- United Kingdom

- /

- Diversified Financial

- /

- AIM:BOKU

3 Promising Penny Stocks On UK Exchange With At Least £100M Market Cap

Reviewed by Simply Wall St

In the last week, the UK market has been flat, but it is up 7.8% over the past year and earnings are expected to grow by 15% per annum in the next few years. Penny stocks may be a throwback term, but they offer opportunities for growth at lower price points, particularly when backed by strong balance sheets and solid fundamentals. This article highlights three such penny stocks on the UK exchange that stand out as potential hidden gems with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £70.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £76.87M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £96.01M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £197.41M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.57M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $241.83M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AdvancedAdvT Limited currently does not have significant operations and has a market cap of £193.14 million.

Operations: AdvancedAdvT Limited has not reported any revenue segments.

Market Cap: £193.14M

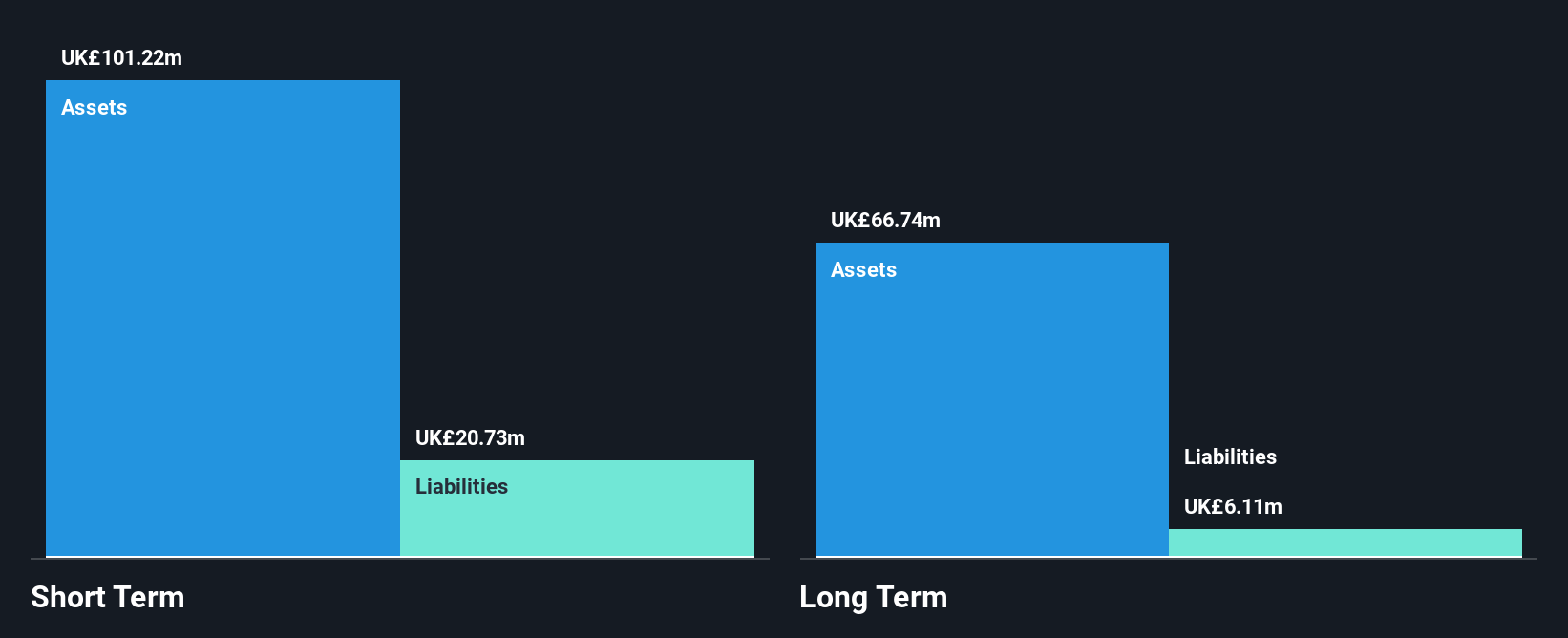

AdvancedAdvT Limited, with a market cap of £193.14 million, has transitioned from being pre-revenue to reporting sales of £19.87 million for the half year ended August 31, 2024, up from £15.15 million the previous year. The company achieved net income of £7.85 million compared to £3.14 million a year ago, indicating profitability growth despite its low return on equity at 3.7%. AdvancedAdvT's short-term assets significantly exceed its liabilities, and it remains debt-free with no shareholder dilution over the past year. Trading below estimated fair value by 37%, it presents potential investment interest amidst stable weekly volatility and experienced board tenure.

- Dive into the specifics of AdvancedAdvT here with our thorough balance sheet health report.

- Examine AdvancedAdvT's past performance report to understand how it has performed in prior years.

Boku (AIM:BOKU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boku, Inc. offers local payment solutions for merchants across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of £577.74 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: £577.74M

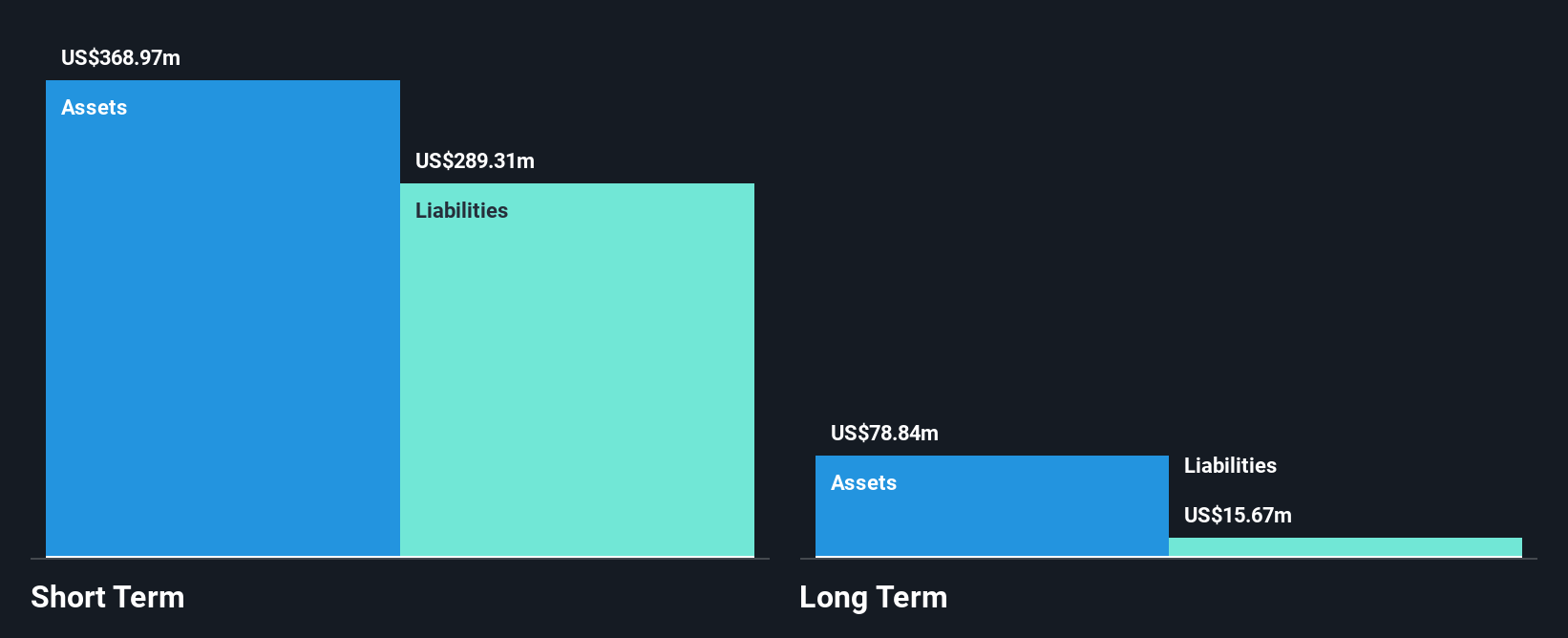

Boku, Inc., with a market cap of £577.74 million, has shown impressive earnings growth, achieving profitability over the past five years and reporting high-quality earnings. Despite a low return on equity at 5.2%, the company is debt-free and maintains strong asset coverage for liabilities. Recent developments include a new commercial agreement with Amazon Japan to enhance digital wallet services and a share buyback program aimed at managing equity remuneration obligations. However, despite increased sales to US$47.28 million for the first half of 2024, Boku reported a net loss of US$1.07 million compared to last year's profit.

- Unlock comprehensive insights into our analysis of Boku stock in this financial health report.

- Assess Boku's future earnings estimates with our detailed growth reports.

Somero Enterprises (AIM:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment globally with a market cap of £160.35 million.

Operations: The company generated $113.69 million in revenue from its Construction Machinery & Equipment segment.

Market Cap: £160.35M

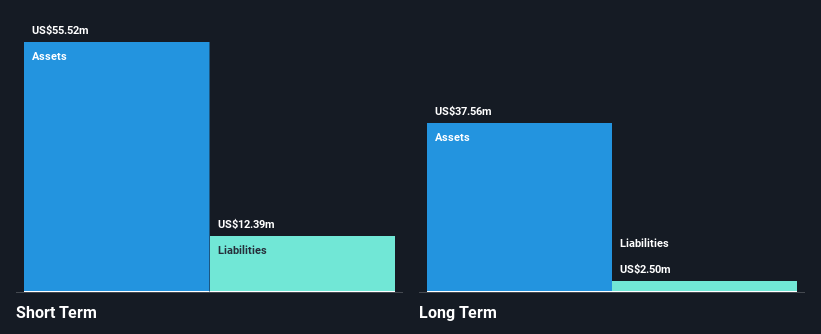

Somero Enterprises, Inc., with a market cap of £160.35 million, operates without debt, ensuring financial stability and eliminating the need for interest coverage. The company boasts a high return on equity at 30.3% and maintains strong asset coverage for both short-term ($55.5M) and long-term liabilities ($2.5M). Despite negative earnings growth over the past year (-8.9%), Somero's earnings have grown by 7.4% annually over five years, indicating resilience in its business model. However, the dividend yield of 8.22% is not well covered by free cash flows, raising sustainability concerns in this area.

- Click here and access our complete financial health analysis report to understand the dynamics of Somero Enterprises.

- Understand Somero Enterprises' track record by examining our performance history report.

Next Steps

- Click here to access our complete index of 470 UK Penny Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BOKU

Boku

Provides local payment solutions for merchants in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives