- United Kingdom

- /

- Semiconductors

- /

- AIM:IQE

Take Care Before Jumping Onto IQE plc (LON:IQE) Even Though It's 33% Cheaper

To the annoyance of some shareholders, IQE plc (LON:IQE) shares are down a considerable 33% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 15% share price drop.

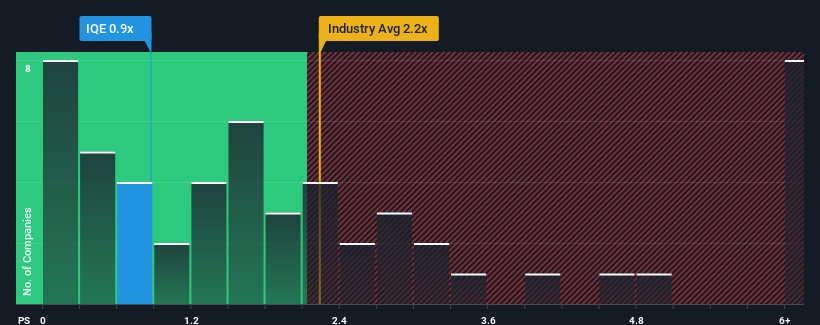

Following the heavy fall in price, it would be understandable if you think IQE is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.9x, considering almost half the companies in the United Kingdom's Semiconductor industry have P/S ratios above 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for IQE

What Does IQE's Recent Performance Look Like?

Recent times have been more advantageous for IQE as its revenue hasn't fallen as much as the rest of the industry. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on IQE.How Is IQE's Revenue Growth Trending?

IQE's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. This means it has also seen a slide in revenue over the longer-term as revenue is down 23% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the two analysts watching the company. With the industry predicted to deliver 14% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that IQE's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

The southerly movements of IQE's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for IQE remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware IQE is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If these risks are making you reconsider your opinion on IQE, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IQE

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives