- United Kingdom

- /

- Specialty Stores

- /

- LSE:MOTR

Motorpoint Group Plc's (LON:MOTR) Stock Retreats 26% But Revenues Haven't Escaped The Attention Of Investors

Motorpoint Group Plc (LON:MOTR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 63%, which is great even in a bull market.

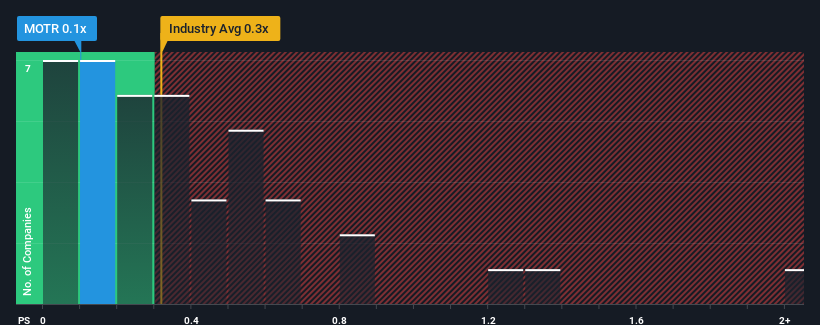

Even after such a large drop in price, it's still not a stretch to say that Motorpoint Group's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United Kingdom, where the median P/S ratio is around 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Motorpoint Group

What Does Motorpoint Group's P/S Mean For Shareholders?

Motorpoint Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Motorpoint Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Motorpoint Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Motorpoint Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. Still, the latest three year period has seen an excellent 51% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 6.4% per year as estimated by the three analysts watching the company. With the industry predicted to deliver 5.8% growth per year, the company is positioned for a comparable revenue result.

With this information, we can see why Motorpoint Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Motorpoint Group looks to be in line with the rest of the Specialty Retail industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Motorpoint Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Motorpoint Group that you need to be mindful of.

If these risks are making you reconsider your opinion on Motorpoint Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MOTR

Motorpoint Group

Operates as an omnichannel vehicle retailer in the United Kingdom.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives