- United Kingdom

- /

- IT

- /

- LSE:FDM

How Does FDM Group (Holdings)'s (LON:FDM) P/E Compare To Its Industry, After Its Big Share Price Gain?

FDM Group (Holdings) (LON:FDM) shareholders are no doubt pleased to see that the share price has bounced 46% in the last month alone, although it is still down 29% over the last quarter. But shareholders may not all be feeling jubilant, since the share price is still down 23% in the last year.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So some would prefer to hold off buying when there is a lot of optimism towards a stock. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

Check out our latest analysis for FDM Group (Holdings)

Does FDM Group (Holdings) Have A Relatively High Or Low P/E For Its Industry?

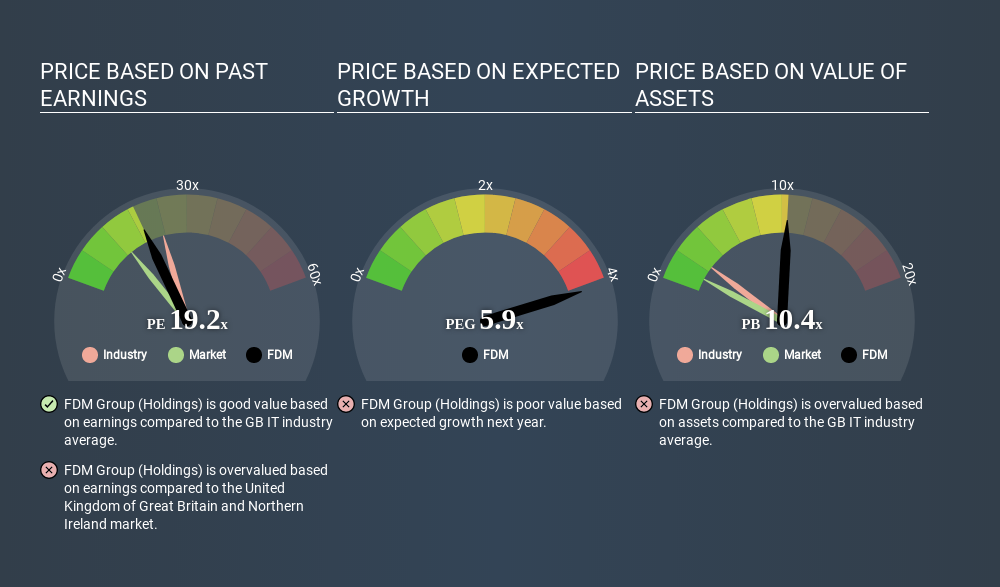

We can tell from its P/E ratio of 19.21 that sentiment around FDM Group (Holdings) isn't particularly high. The image below shows that FDM Group (Holdings) has a lower P/E than the average (23.3) P/E for companies in the it industry.

This suggests that market participants think FDM Group (Holdings) will underperform other companies in its industry. Since the market seems unimpressed with FDM Group (Holdings), it's quite possible it could surprise on the upside. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

FDM Group (Holdings) increased earnings per share by 9.1% last year. And its annual EPS growth rate over 5 years is 24%.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

FDM Group (Holdings)'s Balance Sheet

FDM Group (Holdings) has net cash of UK£37m. That should lead to a higher P/E than if it did have debt, because its strong balance sheets gives it more options.

The Bottom Line On FDM Group (Holdings)'s P/E Ratio

FDM Group (Holdings) has a P/E of 19.2. That's higher than the average in its market, which is 13.5. EPS was up modestly better over the last twelve months. Also positive, the relatively strong balance sheet will allow for investment in growth -- and the P/E indicates shareholders that will happen! What we know for sure is that investors have become much more excited about FDM Group (Holdings) recently, since they have pushed its P/E ratio from 13.1 to 19.2 over the last month. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

You might be able to find a better buy than FDM Group (Holdings). If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives