- United Kingdom

- /

- Building

- /

- AIM:ALU

3 Prominent UK Dividend Stocks To Consider

Reviewed by Simply Wall St

Amidst the backdrop of a faltering FTSE 100 index, influenced by weak trade data from China and declining commodity prices, investors in the United Kingdom are navigating a challenging market landscape. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to bolster their portfolios with reliable returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.47% | ★★★★★★ |

| Treatt (LSE:TET) | 3.31% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.81% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.08% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.72% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.31% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.60% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.70% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.02% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.71% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Alumasc Group (AIM:ALU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, with a market cap of £125.87 million, manufactures and sells building products, systems, and solutions across the United Kingdom, Europe, North America, the Middle East, the Far East, and other international markets.

Operations: The Alumasc Group's revenue is primarily derived from its Water Management segment (£55.87 million), Building Envelope segment (£39.16 million), and Housebuilding Products segment (£15.24 million).

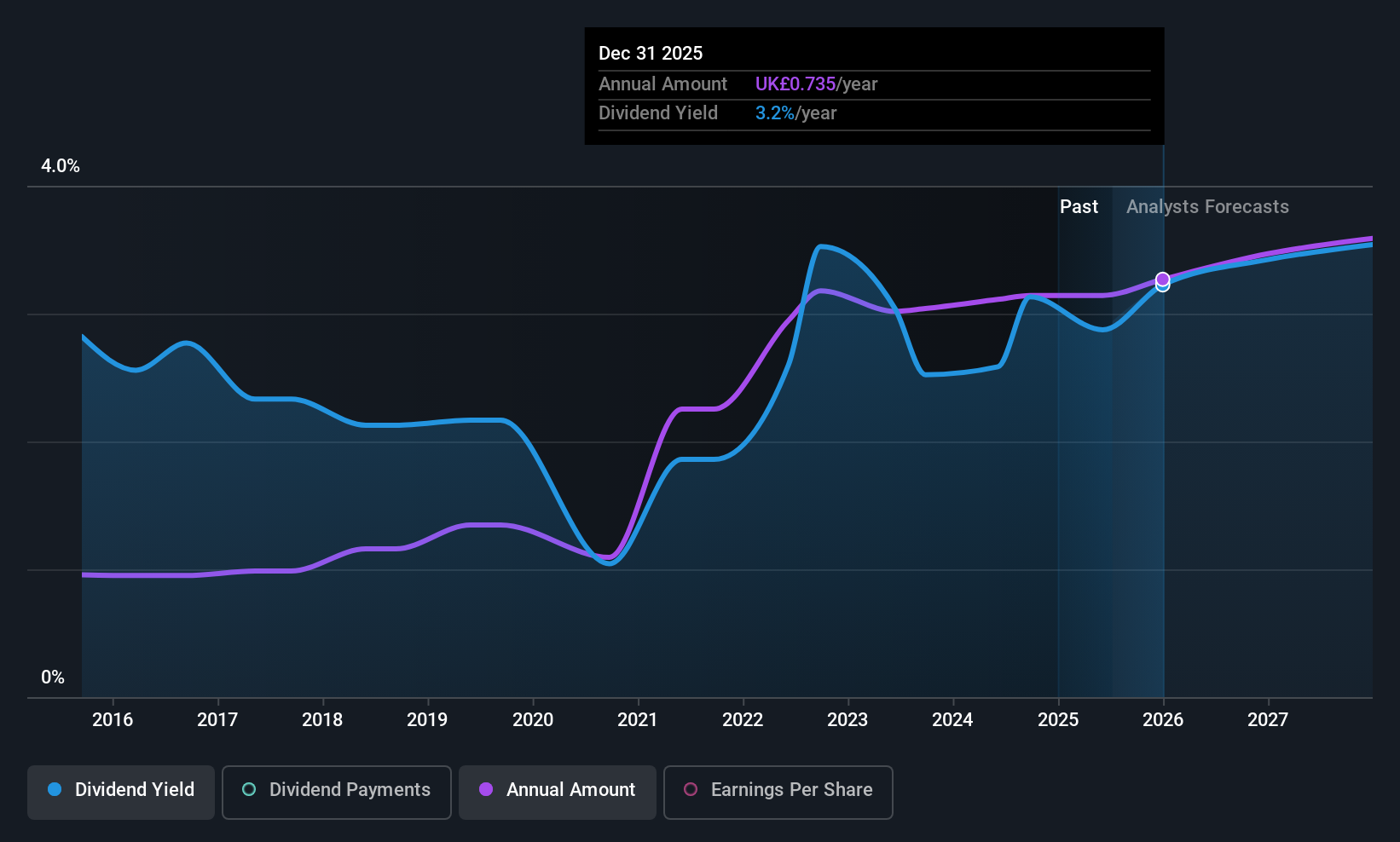

Dividend Yield: 3.1%

Alumasc Group's dividends, while covered by earnings and cash flows with payout ratios of 40.7% and 34.6% respectively, have been volatile over the past decade. Despite a recent growth in dividend payments, its yield of 3.09% remains below the top UK dividend payers. The company trades at a discount to its estimated fair value, though insider selling raises concerns. The appointment of Andrew Barraclough as Non-executive Director may influence future strategic direction positively.

- Take a closer look at Alumasc Group's potential here in our dividend report.

- The analysis detailed in our Alumasc Group valuation report hints at an deflated share price compared to its estimated value.

Computacenter (LSE:CCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computacenter plc offers technology solutions and services to corporate and public sector clients across the UK, Germany, Western Europe, North America, and other international markets, with a market cap of £2.42 billion.

Operations: Computacenter plc generates revenue primarily from its Computer Services segment, amounting to £6.96 billion.

Dividend Yield: 3.1%

Computacenter's dividends, despite being well-covered by earnings and cash flows with payout ratios of 45.8% and 19.2%, have been unreliable over the past decade. The dividend yield of 3.06% is lower than the top UK payers, though recent increases are noted. Trading at a good value with a P/E ratio of 14.2x compared to the market's 16.2x suggests potential upside, yet significant insider selling recently may warrant caution for investors seeking stability in dividend stocks.

- Click to explore a detailed breakdown of our findings in Computacenter's dividend report.

- Our comprehensive valuation report raises the possibility that Computacenter is priced lower than what may be justified by its financials.

Macfarlane Group (LSE:MACF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macfarlane Group PLC, with a market cap of £188.52 million, operates through its subsidiaries to design, manufacture, and distribute protective packaging products to businesses in the United Kingdom and Europe.

Operations: Macfarlane Group PLC generates revenue from its Packaging Distribution segment, which accounts for £228.76 million, and its Manufacturing Operations, contributing £47.46 million.

Dividend Yield: 3.1%

Macfarlane Group's dividends, although covered by earnings and cash flows with payout ratios of 37.5% and 25.9%, have been inconsistent over the past decade, reflecting a volatile dividend history. The yield of 3.09% is below top UK payers, but recent increases are evident. A share buyback program aims to repurchase up to £4 million worth of shares by May 2026, potentially enhancing shareholder value despite the stock trading at a significant discount to its estimated fair value.

- Get an in-depth perspective on Macfarlane Group's performance by reading our dividend report here.

- Our valuation report here indicates Macfarlane Group may be undervalued.

Taking Advantage

- Delve into our full catalog of 57 Top UK Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products, systems, and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives