- United Kingdom

- /

- IT

- /

- AIM:KWS

Exploring Three Potential Value Picks On The UK Exchange

Reviewed by Simply Wall St

Amidst fluctuating global markets, the UK financial landscape remains a focal point for investors, with recent discussions around inflation and public finance figures influencing market sentiment. In such an environment, identifying undervalued stocks can offer potential opportunities for those looking to invest wisely in the midst of prevailing economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Estimated Fair Value | Estimated Discount |

| Kier Group (LSE:KIE) | £1.462 | £2.76 | 47% |

| Essentra (LSE:ESNT) | £1.822 | £3.54 | 48.5% |

| LSL Property Services (LSE:LSL) | £3.17 | £6.0 | 47.2% |

| INSPECS Group (AIM:SPEC) | £0.725 | £1.36 | 46.8% |

| CMC Markets (LSE:CMCX) | £2.68 | £5.18 | 48.3% |

| Ricardo (LSE:RCDO) | £4.90 | £9.1 | 46.1% |

| Loungers (AIM:LGRS) | £2.79 | £5.27 | 47.1% |

| Trident Royalties (AIM:TRR) | £0.39 | £0.73 | 46.4% |

| M&C Saatchi (AIM:SAA) | £2.03 | £3.99 | 49.1% |

| Rank Group (LSE:RNK) | £0.96 | £1.81 | 47% |

Underneath we present a selection of stocks filtered out by our screen.

Underneath we present a selection of stocks filtered out by our screen.

Keywords Studios (AIM:KWS)

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market capitalization of approximately £1.79 billion.

Operations: The company generates revenue from three primary segments: Create (€336.07 million), Engage (€164.89 million), and Globalize (€279.49 million).

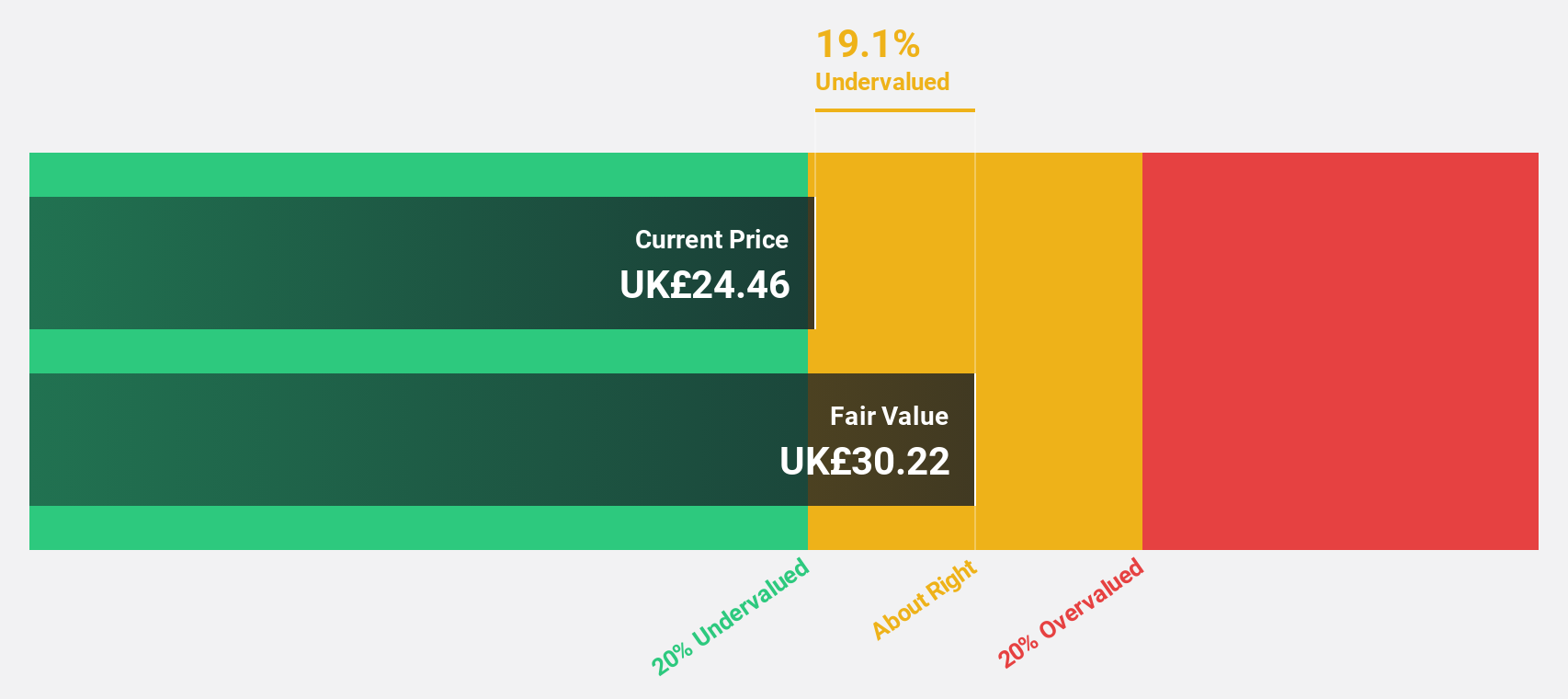

Estimated Discount To Fair Value: 16.9%

Keywords Studios, currently trading at £22.56, appears undervalued based on DCF analysis with an estimated fair value of £27.14. Despite a volatile share price recently, the company's revenue and earnings growth forecasts outpace the UK market, expected at 9.5% and 32.17% per year respectively. However, its profit margins have declined from last year's 6.9% to 2.6%. Recent M&A rumors suggest a potential acquisition by EQT Partners at £25.50 per share which could reflect unrecognized value in the current trading price.

- Our expertly prepared growth report on Keywords Studios implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Keywords Studios with our detailed financial health report.

AstraZeneca (LSE:AZN)

Overview: AstraZeneca PLC is a biopharmaceutical company engaged in the discovery, development, manufacture, and commercialization of prescription medicines, with a market capitalization of approximately £191.67 billion.

Operations: The company generates revenue primarily from its biopharmaceuticals segment, which brought in $47.61 billion.

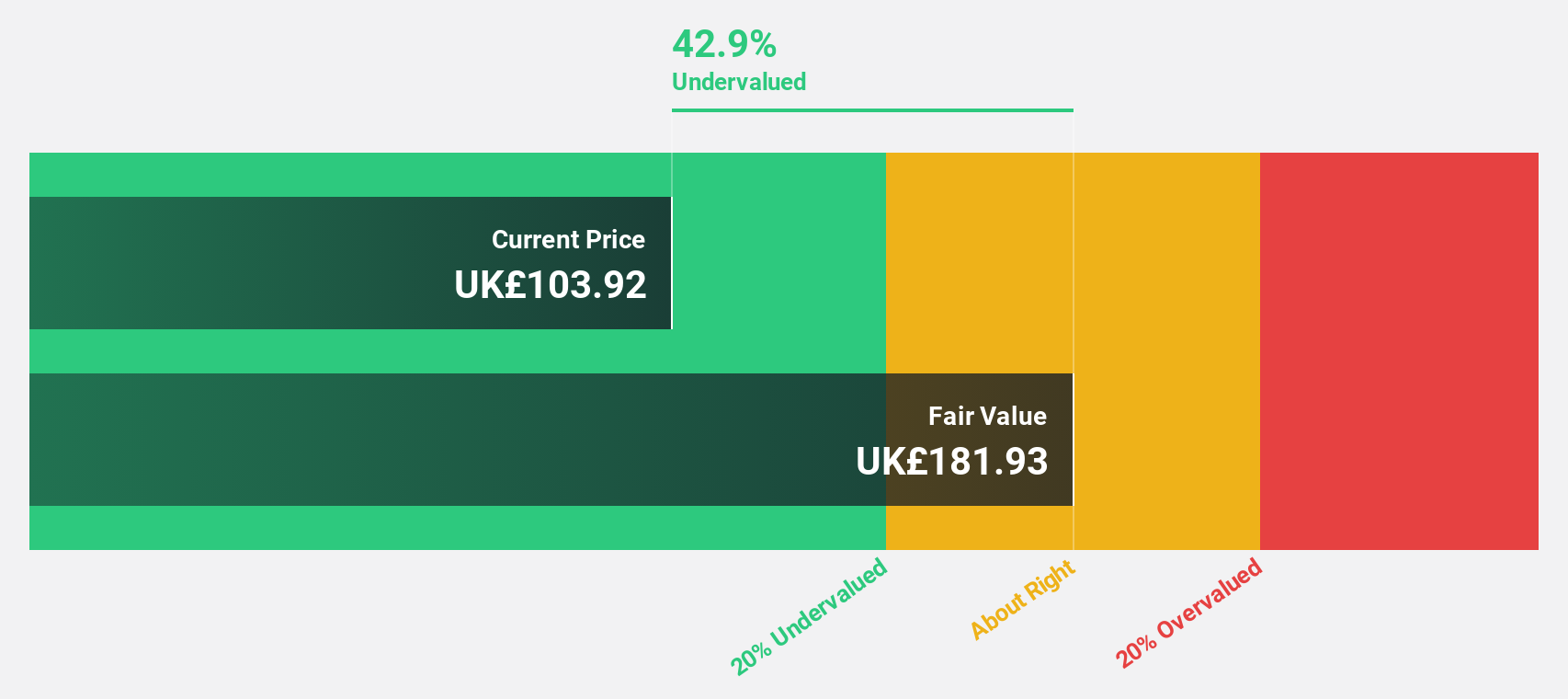

Estimated Discount To Fair Value: 35.3%

AstraZeneca, priced at £123.64, is significantly below its fair value of £191.03, suggesting undervaluation based on cash flows. Despite a high debt level impacting financial health, the company's revenue and earnings are forecasted to grow robustly at 6.1% and 15% per year respectively, outpacing the UK market average. Recent successful Phase III trials like SUPERNOVA for COVID-19 prophylaxis in immunocompromised patients highlight its ongoing commitment to addressing critical health challenges through innovation.

- Our growth report here indicates AstraZeneca may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of AstraZeneca stock in this financial health report.

Babcock International Group (LSE:BAB)

Overview: Babcock International Group PLC operates as a service provider in aerospace, defense, and security sectors across various regions including the UK, Europe, Africa, North America, and Australasia, with a market capitalization of approximately £2.79 billion.

Operations: The company generates revenue from four primary segments: Land (£1.08 billion), Marine (£1.52 billion), Nuclear (£1.33 billion), and Aviation (£0.53 billion).

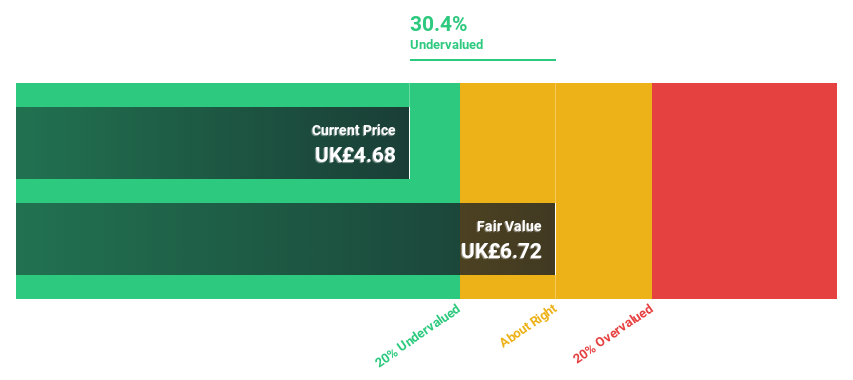

Estimated Discount To Fair Value: 23.9%

Babcock International Group, trading at £5.52, is considered undervalued with a fair value estimate of £7.25, reflecting a significant discount based on discounted cash flow analysis. Despite lower profit margins this year compared to last and a high debt level, Babcock's earnings are expected to grow by 29.46% annually over the next three years, outstripping the UK market average growth rate. The company recently secured a £560 million contract for HMS Victorious' maintenance, ensuring substantial work well into the 2030s and supporting over 1,000 jobs in the south west.

- In light of our recent growth report, it seems possible that Babcock International Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Babcock International Group.

Next Steps

- Navigate through the entire inventory of 66 Undervalued UK Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keywords Studios might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KWS

Keywords Studios

Provides creative and technical services to the video game industry worldwide.

Flawless balance sheet with reasonable growth potential.