- United Kingdom

- /

- Software

- /

- LSE:BYIT

Bytes Technology Group's (LON:BYIT) Shareholders Will Receive A Bigger Dividend Than Last Year

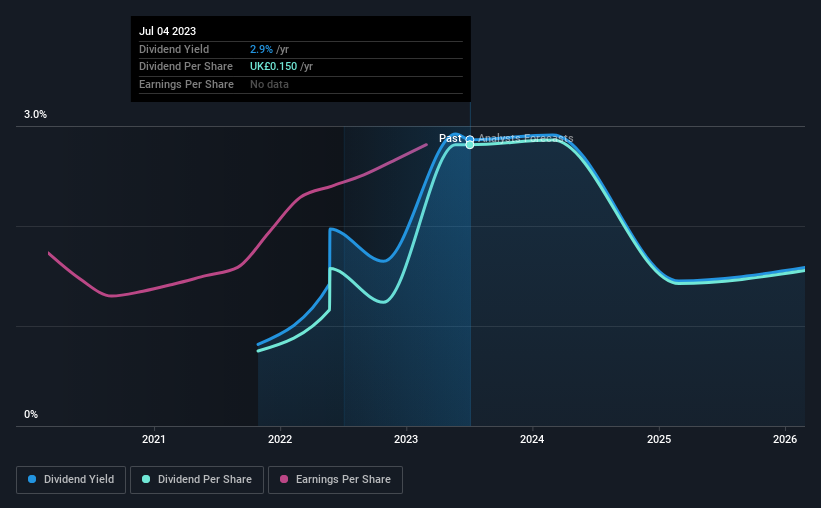

The board of Bytes Technology Group plc (LON:BYIT) has announced that it will be paying its dividend of £0.126 on the 4th of August, an increased payment from last year's comparable dividend. This takes the dividend yield to 2.9%, which shareholders will be pleased with.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Bytes Technology Group's stock price has increased by 35% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Bytes Technology Group

Bytes Technology Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Bytes Technology Group's dividend was only 44% of earnings, however it was paying out 98% of free cash flows. The company might be more focused on returning cash to shareholders, but paying out this much of its cash flow could expose the dividend to being cut in the future.

Over the next year, EPS is forecast to expand by 29.3%. If the dividend continues on this path, the payout ratio could be 69% by next year, which we think can be pretty sustainable going forward.

Bytes Technology Group's Dividend Has Lacked Consistency

Looking back, the dividend has been unstable but with a relatively short history, we think it may be a bit early to draw conclusions about long term dividend sustainability. The annual payment during the last 2 years was £0.04 in 2021, and the most recent fiscal year payment was £0.15. This works out to be a compound annual growth rate (CAGR) of approximately 94% a year over that time. Bytes Technology Group has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that Bytes Technology Group has grown earnings per share at 18% per year over the past three years. While on an earnings basis, this company looks appealing as an income stock, the cash payout ratio still makes us cautious.

Our Thoughts On Bytes Technology Group's Dividend

Overall, we always like to see the dividend being raised, but we don't think Bytes Technology Group will make a great income stock. While Bytes Technology Group is earning enough to cover the payments, the cash flows are lacking. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 2 warning signs for Bytes Technology Group that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Bytes Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BYIT

Bytes Technology Group

Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Cenergy Holdings S.A. (CENER.AT): Europe's Premier Energy Infrastructure Solutions Provider

The cash flow machine

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion