- United Kingdom

- /

- Building

- /

- AIM:ALU

3 UK Penny Stocks With Market Caps Under £300M

Reviewed by Simply Wall St

The London stock market has recently experienced turbulence, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic challenges. Amidst these broader market fluctuations, investors often look towards penny stocks as a potential avenue for growth. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still offer significant opportunities when they are underpinned by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.32 | £348.23M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.125 | £806.26M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.425 | £121.23M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.40 | £183.08M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £194.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.404 | £215.61M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.495 | £188.48M | ★★★★★☆ |

| Character Group (AIM:CCT) | £2.65 | £51.44M | ★★★★★★ |

Click here to see the full list of 474 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alumasc Group (AIM:ALU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Alumasc Group plc, with a market cap of £108.94 million, manufactures and sells building products, systems, and solutions across the United Kingdom and various international markets including Europe, North America, the Middle East, and the Far East.

Operations: The company's revenue is derived from three segments: Water Management (£48.32 million), Building Envelope (£37.60 million), and Housebuilding Products (£14.81 million).

Market Cap: £108.94M

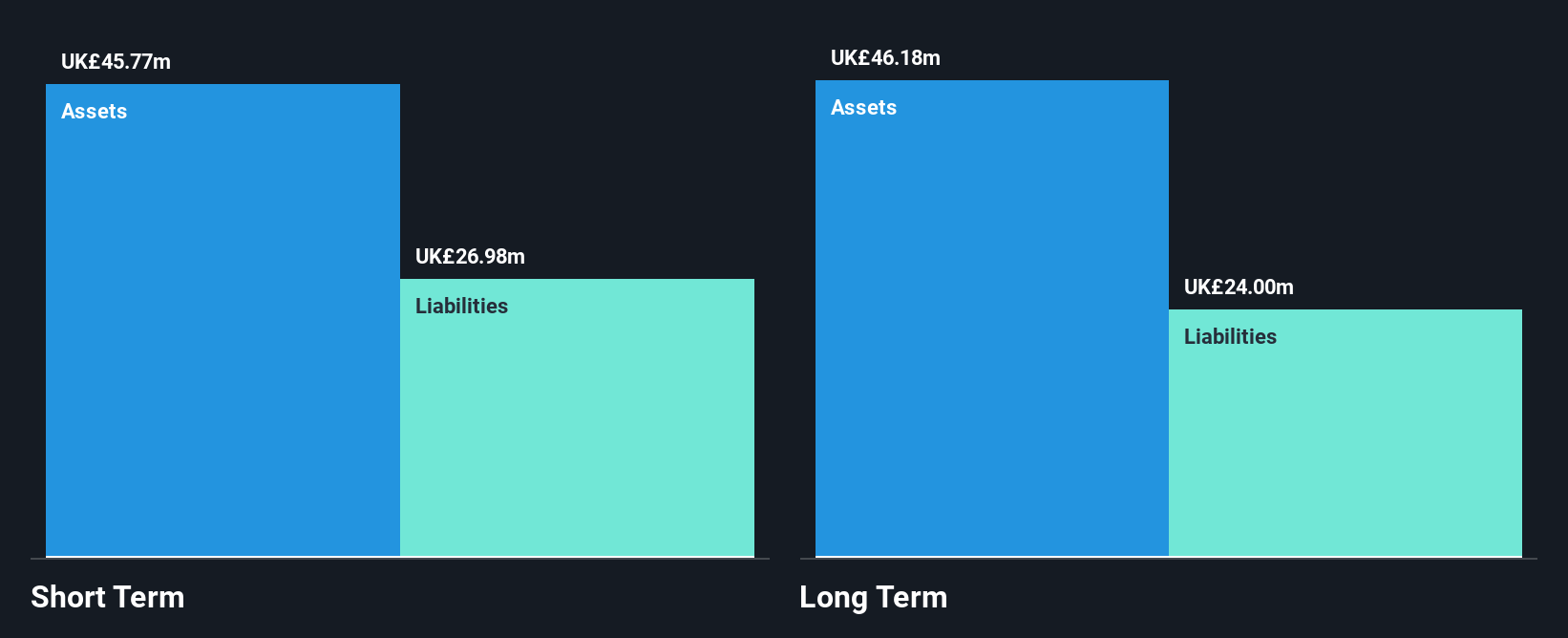

Alumasc Group plc, with a market cap of £108.94 million, has shown solid financial health and growth potential. The company reported sales of £100.72 million for the year ended June 2024, reflecting a notable increase from the previous year. Its return on equity is high at 26.1%, and its debt levels are well-managed with a net debt to equity ratio of 21.6%. Recent strategic hires aim to bolster management strength, particularly in its Water Management division. Despite some volatility in share price and profit margins slightly decreasing to 8.7%, Alumasc offers good value compared to peers and industry standards.

- Navigate through the intricacies of Alumasc Group with our comprehensive balance sheet health report here.

- Explore Alumasc Group's analyst forecasts in our growth report.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the United Kingdom, Europe, the United States, and internationally, with a market cap of £110.65 million.

Operations: The company generates revenue of £19.96 million from its Software & Programming segment, focusing on identity and credential management solutions for digital trust.

Market Cap: £110.65M

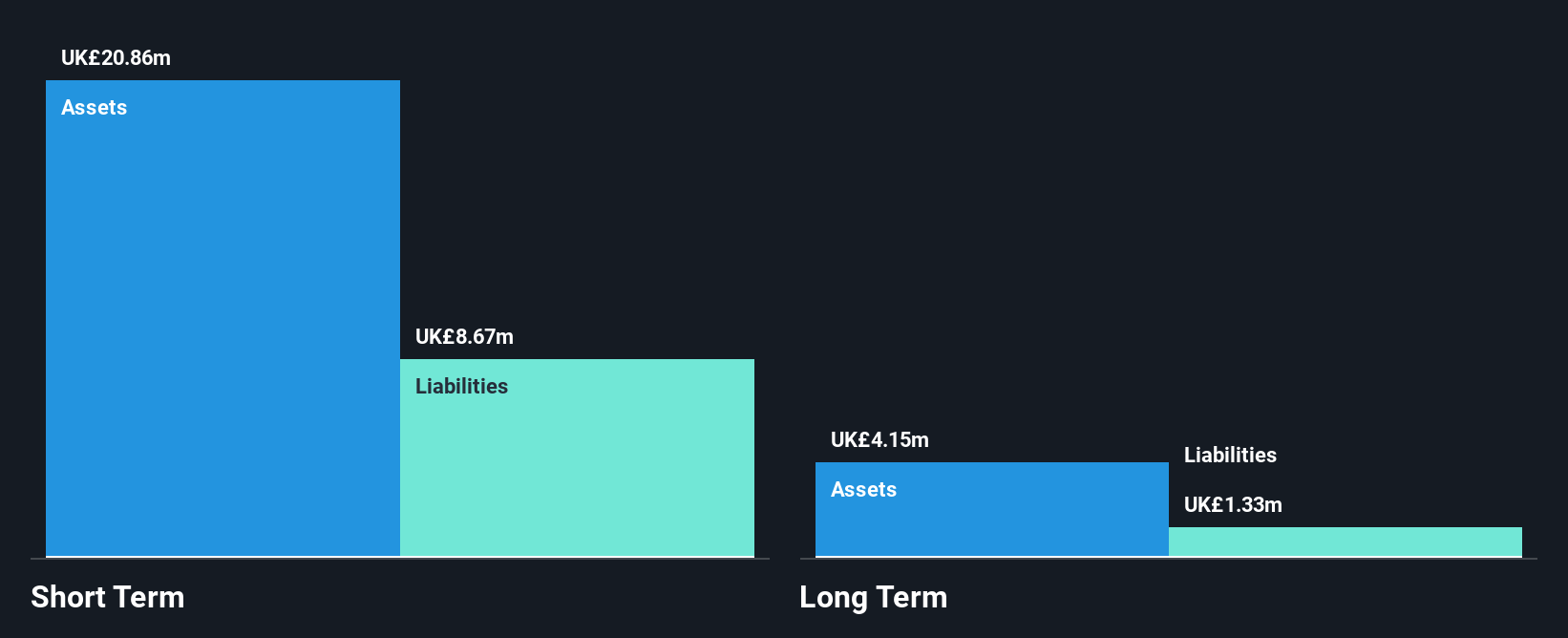

Intercede Group plc, with a market cap of £110.65 million, has demonstrated robust financial performance and strategic growth in the cybersecurity sector. Recent contract renewals and orders totaling over $3.4 million bolster its revenue outlook for FY25 and beyond. The company is debt-free, with short-term assets exceeding both short- and long-term liabilities significantly (£21.5M vs £11.1M and £1.5M respectively), indicating strong financial stability. Its earnings growth of 359.4% last year surpasses industry averages, though future forecasts suggest potential declines in earnings by an average of 50.7% annually over the next three years, warranting cautious optimism amidst high volatility.

- Unlock comprehensive insights into our analysis of Intercede Group stock in this financial health report.

- Gain insights into Intercede Group's future direction by reviewing our growth report.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers, operating in the United Kingdom, Germany, Australia, the rest of Europe, and the United States with a market cap of £267.32 million.

Operations: The company generates revenue of £16.51 million from its electric equipment segment.

Market Cap: £267.32M

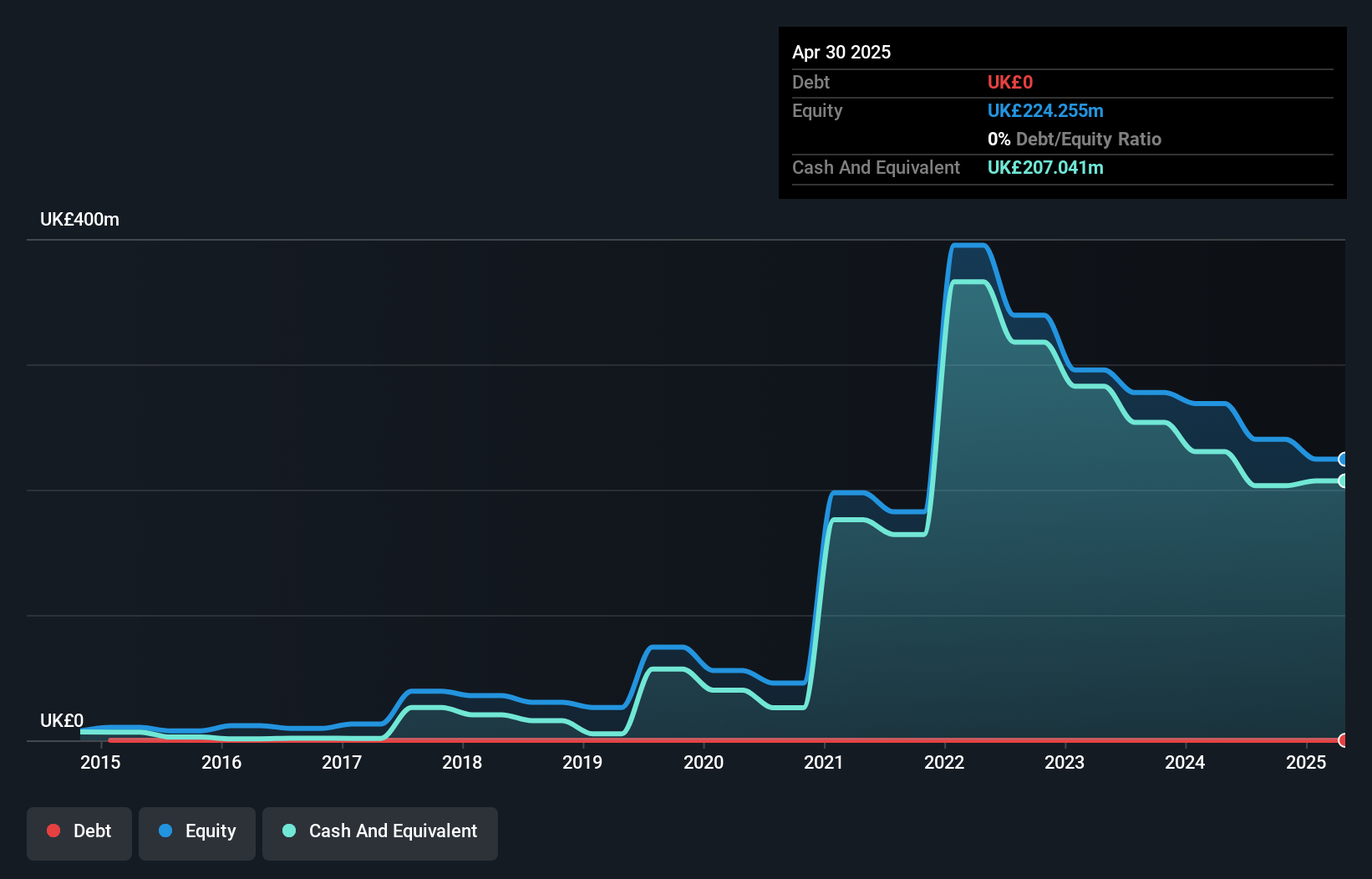

ITM Power, with a market cap of £267.32 million, is navigating the volatile penny stock landscape by leveraging its strong cash position and lack of debt to support operations for over three years. Despite being unprofitable and not expected to achieve profitability soon, ITM's revenue increased significantly from £5.23 million to £16.51 million year-over-year, reflecting growth potential in its electric equipment segment. The company has secured a major contract for the REFHYNE II project with Shell, indicating strategic partnerships that could enhance future revenue streams. Recent executive changes aim to strengthen financial leadership as Amy Grey joins as CFO in early 2025.

- Take a closer look at ITM Power's potential here in our financial health report.

- Examine ITM Power's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Click through to start exploring the rest of the 471 UK Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALU

Alumasc Group

Manufactures and sells building products, systems, and solutions in the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Flawless balance sheet, good value and pays a dividend.