- United Kingdom

- /

- IT

- /

- LSE:CCC

3 Top UK Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such uncertain times, dividend stocks can offer a reliable income stream and potential stability for investors looking to enhance their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Keller Group (LSE:KLR) | 3.18% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.25% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.60% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.92% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.54% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.81% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.66% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.81% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.97% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.52% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

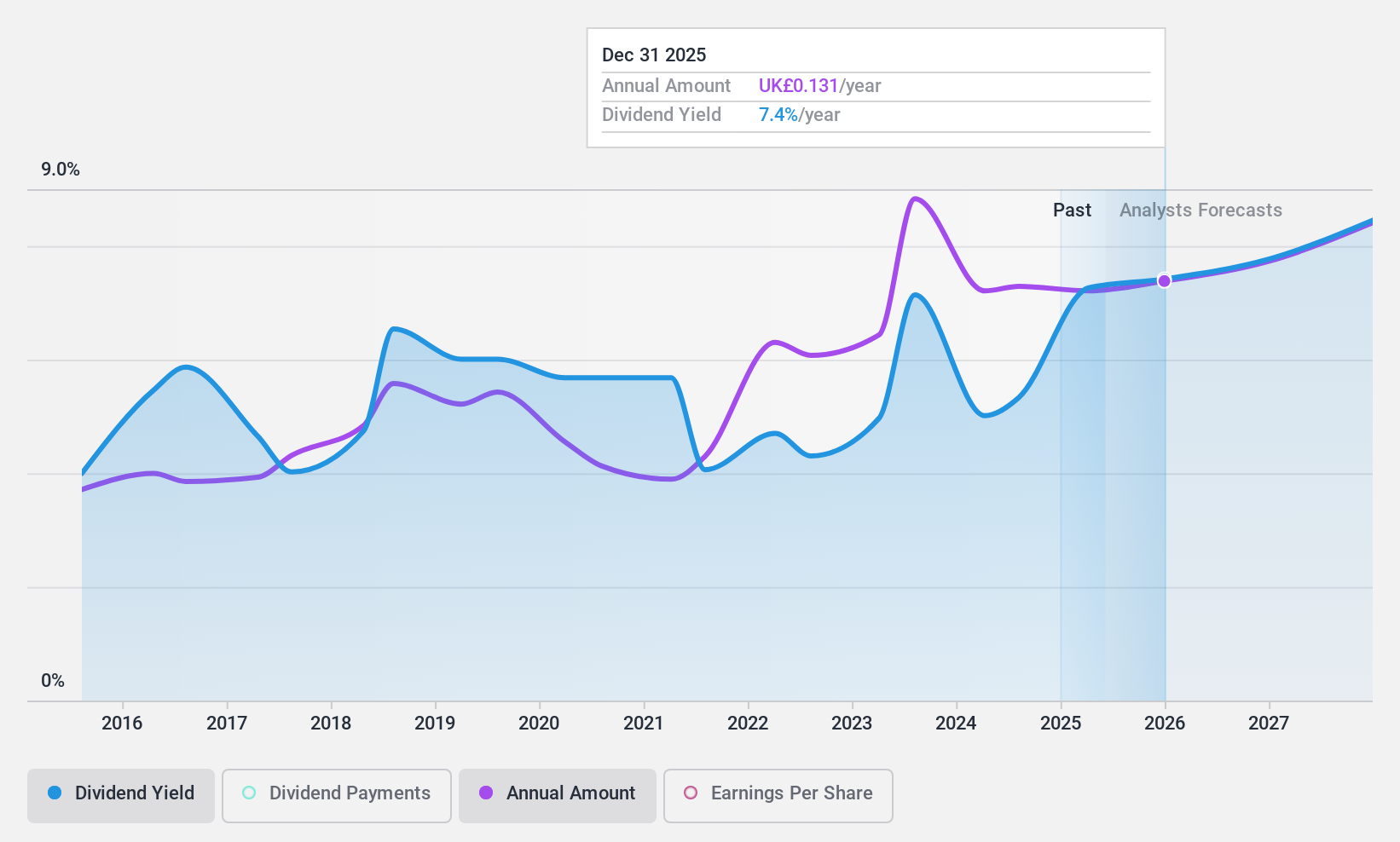

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, with a market cap of £269.31 million, owns, operates, and develops agricultural plantations in Indonesia and Malaysia.

Operations: Anglo-Eastern Plantations generates revenue of $364.23 million from its plantation cultivation activities.

Dividend Yield: 3.5%

Anglo-Eastern Plantations' dividends are well-covered by earnings and cash flows, with a low payout ratio of 10.7% and cash payout ratio of 24.4%. However, its dividend yield is lower than the top UK payers and has been volatile over the past decade. Recent leadership changes include Kevin Wong Tack Wee as CEO, which may influence strategic growth. Production results showed declines in fresh fruit bunches and crude palm oil output compared to the previous year.

- Unlock comprehensive insights into our analysis of Anglo-Eastern Plantations stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Anglo-Eastern Plantations shares in the market.

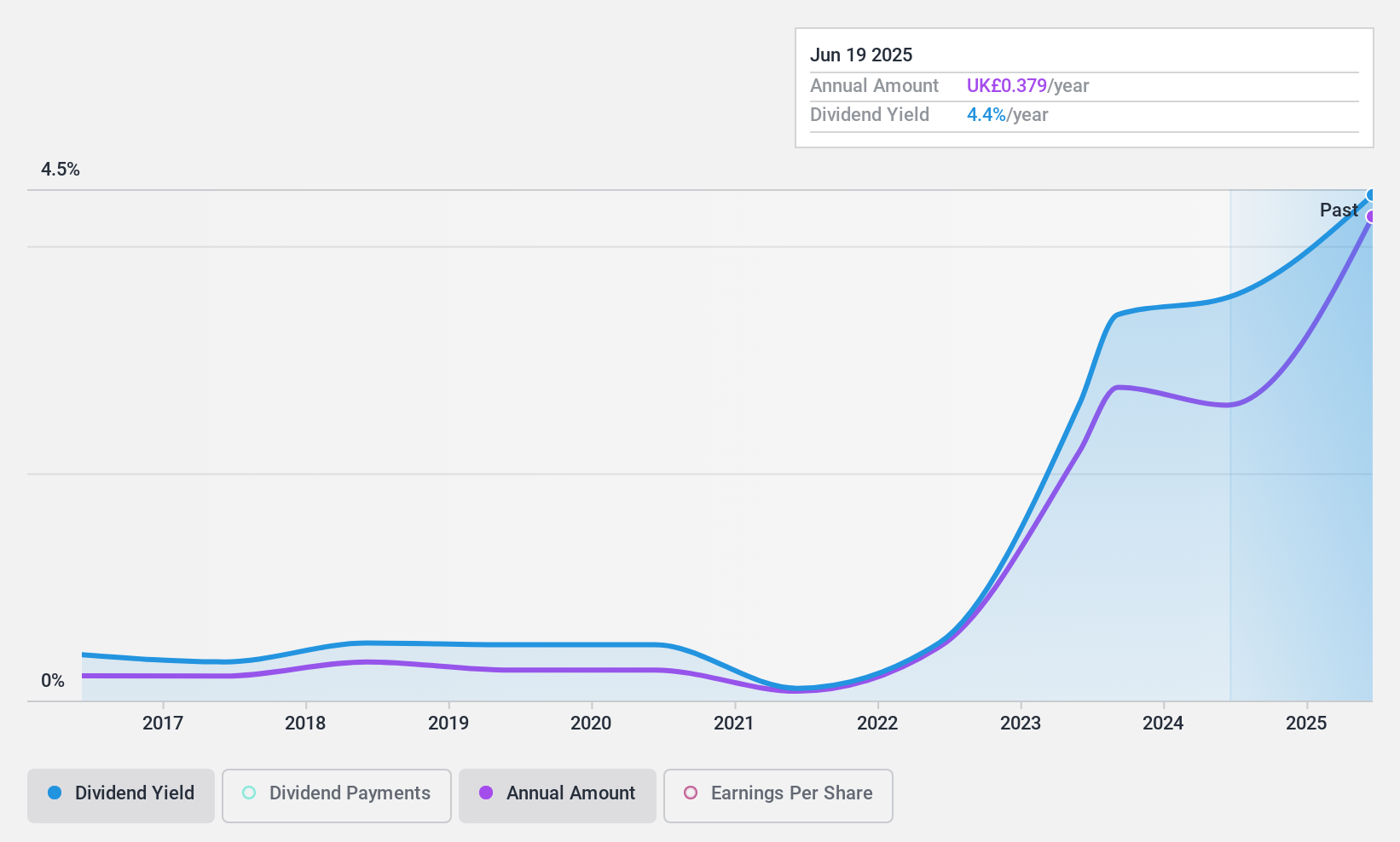

Computacenter (LSE:CCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computacenter plc offers technology and services to corporate and public sector organizations across the UK, Germany, France, North America, and internationally, with a market cap of £2.33 billion.

Operations: Computacenter plc's revenue from its Computer Services segment amounts to £6.44 billion.

Dividend Yield: 3.2%

Computacenter's dividends are supported by a low payout ratio of 46.8% and cash payout ratio of 28.2%, indicating good coverage by earnings and cash flows. Despite this, the dividend yield of 3.18% is below the top UK payers, and payments have been volatile over the past decade. The company trades at a good value relative to peers, with analysts expecting price growth. Recent board changes include Kelly Kuhn's appointment as an independent Non-Executive Director.

- Click here to discover the nuances of Computacenter with our detailed analytical dividend report.

- According our valuation report, there's an indication that Computacenter's share price might be on the cheaper side.

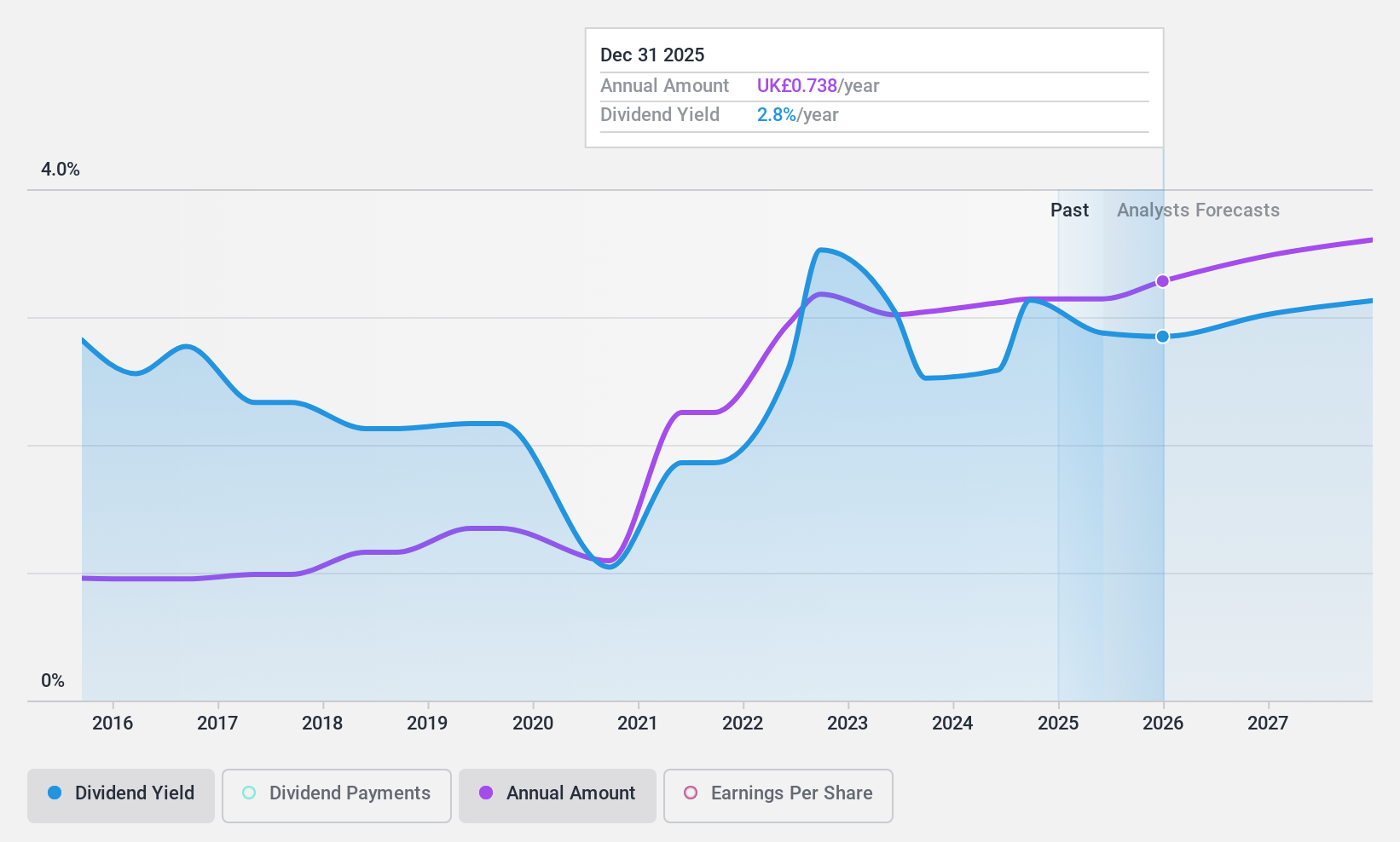

Man Group (LSE:EMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Man Group Limited is a publicly owned investment manager with a market cap of £2.46 billion.

Operations: Man Group Limited generates revenue of $1.40 billion from its Investment Management Business segment.

Dividend Yield: 5.9%

Man Group's dividend yield of 5.92% places it in the top 25% of UK dividend payers, supported by a payout ratio of 60.3% and cash payout ratio of 47.5%, indicating sustainable coverage by earnings and cash flows. However, its dividend history is marked by volatility, with significant annual drops over the past decade. Despite this instability, Man Group trades at a significant discount to estimated fair value and analysts anticipate price appreciation.

- Take a closer look at Man Group's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Man Group is priced lower than what may be justified by its financials.

Next Steps

- Investigate our full lineup of 62 Top UK Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CCC

Computacenter

Provides technology and services to corporate and public sector organizations in the United Kingdom, Germany, France, North America, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.