- United Kingdom

- /

- Biotech

- /

- LSE:OXB

Exploring Redcentric And 2 Other High Growth Tech Stocks In The UK

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery and its impact on UK companies. In this environment, identifying high-growth tech stocks like Redcentric becomes crucial as investors seek opportunities that can withstand external pressures and capitalize on technological advancements within the UK's evolving market.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Facilities by ADF | 26.24% | 161.47% | ★★★★★☆ |

| YouGov | 4.26% | 64.92% | ★★★★★☆ |

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| Pinewood Technologies Group | 24.56% | 42.77% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Oxford Biomedica | 15.27% | 99.34% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Trustpilot Group | 15.02% | 40.20% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 37 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Redcentric (AIM:RCN)

Simply Wall St Growth Rating: ★★★★★☆

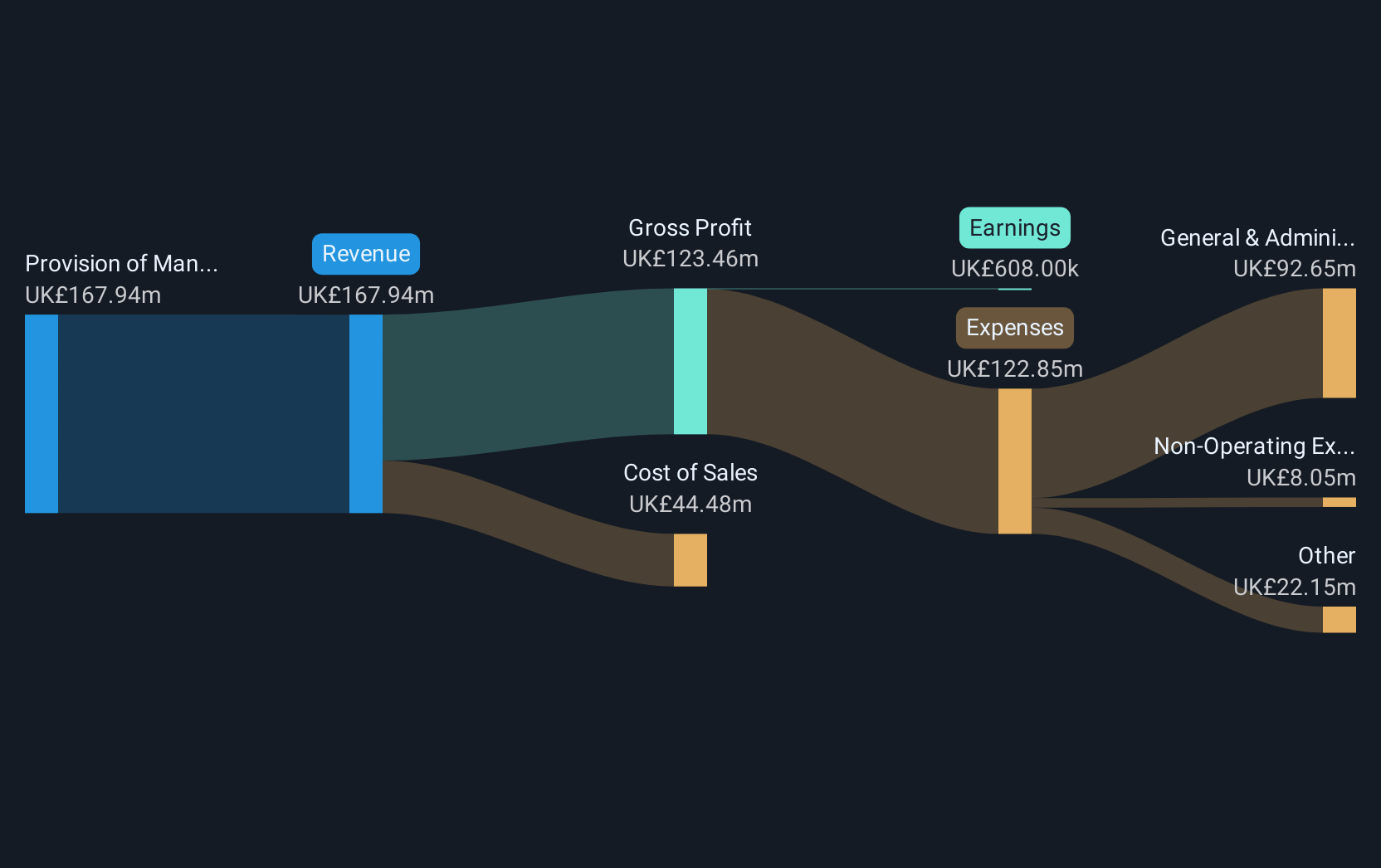

Overview: Redcentric plc offers IT managed services to both public and private sectors in the United Kingdom, with a market capitalization of £195.09 million.

Operations: The company generates revenue primarily from providing managed IT services, amounting to £167.94 million.

Redcentric plc, amid executive transitions, underscores a promising trajectory with an anticipated earnings growth of 67.9% annually. Despite revenue growth projections at 5.3% per year—slightly above the UK market average of 4%—the firm has recently achieved profitability, marking a pivotal shift in its financial landscape. The recent appointment of Brian Woodford as CEO is poised to further this momentum, bringing a wealth of experience from companies like Vodafone and Capita, potentially enhancing Redcentric's strategic direction and innovation in the tech sector. This leadership change aligns with the company’s focus on sustaining its recent profitable status and expanding its market presence amidst competitive industry dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Redcentric.

Review our historical performance report to gain insights into Redcentric's's past performance.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

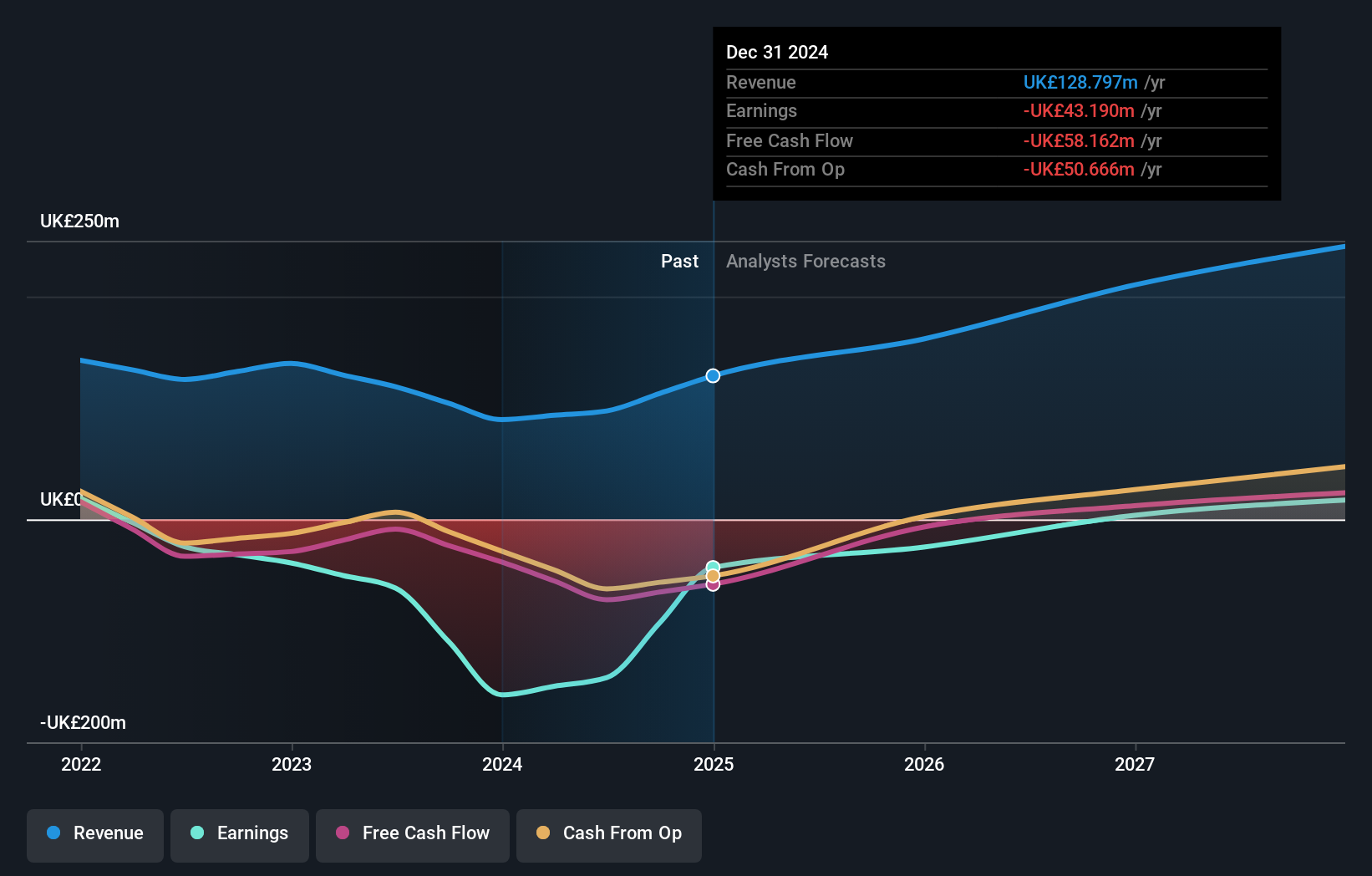

Overview: Oxford Biomedica plc is a contract development and manufacturing organization that specializes in delivering therapies to patients globally, with a market cap of £295.20 million.

Operations: Oxford Biomedica plc operates as a contract development and manufacturing organization, focusing on the global delivery of therapies. The company generates revenue through its specialized services in gene and cell therapy production.

Oxford Biomedica's recent financial performance reflects a significant reduction in net loss, from £157.49 million to £43.19 million year-over-year, and a promising increase in sales to £128.8 million. With revenue growth projected at 15.3% annually and earnings expected to surge by 99.34%, the company is on track for profitability by 2025, aligning with its medium-term revenue CAGR target of over 35%. Moreover, its strategic partnership with Boehringer Ingelheim on the LENTICLAIR™? 1 trial underscores Oxford Biomedica’s pivotal role in advancing gene therapies for cystic fibrosis, leveraging its proprietary lentiviral vector technology—a testament to its innovative edge in biotech solutions.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

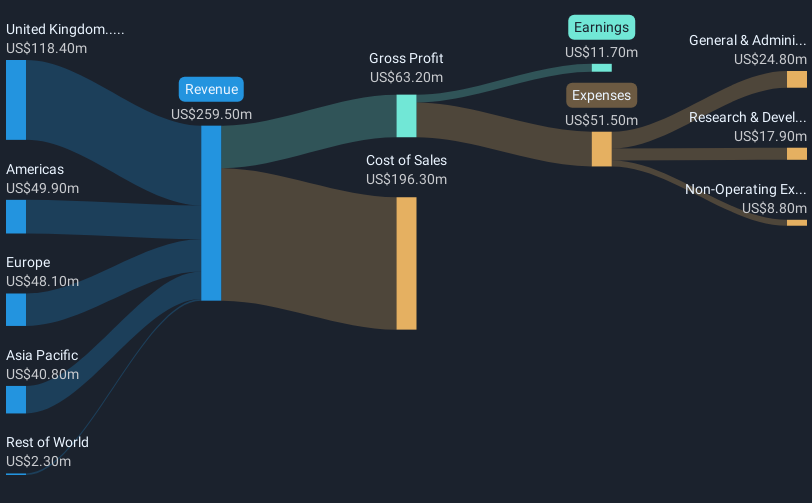

Overview: Raspberry Pi Holdings plc is a company that specializes in designing and developing single board computers and compute modules globally, with a market capitalization of £856.83 million.

Operations: Raspberry Pi Holdings generates revenue primarily from its computer hardware segment, totaling $259.50 million. The company focuses on the global design and development of single board computers and compute modules.

Despite a challenging fiscal year where Raspberry Pi Holdings saw a decrease in sales from $265.8 million to $259.5 million and net income drop sharply from $31.6 million to $11.7 million, the company's future looks promising with an expected earnings growth of 31% annually. This performance positions it well above the UK market average growth of 13.9%. Additionally, their recent presentation at Embedded World 2025 highlights their ongoing commitment to innovation within the tech sector, potentially setting the stage for recovery and sustained growth in an increasingly competitive landscape.

- Delve into the full analysis health report here for a deeper understanding of Raspberry Pi Holdings.

Assess Raspberry Pi Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Unlock our comprehensive list of 37 UK High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oxford Biomedica, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXB

Oxford Biomedica

A contract development and manufacturing organization, focuses on delivering therapies to patients worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives