- United Kingdom

- /

- Specialty Stores

- /

- LSE:WOSG

Why Investors Shouldn't Be Surprised By Watches of Switzerland Group plc's (LON:WOSG) 29% Share Price Surge

Watches of Switzerland Group plc (LON:WOSG) shares have had a really impressive month, gaining 29% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.1% over the last year.

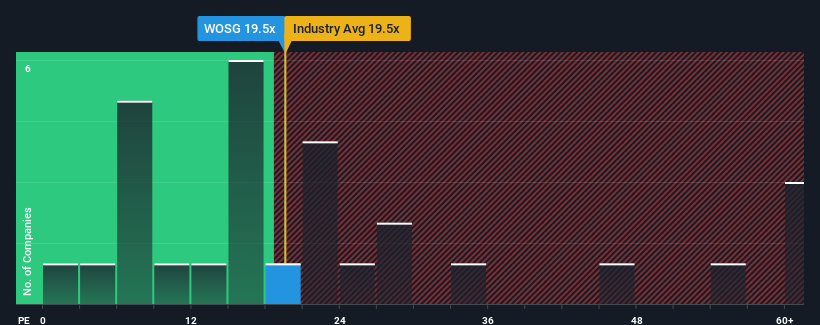

Since its price has surged higher, given around half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 16x, you may consider Watches of Switzerland Group as a stock to potentially avoid with its 19.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Watches of Switzerland Group's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Watches of Switzerland Group

How Is Watches of Switzerland Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Watches of Switzerland Group's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 51% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 28% per year during the coming three years according to the nine analysts following the company. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Watches of Switzerland Group's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Watches of Switzerland Group's P/E?

Watches of Switzerland Group shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Watches of Switzerland Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Watches of Switzerland Group that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Watches of Switzerland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WOSG

Watches of Switzerland Group

Operates as a retailer of luxury watches and jewelry in the United Kingdom, Europe, and the United States.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026