- United Kingdom

- /

- IT

- /

- LSE:FDM

3 UK Penny Stocks With Market Caps Larger Than £300M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid global economic concerns, particularly from China's slow recovery. Despite these broader market pressures, investors continue to seek opportunities in smaller companies that offer potential growth and value. Penny stocks, though an older term, remain relevant as they often represent emerging companies with promising prospects when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.85 | £176.31M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.95 | £474.22M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.255 | £304.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.11 | £800.61M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.08 | £405.78M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.46 | £167.92M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.452 | £219.31M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.53 | £187.85M | ★★★★★☆ |

| Ultimate Products (LSE:ULTP) | £1.4225 | £121.88M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.90 | £67.78M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Central Asia Metals (AIM:CAML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Central Asia Metals plc, along with its subsidiaries, operates as a base metals producer with a market cap of £313.15 million.

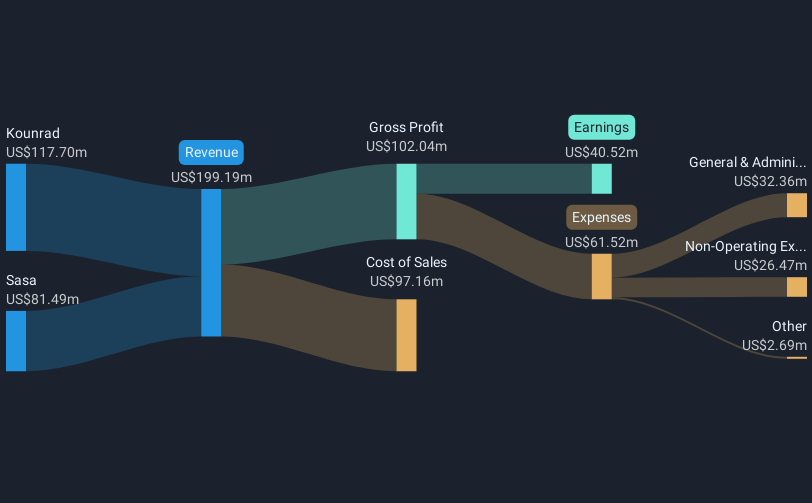

Operations: The company's revenue is derived from two primary segments: Sasa, contributing $81.49 million, and Kounrad, generating $117.7 million.

Market Cap: £313.15M

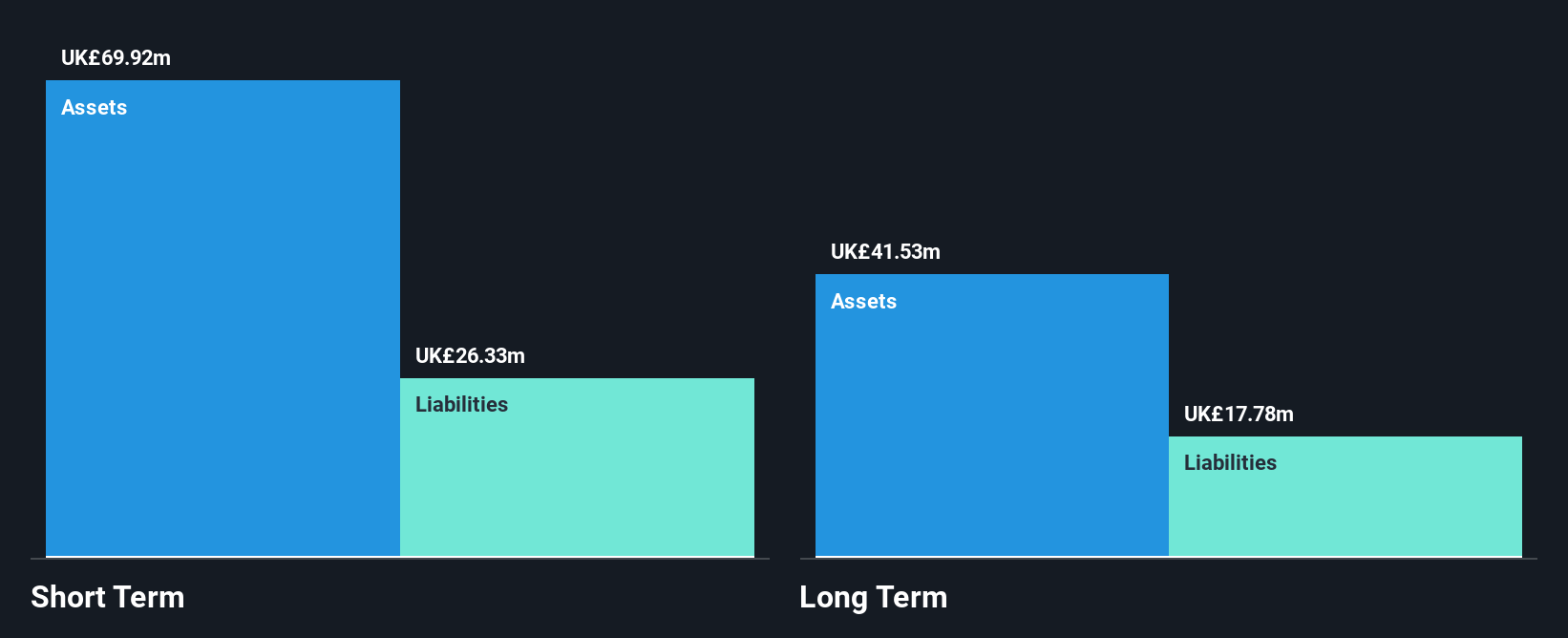

Central Asia Metals plc has shown significant earnings growth over the past year, with a very large increase of 2874.7%, marking a strong recovery from its five-year average decline. Despite this volatility, the company trades at a substantial discount to its estimated fair value and is considered good relative value compared to industry peers. The recent executive changes, including Gavin Ferrar's appointment as CEO, may impact strategic direction but do not overshadow its stable financial position, with short-term assets covering both short- and long-term liabilities and debt well covered by operating cash flow. However, dividend sustainability remains questionable due to limited earnings coverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Central Asia Metals.

- Explore Central Asia Metals' analyst forecasts in our growth report.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of approximately £624.68 million.

Operations: The company generates revenue of £1.04 billion from its online retailing operations focused on domestic appliances and ancillary services.

Market Cap: £624.68M

AO World has demonstrated robust financial health, with earnings growth of 298.4% over the past year, surpassing its five-year average and industry performance. The company is trading below its estimated fair value, suggesting potential undervaluation. Despite a low return on equity at 17.9%, AO World maintains strong cash flow coverage for its debt and interest payments, reflecting prudent financial management. The management team and board are experienced, contributing to the company's strategic stability. However, short-term liabilities slightly exceed short-term assets (£243.9M vs £234.7M), which may require attention to maintain liquidity balance.

- Navigate through the intricacies of AO World with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into AO World's future.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc is a provider of information technology services operating in regions including the United Kingdom, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £405.87 million.

Operations: The company generates revenue of £294.27 million from its global professional services operations.

Market Cap: £405.87M

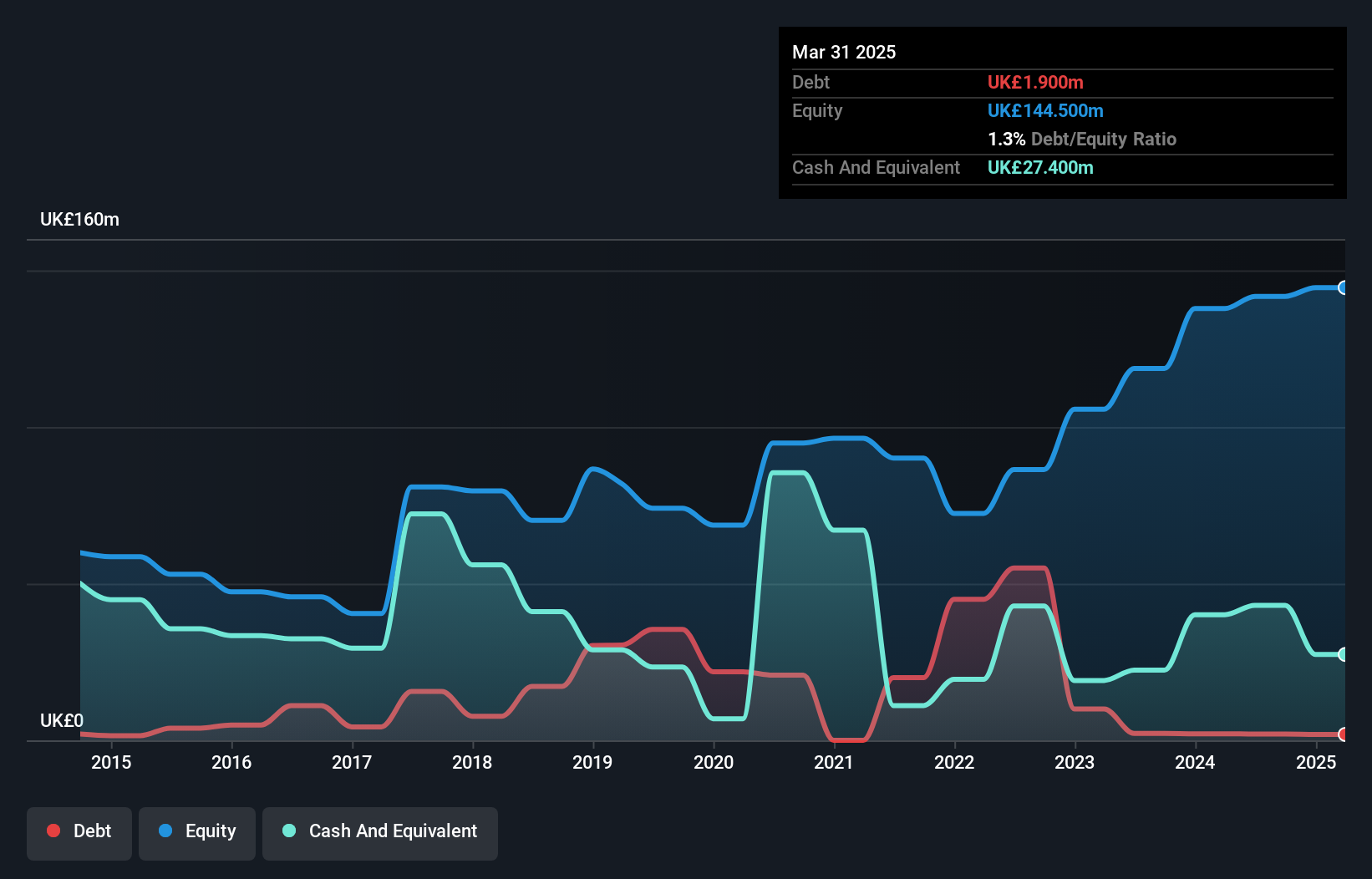

FDM Group (Holdings) plc, with a market cap of £405.87 million, faces challenges as recent earnings have declined significantly, with sales dropping to £140.19 million for the half-year ending June 30, 2024, compared to the previous year's £179.89 million. Despite this downturn and negative earnings growth of -22.9% over the past year, FDM remains debt-free and is trading at good value relative to peers and industry standards. The company boasts high-quality past earnings and an outstanding return on equity of 45.2%, supported by a seasoned management team with an average tenure of 9.7 years.

- Dive into the specifics of FDM Group (Holdings) here with our thorough balance sheet health report.

- Learn about FDM Group (Holdings)'s future growth trajectory here.

Summing It All Up

- Click through to start exploring the rest of the 469 UK Penny Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet average dividend payer.