Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, LoopUp Group plc (LON:LOOP) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for LoopUp Group

How Much Debt Does LoopUp Group Carry?

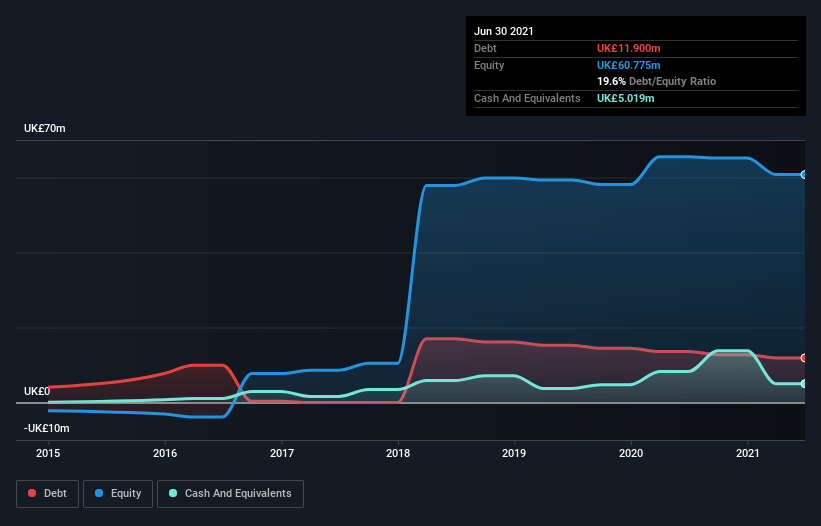

You can click the graphic below for the historical numbers, but it shows that LoopUp Group had UK£11.9m of debt in June 2021, down from UK£13.6m, one year before. However, it does have UK£5.02m in cash offsetting this, leading to net debt of about UK£6.88m.

How Healthy Is LoopUp Group's Balance Sheet?

The latest balance sheet data shows that LoopUp Group had liabilities of UK£6.89m due within a year, and liabilities of UK£16.9m falling due after that. Offsetting these obligations, it had cash of UK£5.02m as well as receivables valued at UK£5.77m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£13.0m.

This is a mountain of leverage relative to its market capitalization of UK£14.4m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if LoopUp Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, LoopUp Group made a loss at the EBIT level, and saw its revenue drop to UK£30m, which is a fall of 43%. To be frank that doesn't bode well.

Caveat Emptor

Not only did LoopUp Group's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping UK£5.3m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of UK£5.0m. So we do think this stock is quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for LoopUp Group that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:LOOP

LoopUp Group

Provides cloud communications platform for business-critical external and specialist communications in the United Kingdom, the European Union, North America, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Undervalued, Underestimated

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026