- United Kingdom

- /

- Software

- /

- AIM:GBG

UK Exchange Stocks: GB Group And 2 Other Companies That May Be Priced Below Intrinsic Estimates

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting concerns about global economic recovery. As investors navigate these uncertain times, identifying stocks that may be undervalued can offer potential opportunities for those looking to invest in companies whose intrinsic value might not be fully reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.918 | £1.70 | 45.9% |

| Hercules Site Services (AIM:HERC) | £0.495 | £0.93 | 46.7% |

| Brickability Group (AIM:BRCK) | £0.564 | £1.10 | 48.6% |

| On the Beach Group (LSE:OTB) | £2.54 | £4.94 | 48.6% |

| GlobalData (AIM:DATA) | £1.855 | £3.55 | 47.7% |

| Gaming Realms (AIM:GMR) | £0.389 | £0.72 | 45.7% |

| Victrex (LSE:VCT) | £9.92 | £19.54 | 49.2% |

| Duke Capital (AIM:DUKE) | £0.296 | £0.57 | 48% |

| Deliveroo (LSE:ROO) | £1.376 | £2.60 | 47.1% |

| Entain (LSE:ENT) | £7.358 | £14.55 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

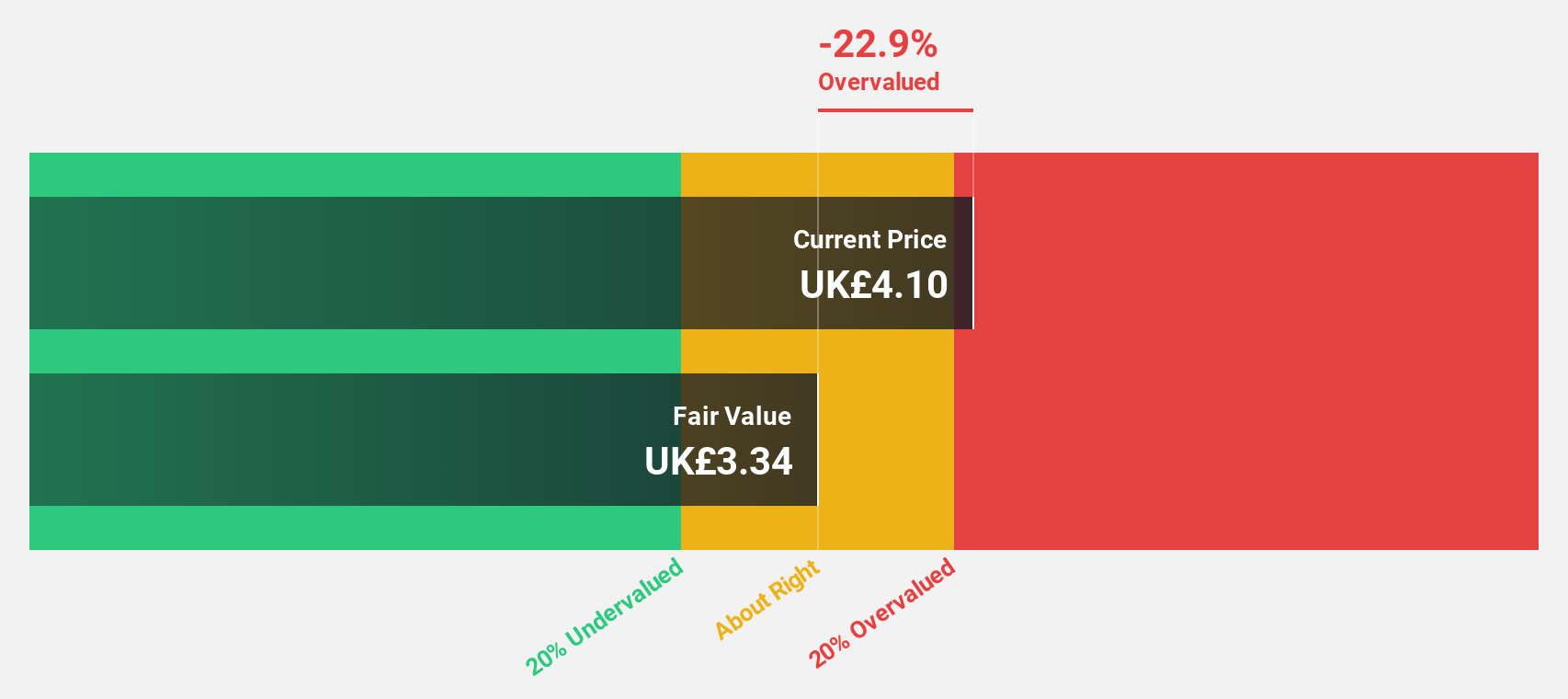

GB Group (AIM:GBG)

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally, with a market cap of £871.83 million.

Operations: The company's revenue is derived from three main segments: Fraud (£38.14 million), Identity (£159.78 million), and Location (£83.94 million).

Estimated Discount To Fair Value: 22.9%

GB Group plc has shown a turnaround with net income of £1.58 million for the half year ending September 2024, compared to a previous loss. Despite low forecasted return on equity, the stock is trading at £3.47, below its estimated fair value of £4.51, suggesting undervaluation based on cash flows. Earnings are expected to grow significantly at 38.9% annually over the next three years, outpacing UK market growth rates and indicating potential for future profitability improvements.

- Our expertly prepared growth report on GB Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of GB Group.

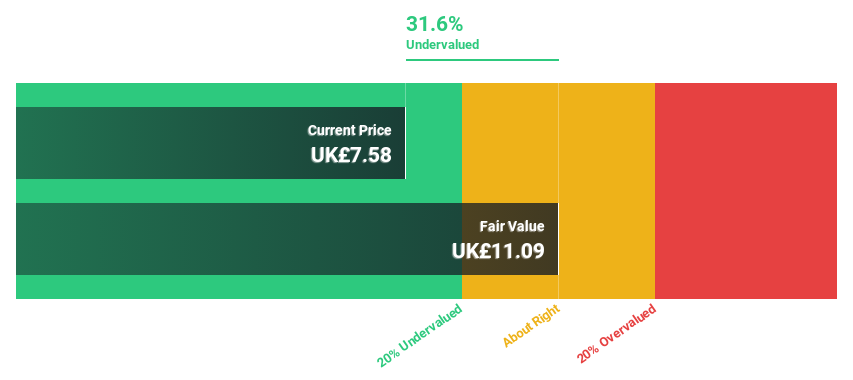

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with a market cap of £4.70 billion.

Operations: Entain Plc's revenue segments include a Segment Adjustment of £4.93 billion and an Elimination of Internal Revenue amounting to -£12.70 million.

Estimated Discount To Fair Value: 49.4%

Entain is trading at £7.36, significantly below its estimated fair value of £14.55, highlighting potential undervaluation based on cash flows. With revenue growth forecasted at 4.7% annually, surpassing the UK market rate, and an expected annual earnings growth of 88.87%, Entain shows promising financial prospects despite a low projected return on equity of 15.7%. Analysts anticipate a stock price increase of 30.2%, although dividend coverage remains weak.

- According our earnings growth report, there's an indication that Entain might be ready to expand.

- Dive into the specifics of Entain here with our thorough financial health report.

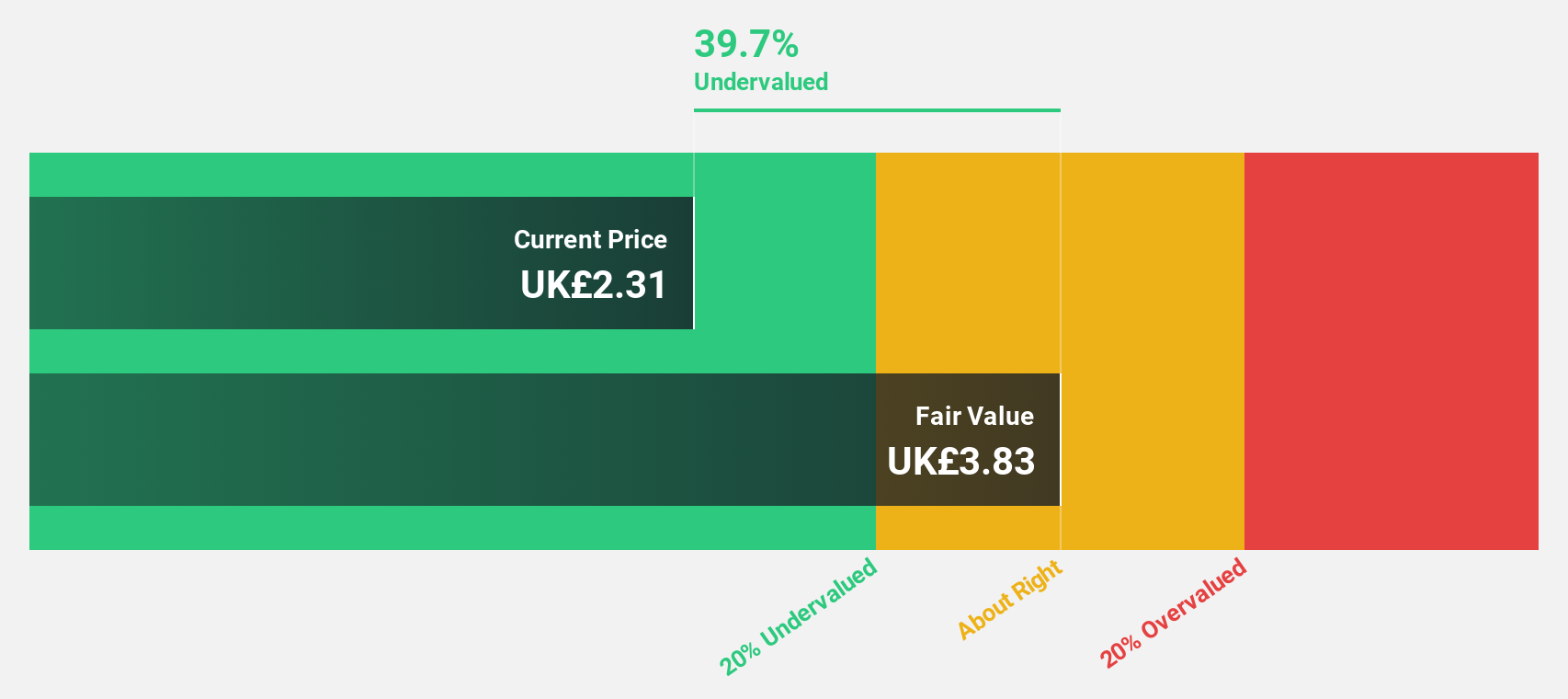

Watches of Switzerland Group (LSE:WOSG)

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry across the United Kingdom, Europe, and the United States, with a market cap of £1.34 billion.

Operations: The company's revenue is derived from its operations in the US, contributing £718.90 million, and in the UK and Europe, generating £842.40 million.

Estimated Discount To Fair Value: 39.2%

Watches of Switzerland Group is trading at £5.55, well below its estimated fair value of £9.13, reflecting potential undervaluation based on cash flows. Despite a drop in net income to £28.9 million for H1 2025 from £47 million the previous year, earnings are forecast to grow significantly at 26.95% annually over the next three years, outpacing UK market growth rates and indicating robust future financial performance despite current profit margin challenges.

- In light of our recent growth report, it seems possible that Watches of Switzerland Group's financial performance will exceed current levels.

- Click here to discover the nuances of Watches of Switzerland Group with our detailed financial health report.

Where To Now?

- Click this link to deep-dive into the 48 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GBG

GB Group

Provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives