- United Kingdom

- /

- Software

- /

- LSE:ALFA

Alfa Financial Software Holdings' (LON:ALFA) Shareholders Are Down 76% On Their Shares

While it may not be enough for some shareholders, we think it is good to see the Alfa Financial Software Holdings PLC (LON:ALFA) share price up 27% in a single quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 76% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

View our latest analysis for Alfa Financial Software Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Alfa Financial Software Holdings actually saw its earnings per share (EPS) improve by 8.4% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

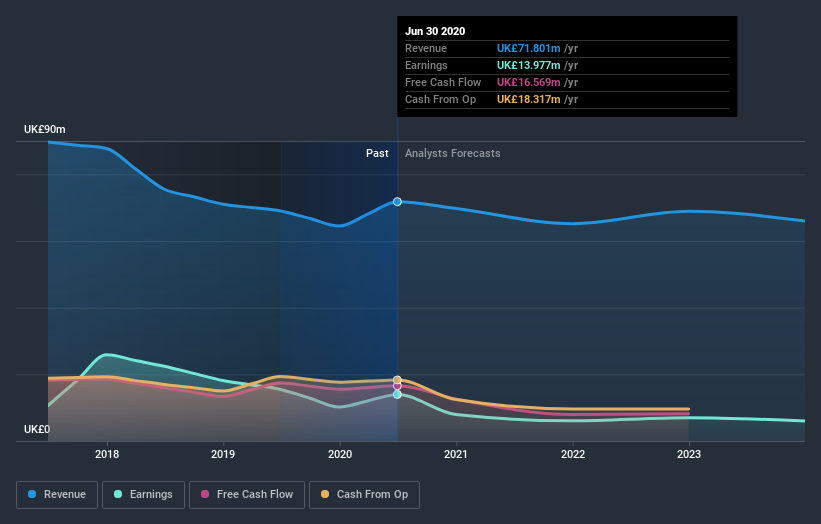

We think that the revenue decline over three years, at a rate of 11% per year, probably had some shareholders looking to sell. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Alfa Financial Software Holdings stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Alfa Financial Software Holdings' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Alfa Financial Software Holdings' TSR, at -73% is higher than its share price return of -76%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Alfa Financial Software Holdings shareholders have gained 39% (in total) over the last year. This recent result is much better than the 20% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Alfa Financial Software Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Of course Alfa Financial Software Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Alfa Financial Software Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:ALFA

Alfa Financial Software Holdings

Through its subsidiaries, provides software and consultancy services to the auto and equipment finance industry in the United Kingdom, the United States, rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives