- United Kingdom

- /

- Software

- /

- AIM:IGP

Intercede Group And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

Recent data indicating China's sluggish economic recovery has impacted the UK market, with the FTSE 100 and FTSE 250 indices experiencing declines. Despite these broader market challenges, investors often turn to penny stocks for their potential to offer affordability and growth, even as the term feels somewhat outdated. In this article, we explore three UK penny stocks that stand out due to their financial strength and potential for future growth amidst current global economic conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.63 | £519.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.96 | £319.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Vertu Motors (AIM:VTU) | £0.623 | £196.23M | ✅ 3 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.855 | £316.16M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.01 | £309.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £193.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.40 | £74.15M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £2.185 | £825.19M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 300 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the UK, Europe, the US, and internationally, with a market cap of £98.79 million.

Operations: Intercede Group generates its revenue primarily from the Software & Programming segment, amounting to £17.71 million.

Market Cap: £98.79M

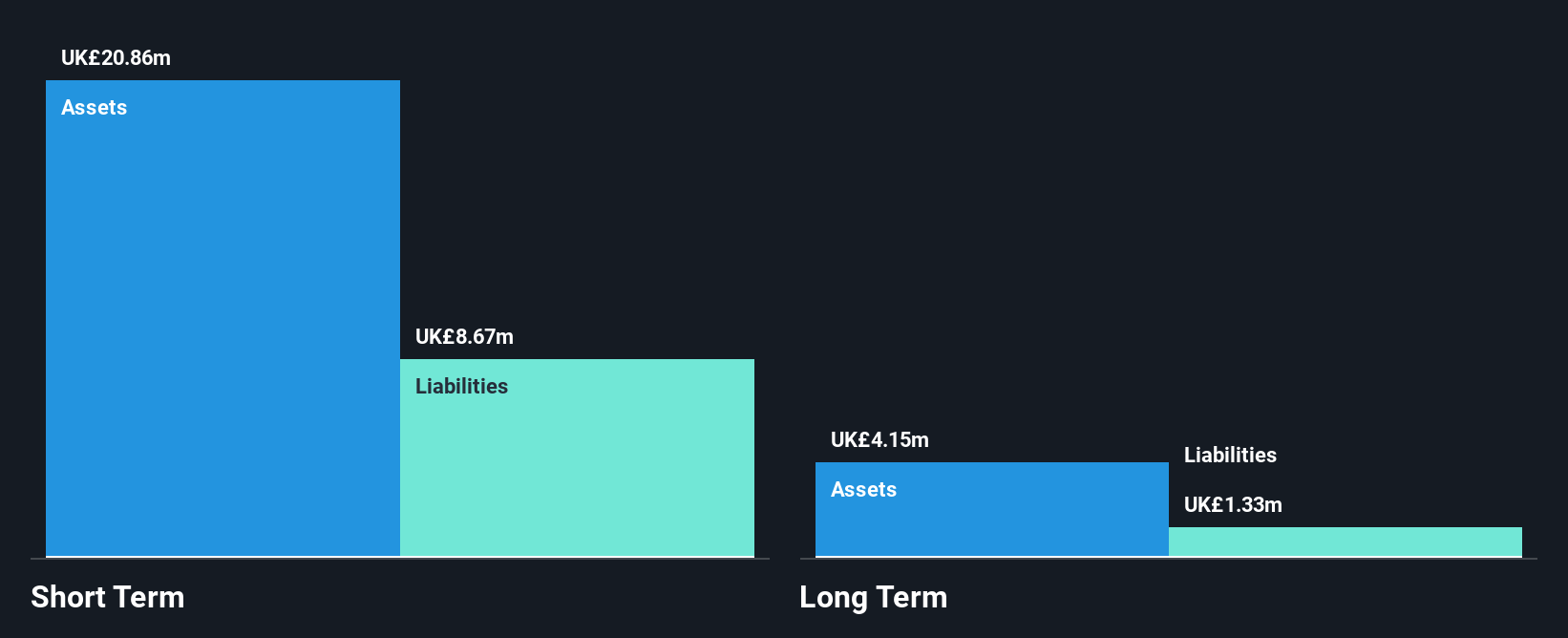

Intercede Group plc, a cybersecurity firm, is trading at a favorable value with a Price-To-Earnings ratio of 24.4x, below the industry average. The company is debt-free and maintains strong liquidity with short-term assets of £24.5 million exceeding liabilities. Despite recent earnings declines and lower profit margins compared to last year, Intercede's Return on Equity remains high at 23.8%. Recent developments include MyID CMS enhancements supporting Enterprise Attestation and significant contract renewals worth CAD 1.5 million in Q1 2025, indicating continued demand for its credential management solutions across various sectors including U.S. federal agencies and defense manufacturers.

- Dive into the specifics of Intercede Group here with our thorough balance sheet health report.

- Gain insights into Intercede Group's outlook and expected performance with our report on the company's earnings estimates.

Logistics Development Group (AIM:LDG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Logistics Development Group plc operates as an investment company with a market cap of £68.28 million.

Operations: Logistics Development Group plc does not report any revenue segments.

Market Cap: £68.28M

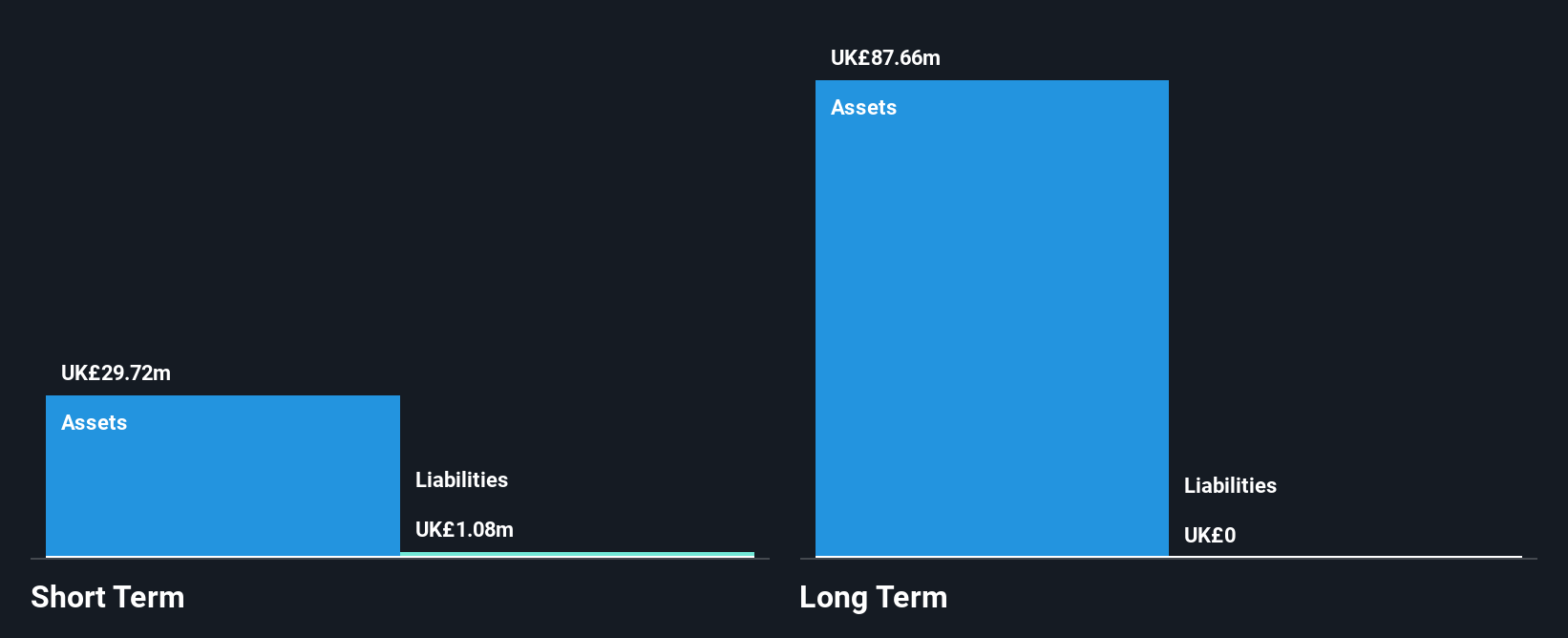

Logistics Development Group plc, with a market cap of £68.28 million, stands out for its debt-free status and recent transition to profitability. Despite being pre-revenue, the company reported net income of £18.82 million for the thirteen months ending December 31, 2024. Its Price-To-Earnings ratio is attractively low at 3.9x compared to the UK market average of 16.1x, suggesting potential undervaluation. While its board's average tenure is short at 2.5 years, indicating inexperience, LDG's strong liquidity position—with short-term assets (£29.7M) far exceeding liabilities (£1.1M)—provides financial stability amidst volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Logistics Development Group.

- Examine Logistics Development Group's past performance report to understand how it has performed in prior years.

Savannah Resources (AIM:SAV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Savannah Resources Plc is involved in the exploration and development of lithium properties, with a market cap of £85.45 million.

Operations: The company's revenue is primarily generated from its Portugal Lithium segment, which accounts for £1.93 million, supplemented by contributions from HQ, Corporate and Other activities totaling £1.11 million.

Market Cap: £85.45M

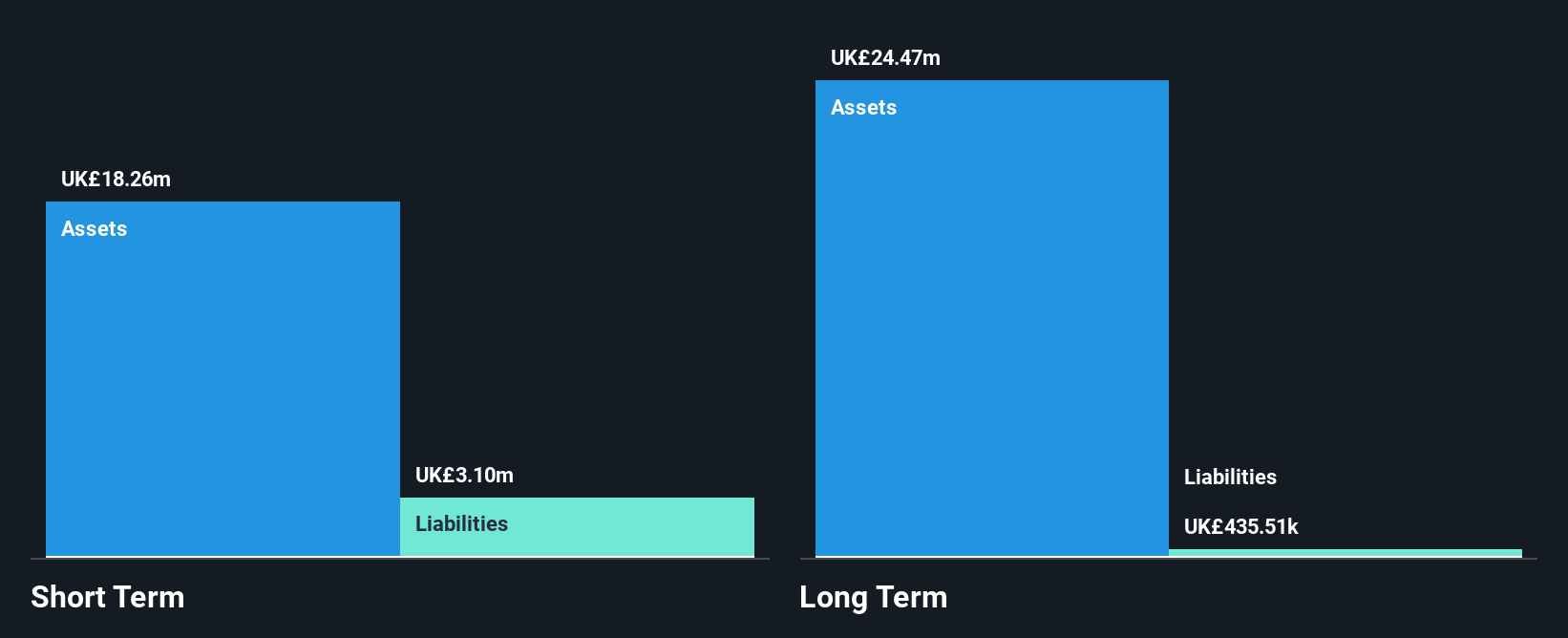

Savannah Resources Plc, with a market cap of £85.45 million, is focused on lithium exploration in Portugal but remains pre-revenue with no significant income streams. Recent equity offerings raised approximately £4.59 million, reflecting ongoing capital requirements as the company advances its Barroso Lithium Project. The project is progressing through a Definitive Feasibility Study and environmental licensing phases, supported by recent drilling results indicating potential resource expansion. Despite being debt-free and having short-term assets of £18.3 million exceeding liabilities (£3.1M), Savannah faces challenges due to its unprofitability and inexperienced board and management team with average tenures under two years.

- Click to explore a detailed breakdown of our findings in Savannah Resources' financial health report.

- Explore Savannah Resources' analyst forecasts in our growth report.

Seize The Opportunity

- Unlock more gems! Our UK Penny Stocks screener has unearthed 297 more companies for you to explore.Click here to unveil our expertly curated list of 300 UK Penny Stocks.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IGP

Intercede Group

A cybersecurity company, develops and supplies identity and credential management software for digital trust primarily in the United Kingdom, rest of Europe, the United States, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives