- United Kingdom

- /

- Capital Markets

- /

- AIM:FRP

3 UK Penny Stocks With Market Caps Under £500M To Watch

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market challenges, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at accessible price points. While the term 'penny stocks' might seem outdated, their potential for value and growth remains relevant, especially when these companies are backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.30 | £866.67M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.30 | £82.01M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.34 | £332.18M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.92 | £2.18B | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market capitalization of £282.61 million.

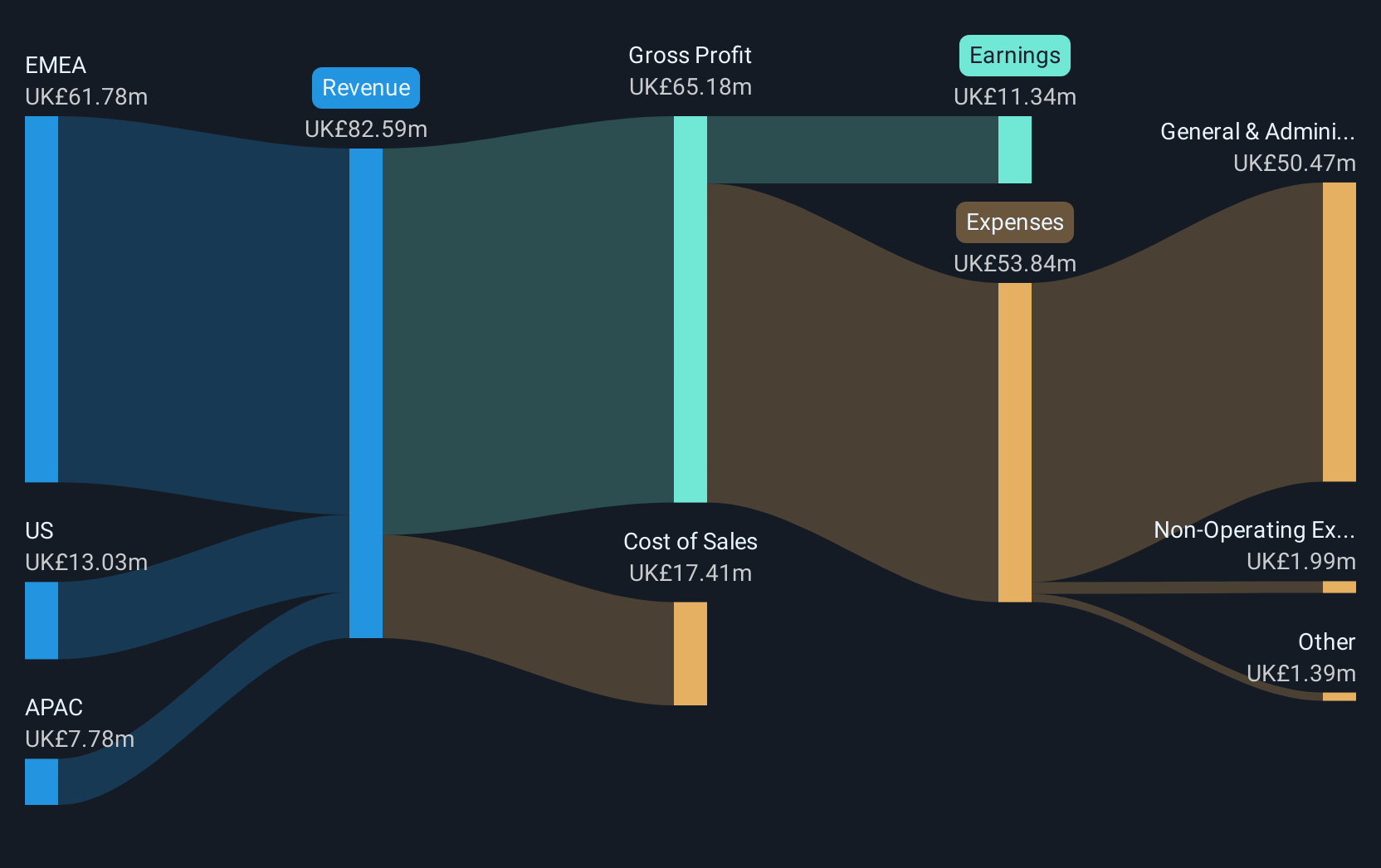

Operations: The company generates revenue of £78.97 million from its data-driven omni-channel marketing automation services.

Market Cap: £282.61M

dotdigital Group Plc, with a market capitalization of £282.61 million and revenue of £78.97 million, offers value in the penny stock space due to its debt-free status and solid financials, including short-term assets (£60.2M) exceeding both long-term (£8.7M) and short-term liabilities (£19.7M). Despite experiencing negative earnings growth over the past year (-12.1%), it maintains high-quality earnings and stable weekly volatility (6%). Trading at a price-to-earnings ratio of 25.5x below the industry average, analysts anticipate a potential price increase by 38.8%. Recent executive changes include CFO Alistair Gurney's upcoming departure by mid-2025.

- Dive into the specifics of dotdigital Group here with our thorough balance sheet health report.

- Understand dotdigital Group's earnings outlook by examining our growth report.

FRP Advisory Group (AIM:FRP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FRP Advisory Group plc, with a market cap of £340.62 million, offers business advisory services to companies, lenders, investors, individuals, and other stakeholders through its subsidiaries.

Operations: The company generates £147.1 million in revenue from its specialist business advisory services segment.

Market Cap: £340.62M

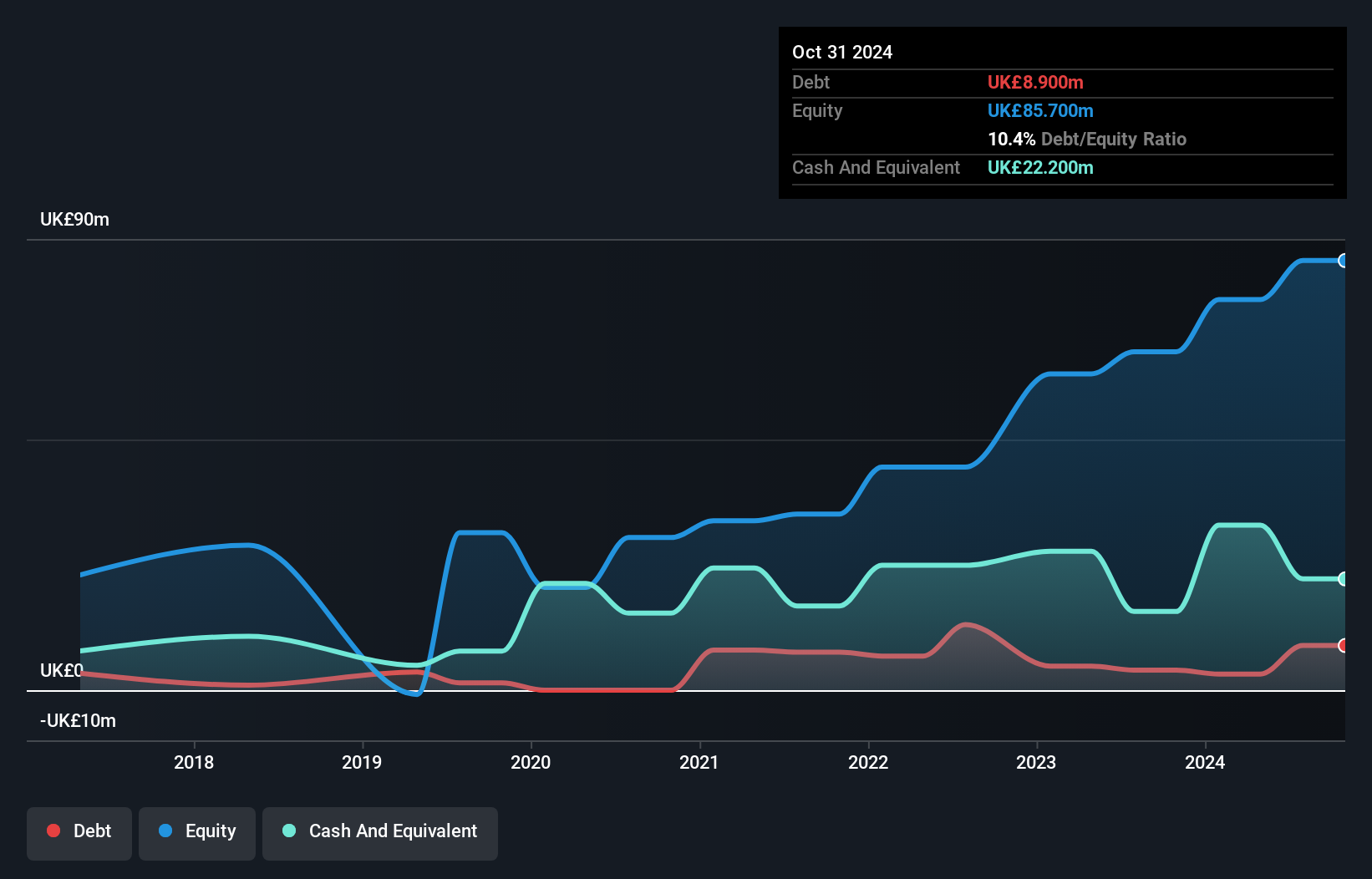

FRP Advisory Group plc, with a market cap of £340.62 million and revenue of £147.1 million, stands out in the penny stock arena due to its robust financial health and growth trajectory. The company has achieved impressive earnings growth of 68.6% over the past year, surpassing industry averages, while maintaining high-quality earnings and strong profit margins (17.9%). Its debt is well managed with operating cash flow coverage at 319.1%, and short-term assets exceed both short- (£41.7M) and long-term liabilities (£19.5M). Recent dividend affirmations reflect confidence in sustained performance amidst strategic acquisitions driving revenue growth.

- Click here to discover the nuances of FRP Advisory Group with our detailed analytical financial health report.

- Gain insights into FRP Advisory Group's future direction by reviewing our growth report.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £459.09 million.

Operations: The company's revenue is primarily derived from three segments: Infrastructure (£87.79 million), Private Equity (£50.78 million), and Foresight Capital Management (£8.10 million).

Market Cap: £459.09M

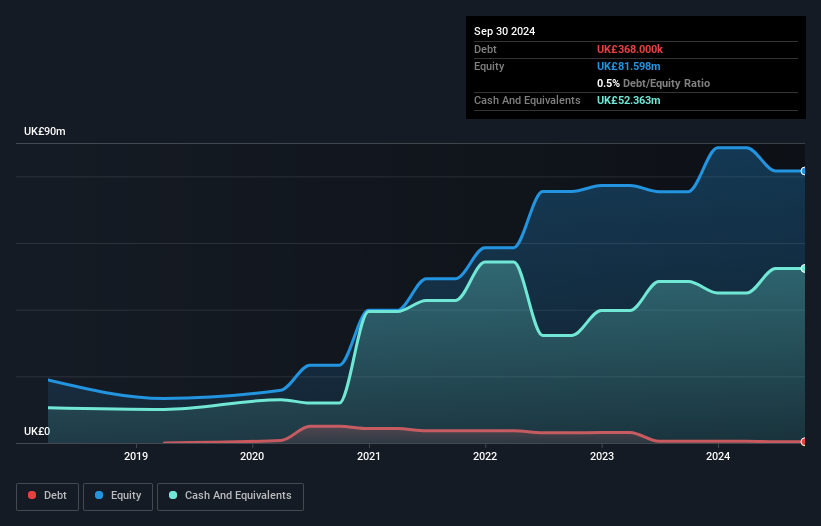

Foresight Group Holdings, with a market cap of £459.09 million, demonstrates strong financial health and growth potential. The company reported significant earnings growth of 45.9% over the past year, exceeding its five-year average and industry benchmarks. Its robust Return on Equity of 37.5% and well-covered debt by operating cash flow highlight efficient financial management. Recent developments include an increased equity buyback plan to £15 million and a strategic appointment as sub-investment manager for the Liontrust Diversified Real Assets fund, expected to enhance distribution capabilities. Despite high-quality earnings impacted by one-off items, Foresight remains undervalued at 28.9% below fair value estimates according to analysts' consensus projections for future growth.

- Get an in-depth perspective on Foresight Group Holdings' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Foresight Group Holdings' future.

Turning Ideas Into Actions

- Reveal the 443 hidden gems among our UK Penny Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRP

FRP Advisory Group

Provides business advisory services to companies, lenders, investors, individuals, and other stakeholders.

Outstanding track record and undervalued.

Market Insights

Community Narratives