- United Kingdom

- /

- Specialty Stores

- /

- LSE:WOSG

3 UK Penny Stocks With Market Caps Under £1B

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. In such uncertain times, investors often look for stocks that offer potential growth at an affordable price point. While the term "penny stocks" might seem outdated, these investments in smaller or newer companies can still present unique opportunities when they exhibit strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.675 | £523.4M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.14 | £172.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.54 | £260.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.09 | £173.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Volex (AIM:VLX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Volex plc manufactures and sells power and connectivity solutions across North America, Europe, and Asia, with a market cap of £700.58 million.

Operations: The company generates revenue across three regions: $170.4 million from Asia, $412.6 million from Europe, and $503.5 million from North America.

Market Cap: £700.58M

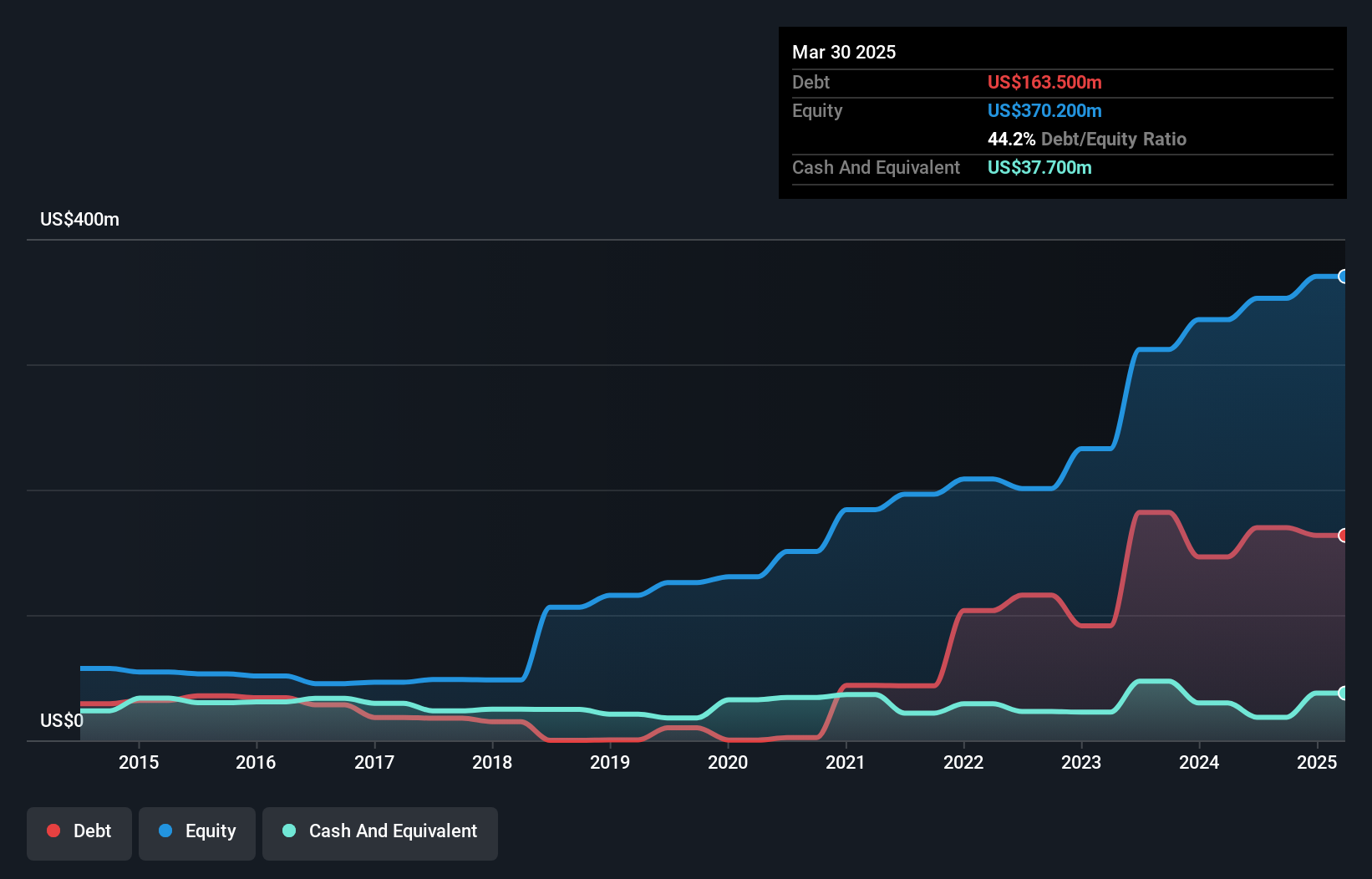

Volex plc, with a market cap of £700.58 million, demonstrates robust financial health and growth potential within the penny stock category. Its earnings have grown by 21.9% over the past year, outpacing both its historical average and industry peers. The company's Price-To-Earnings ratio (19.5x) suggests good value relative to the Electrical industry average (23.8x). Volex's debt is well managed with satisfactory net debt to equity and strong interest coverage ratios. Recent corporate guidance indicates continued revenue growth driven by strong customer relationships, while legal resolutions and dividend increases reflect proactive management strategies supporting shareholder value.

- Take a closer look at Volex's potential here in our financial health report.

- Explore Volex's analyst forecasts in our growth report.

S4 Capital (LSE:SFOR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: S4 Capital plc, along with its subsidiaries, offers digital advertising and marketing services across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £159.19 million.

Operations: The company generates revenue primarily from Technology Services, amounting to £69.6 million.

Market Cap: £159.19M

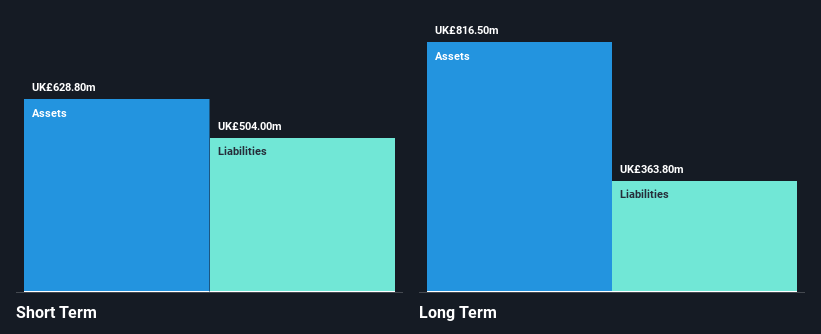

S4 Capital plc, with a market cap of £159.19 million, is navigating challenges as it remains unprofitable and has seen losses increase over the past five years. Despite this, the company maintains a positive cash flow and sufficient cash runway for over three years. Recent strategic appointments in India aim to bolster growth through enhanced digital marketing capabilities. However, macroeconomic uncertainties have led to a projected mid-single-digit decline in net revenue for 2025. The company's debt levels have risen significantly, yet its short-term assets exceed liabilities, indicating financial resilience amidst volatility in share price and earnings performance.

- Get an in-depth perspective on S4 Capital's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into S4 Capital's future.

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry, operating in the United Kingdom, Europe, and the United States, with a market cap of £911.08 million.

Operations: The company's revenue is derived from two main geographical segments, with £865.9 million generated in the UK & Europe and £790.1 million in the US.

Market Cap: £911.08M

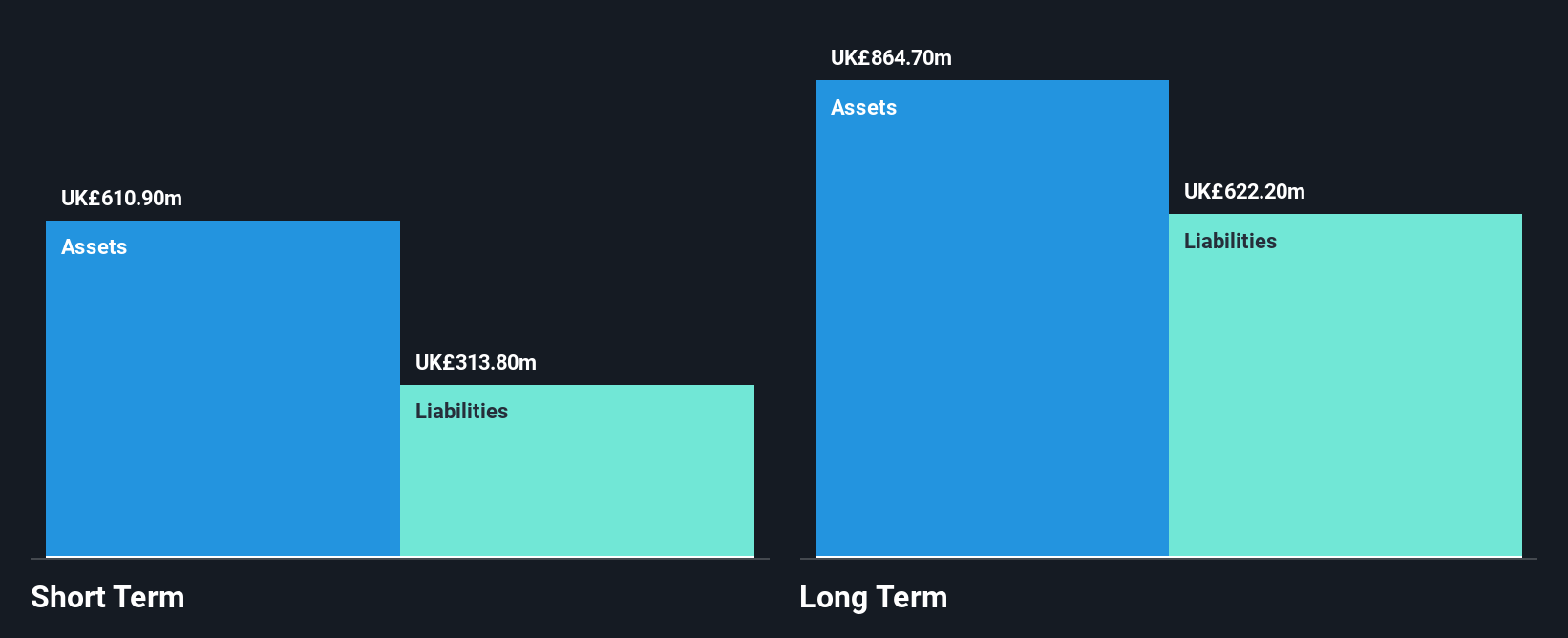

Watches of Switzerland Group PLC, with a market cap of £911.08 million, is trading at a significant discount to its estimated fair value, offering potential investment appeal. Despite recent negative earnings growth and a one-off loss impacting financial results, the company maintains strong liquidity with short-term assets exceeding short-term liabilities and debt well-covered by operating cash flow. The board and management are experienced, though return on equity remains low at 10%. A recent buyback plan expiration may influence future capital allocation strategies. Overall financial stability is supported by reduced debt levels over the past five years.

- Jump into the full analysis health report here for a deeper understanding of Watches of Switzerland Group.

- Learn about Watches of Switzerland Group's future growth trajectory here.

Summing It All Up

- Jump into our full catalog of 297 UK Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Watches of Switzerland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WOSG

Watches of Switzerland Group

Operates as a retailer of luxury watches and jewelry in the United Kingdom, Europe, and the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion