- United Kingdom

- /

- Software

- /

- AIM:TRCS

High Growth Tech Stocks to Watch in the United Kingdom September 2024

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 and FTSE 250 indices have recently experienced declines, influenced by weak trade data from China, highlighting the interconnectedness of global markets. In this environment, identifying high-growth tech stocks becomes crucial as these companies often show resilience and potential for substantial returns despite broader economic uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.83% | 34.03% | ★★★★★★ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £796.94 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc focuses on developing, licensing, and supporting computer software tailored for the U.S. healthcare sector. The company's revenue is primarily derived from software licensing and support services.

Craneware's earnings growth of 26.8% over the past year significantly outpaced the Healthcare Services industry’s 8%. With revenue projected to grow at 8.2% annually, faster than the UK market's 3.8%, and earnings forecasted to rise by an impressive 25.6% per year, Craneware demonstrates robust potential in high-growth tech sectors. The company's recent collaboration with Microsoft Azure enhances its cloud capabilities and AI innovation, positioning it well for future expansion in healthcare analytics and operational efficiency.

- Dive into the specifics of Craneware here with our thorough health report.

Assess Craneware's past performance with our detailed historical performance reports.

Tracsis (AIM:TRCS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tracsis plc, with a market cap of £213.88 million, provides software and hardware solutions as well as data analytics/GIS services for the rail, traffic data, and transportation industry.

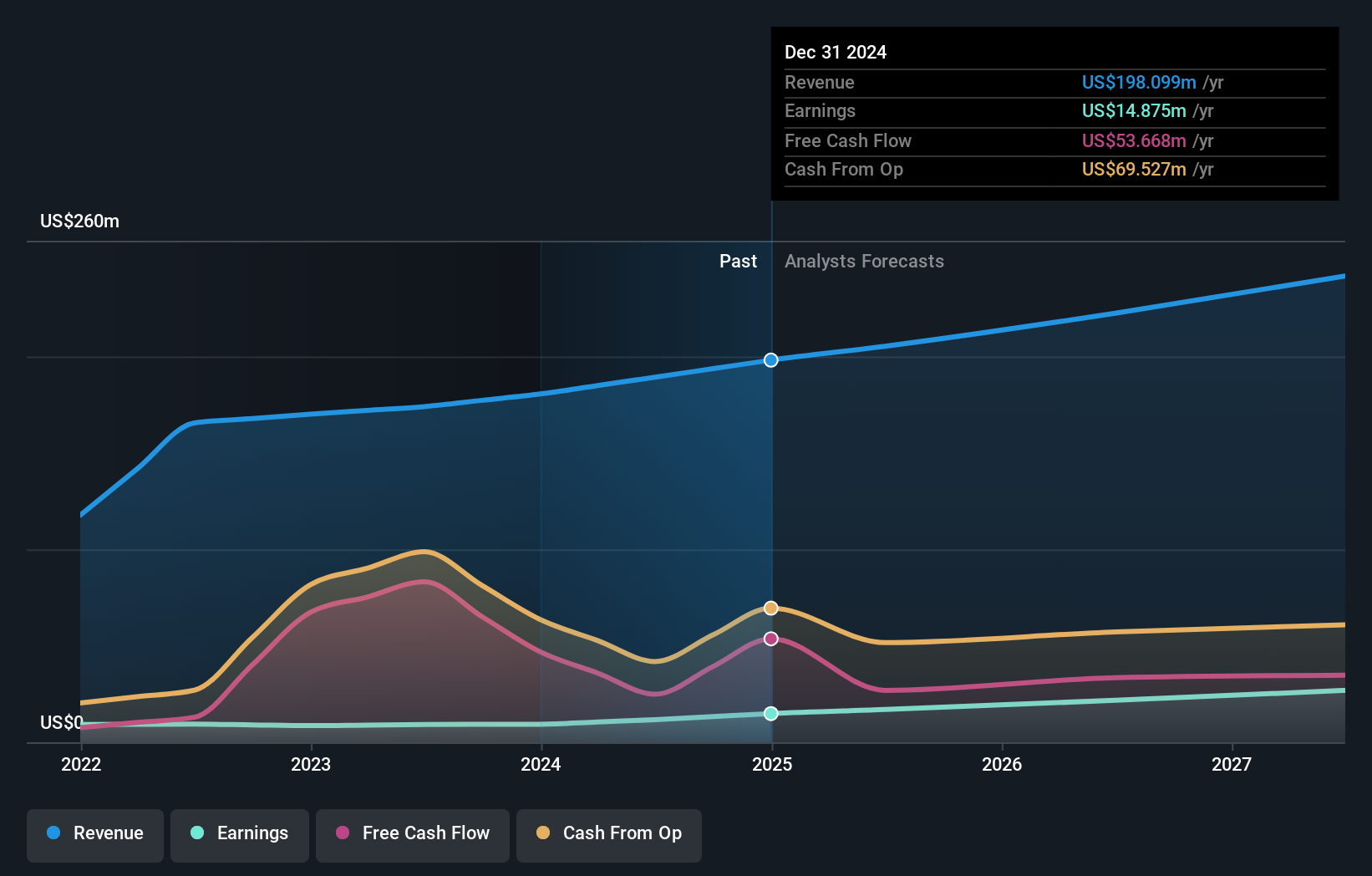

Operations: Tracsis generates revenue primarily from two segments: Rail Technology & Services (£34.59 million) and Data, Analytics, Consultancy & Events (£44.80 million). The company focuses on providing specialized software, hardware solutions, and data analytics services tailored to the rail and transportation sectors.

Tracsis has demonstrated impressive earnings growth of 99.1% over the past year, significantly outpacing the Software industry's 16.2%. The company's revenue is forecasted to grow at 6.3% annually, while its earnings are expected to rise by a substantial 40.6% per year, far exceeding the UK market's average of 14.3%. With R&D expenses contributing to innovative solutions in transport analytics and software services, Tracsis is well-positioned for continued expansion in high-growth tech sectors within the UK.

- Navigate through the intricacies of Tracsis with our comprehensive health report here.

Examine Tracsis' past performance report to understand how it has performed in the past.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.04 billion.

Operations: Informa generates revenue through four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across various regions, including the UK, Continental Europe, the US, and China.

Informa's revenue is projected to grow at 6.7% annually, outpacing the UK's market average of 3.8%. Despite a one-off loss of £213.5 million impacting recent financial results, earnings are forecasted to rise by 21.5% per year over the next three years, significantly higher than the UK market's average growth rate of 14.3%. The company has also repurchased 41,673,066 shares for £338.9 million in H1 2024, indicating strong shareholder value initiatives.

- Click here to discover the nuances of Informa with our detailed analytical health report.

Evaluate Informa's historical performance by accessing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 43 UK High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tracsis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRCS

Tracsis

Provides software and hardware, data analytics/GIS services for the rail, traffic data, and transportation industries in the United Kingdom, Ireland, rest of Europe, Europe, North America, and internationally.

Very undervalued with flawless balance sheet.