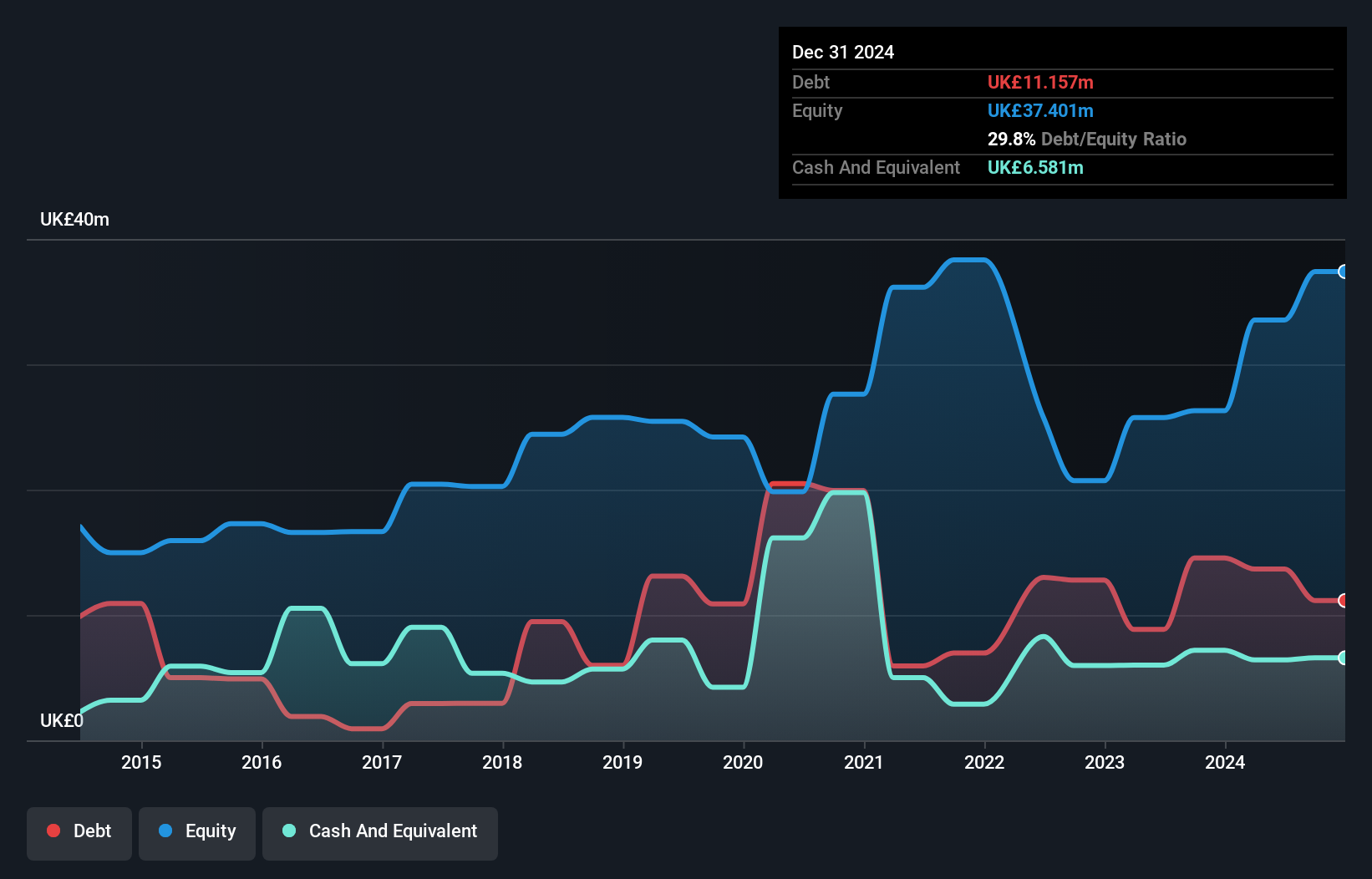

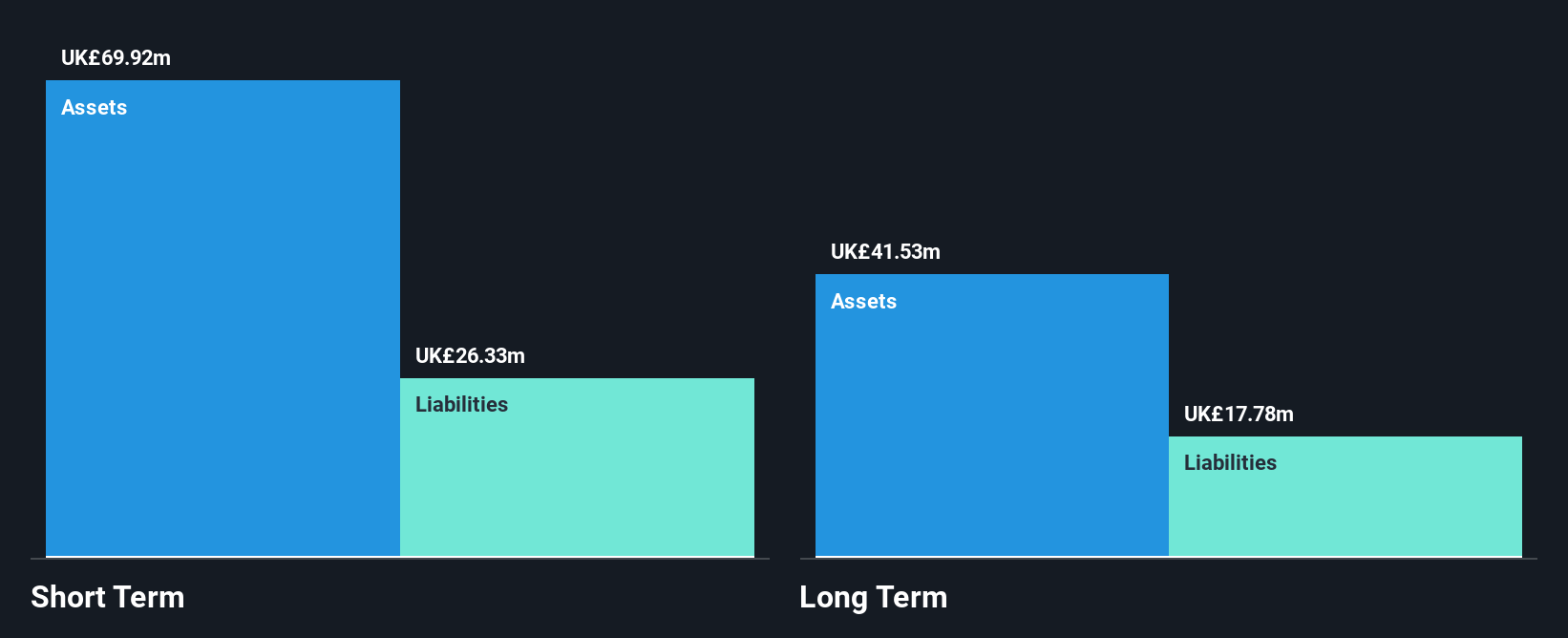

Made Tech Group Plc, with a market cap of £44.89 million, is experiencing robust sales momentum, evidenced by recent contract wins totaling £68.2 million for fiscal 2025. Despite being unprofitable and having negative return on equity at -9.19%, the company has a strong cash position that covers liabilities and provides a cash runway exceeding three years even with shrinking positive free cash flow. Revenue growth is modestly projected at 6.52% annually, although historical earnings have declined significantly by 39.2% per year over five years, reflecting challenges in achieving profitability amidst strategic public sector engagements.

- Take a closer look at Made Tech Group's potential here in our financial health report.

- Learn about Made Tech Group's future growth trajectory here.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc offers IT services across various regions including the United Kingdom, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £247.60 million.

Operations: The company generates revenue of £257.70 million from its global professional services segment.

Market Cap: £247.6M

FDM Group (Holdings) plc, with a market cap of £247.60 million, presents a mixed picture for investors interested in penny stocks. The company is debt-free and has an impressive return on equity at 30.5%, but recent financial performance shows challenges with declining earnings and reduced profit margins from 12.2% to 8%. Despite trading at a significant discount to its estimated fair value, the sustainability of its dividend yield of 9.93% remains questionable due to insufficient earnings coverage. The management team and board are experienced, suggesting strong governance amid ongoing strategic adjustments following executive changes earlier this year.

- Unlock comprehensive insights into our analysis of FDM Group (Holdings) stock in this financial health report.

- Assess FDM Group (Holdings)'s future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Reveal the 397 hidden gems among our UK Penny Stocks screener with a single click here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products, systems, and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives