- United Kingdom

- /

- Software

- /

- LSE:GBG

UK£4.21 - That's What Analysts Think GB Group plc (LON:GBG) Is Worth After These Results

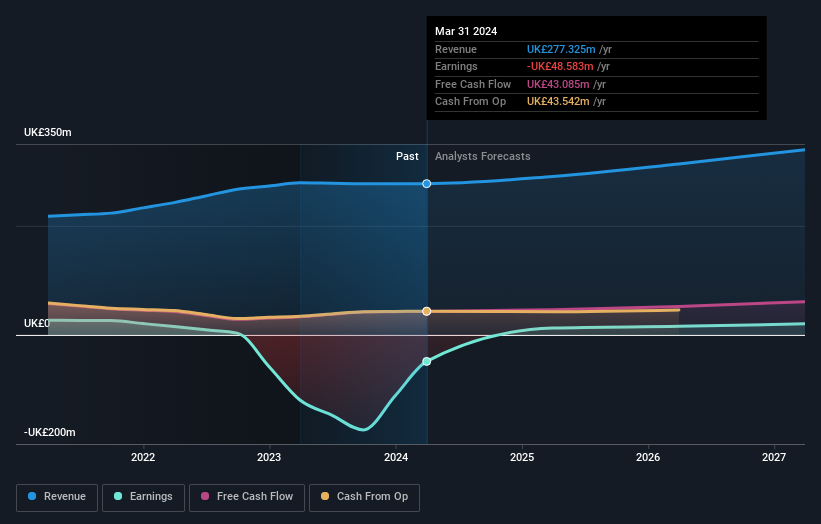

GB Group plc (LON:GBG) last week reported its latest full-year results, which makes it a good time for investors to dive in and see if the business is performing in line with expectations. The statutory results were not great - while revenues of UK£277m were in line with expectations,GB Group lost UK£0.19 a share in the process. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for GB Group

After the latest results, the six analysts covering GB Group are now predicting revenues of UK£290.4m in 2025. If met, this would reflect a modest 4.7% improvement in revenue compared to the last 12 months. GB Group is also expected to turn profitable, with statutory earnings of UK£0.049 per share. In the lead-up to this report, the analysts had been modelling revenues of UK£292.7m and earnings per share (EPS) of UK£0.046 in 2025. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target rose 6.2% to UK£4.21, suggesting that higher earnings estimates flow through to the stock's valuation as well. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic GB Group analyst has a price target of UK£5.50 per share, while the most pessimistic values it at UK£3.50. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that GB Group's revenue growth is expected to slow, with the forecast 4.7% annualised growth rate until the end of 2025 being well below the historical 11% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 11% per year. Factoring in the forecast slowdown in growth, it seems obvious that GB Group is also expected to grow slower than other industry participants.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around GB Group's earnings potential next year. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on GB Group. Long-term earnings power is much more important than next year's profits. We have forecasts for GB Group going out to 2027, and you can see them free on our platform here.

You can also see whether GB Group is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026