- United Kingdom

- /

- Software

- /

- AIM:AOM

ActiveOps And 2 Other Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, investors often find opportunities in penny stocks—smaller or newer companies that can offer a blend of affordability and potential growth. While the term "penny stocks" may seem outdated, their relevance persists as they continue to attract attention for their unique ability to provide value and growth prospects when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £455.98M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £323.15M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.185 | £316.77M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.956 | £152.36M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £468.97M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.22 | £836.53M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.32 | £165.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £0.87 | £73.85M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ActiveOps Plc provides hosted operations management software as a service to various industries across Europe, the Middle East, India, Africa, North America, and Asia Pacific with a market cap of £73.86 million.

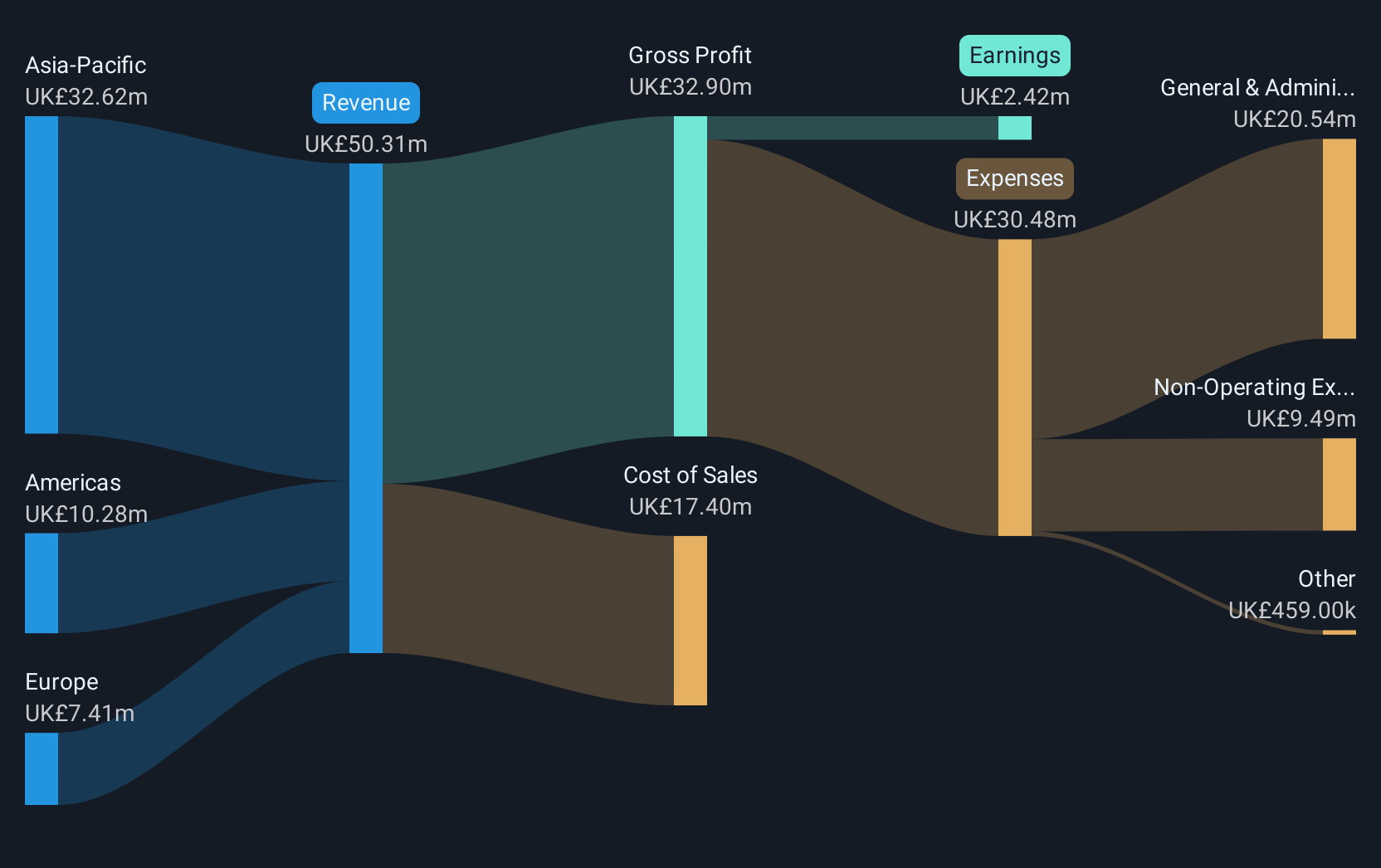

Operations: The company's revenue is primarily derived from its SaaS offerings at £25.03 million and supplemented by Training & Implementation services contributing £3.01 million.

Market Cap: £73.86M

ActiveOps Plc, with a market cap of £73.86 million, has shown significant growth in earnings, increasing by 1031% over the past year and outperforming the software industry average. Despite a low Return on Equity of 14.1%, the company is debt-free and maintains stable weekly volatility at 3%. Revenue from SaaS offerings stands at £25.03 million, supplemented by training services (£3.01 million). Recent executive changes include appointing Paul Maguire as Group Managing Director to drive global growth. ActiveOps' ControliQ solution is being utilized by CIBC Mellon to enhance fund accounting operations through AI-driven insights for improved productivity and decision-making capabilities.

- Click to explore a detailed breakdown of our findings in ActiveOps' financial health report.

- Understand ActiveOps' earnings outlook by examining our growth report.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Technologies PLC, operating under the Buddi brand, develops and delivers remote monitoring technologies and services for the offender and personal monitoring industry across the Americas, Europe, and Asia-Pacific, with a market cap of £340.16 million.

Operations: The company generates £54.45 million in revenue from the provision of electronic tracking devices, products, and services.

Market Cap: £340.16M

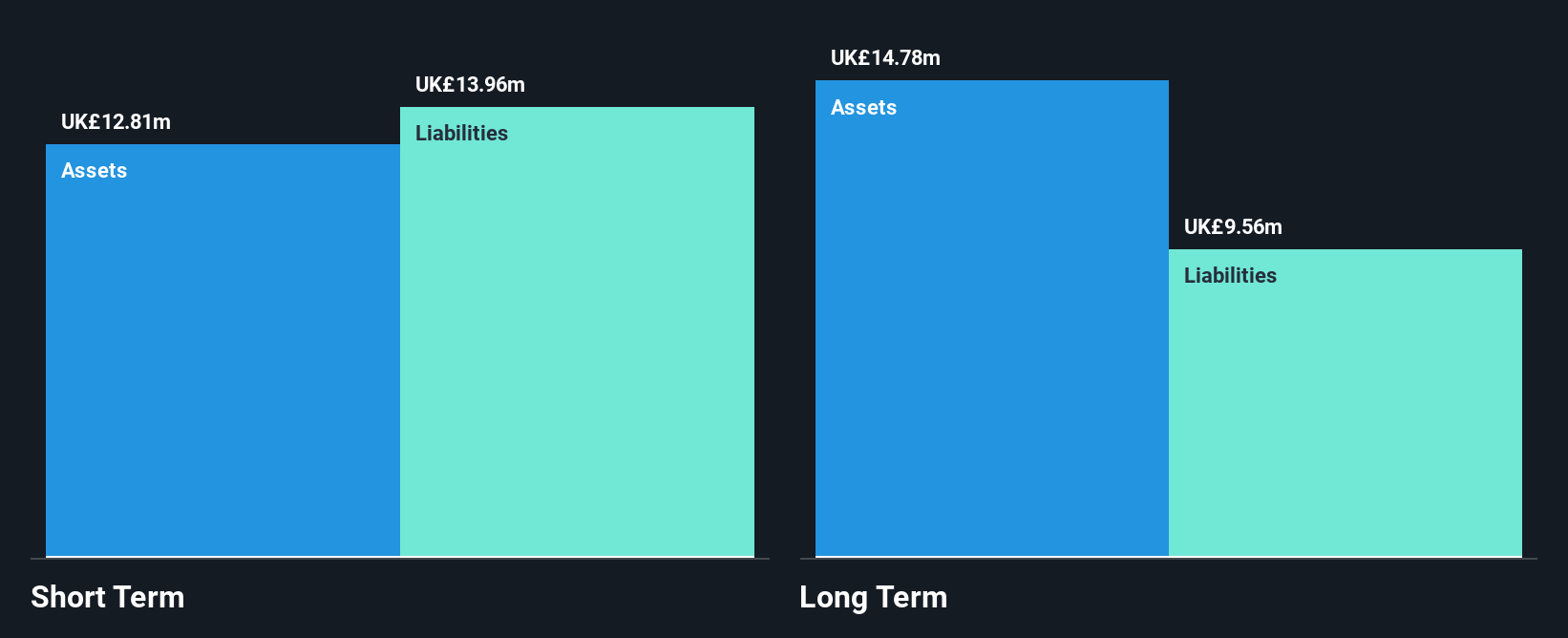

Big Technologies PLC, with a market cap of £340.16 million, is debt-free and has stable weekly volatility at 6%. Despite a decline in profit margins from 36.4% to 23% and negative earnings growth over the past year, the company maintains high-quality earnings and has not diluted shareholders recently. Short-term assets of £111.9 million comfortably cover both short- and long-term liabilities. Analysts forecast earnings growth at 26.69% per year, although recent guidance suggests revenue may decrease slightly to £50.3 million for 2024, aligning with market expectations for similar performance in 2025.

- Dive into the specifics of Big Technologies here with our thorough balance sheet health report.

- Gain insights into Big Technologies' future direction by reviewing our growth report.

eEnergy Group (AIM:EAAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: eEnergy Group Plc, with a market cap of £17.81 million, operates as an integrated energy services company in the United Kingdom and Ireland through its subsidiaries.

Operations: The company generates revenue through its operations as an integrated energy services provider in the United Kingdom and Ireland.

Market Cap: £17.81M

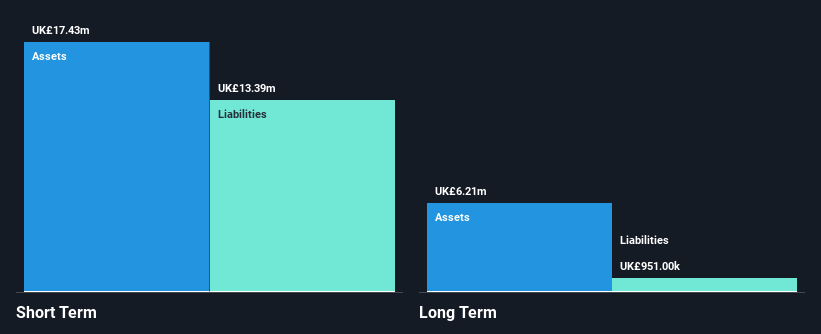

eEnergy Group Plc, with a market cap of £17.81 million, has shown improvement in its financial position by transitioning to positive shareholder equity from negative five years ago. The company is currently unprofitable and faces challenges with less than a year of cash runway based on free cash flow trends. Despite having more cash than total debt and covering both short- and long-term liabilities with its assets, the share price remains highly volatile. The management team is relatively new, averaging 0.7 years in tenure, while the board averages 4.6 years, indicating some level of experience at the governance level.

- Take a closer look at eEnergy Group's potential here in our financial health report.

- Learn about eEnergy Group's future growth trajectory here.

Where To Now?

- Click this link to deep-dive into the 445 companies within our UK Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AOM

ActiveOps

Engages in the provision of hosted operations management software as a service solution to industries in Europe, the Middle East, India, Africa, North America, and Asia Pacific.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives