- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BAB

3 UK Stocks Estimated To Be Trading At Up To 42.1% Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower amid weak trade data from China and concerns about the global economic recovery. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £2.00 | £3.72 | 46.2% |

| JD Sports Fashion (LSE:JD.) | £1.3865 | £2.75 | 49.7% |

| Tracsis (AIM:TRCS) | £5.35 | £9.97 | 46.3% |

| Redcentric (AIM:RCN) | £1.3075 | £2.43 | 46.1% |

| Videndum (LSE:VID) | £2.54 | £4.60 | 44.8% |

| Foxtons Group (LSE:FOXT) | £0.63 | £1.20 | 47.4% |

| SysGroup (AIM:SYS) | £0.33 | £0.65 | 49.2% |

| Hochschild Mining (LSE:HOC) | £1.89 | £3.56 | 46.9% |

| BATM Advanced Communications (LSE:BVC) | £0.1985 | £0.37 | 46.1% |

| Genel Energy (LSE:GENL) | £0.772 | £1.50 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Babcock International Group (LSE:BAB)

Overview: Babcock International Group PLC is involved in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security across various regions including the UK and internationally, with a market cap of £2.42 billion.

Operations: The company's revenue is derived from four main segments: Land (£1.10 billion), Marine (£1.43 billion), Nuclear (£1.52 billion), and Aviation (£341.50 million).

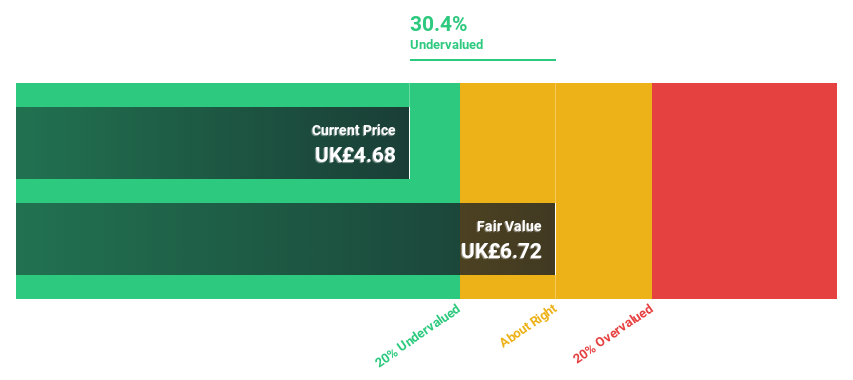

Estimated Discount To Fair Value: 30%

Babcock International Group is trading at approximately 30% below its estimated fair value of £6.88 per share, making it highly undervalued based on discounted cash flow analysis. Despite a high debt level, the company has returned to profitability with net income reaching £165.7 million for FY24. Earnings are forecast to grow annually by 15.3%, outpacing the UK market average, while revenue growth remains modest at 4% per year.

- Our growth report here indicates Babcock International Group may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Babcock International Group.

Barratt Developments (LSE:BDEV)

Overview: Barratt Developments plc operates in the housebuilding industry within the United Kingdom and has a market capitalization of approximately £6.96 billion.

Operations: The company generates revenue primarily from its housebuilding segment, which amounts to £4.17 billion.

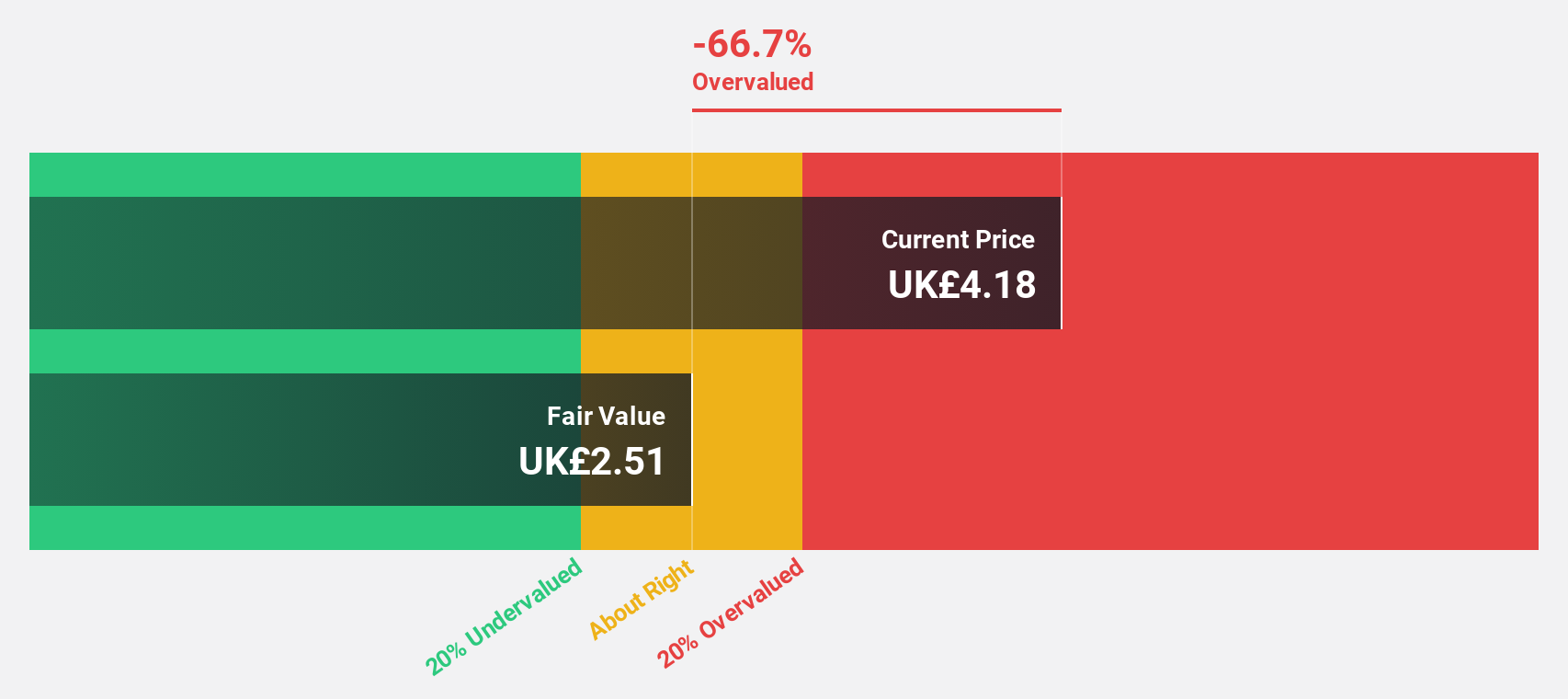

Estimated Discount To Fair Value: 34.6%

Barratt Developments is trading 34.6% below its estimated fair value of £7.37, highlighting its undervaluation based on discounted cash flow analysis. Despite a challenging year with sales dropping to £4.17 billion from £5.32 billion and net income falling to £114.1 million, earnings are projected to grow significantly at 44.5% annually, surpassing UK market averages. However, dividends have been reduced due to lower earnings coverage and recent shareholder dilution remains a concern.

- The analysis detailed in our Barratt Developments growth report hints at robust future financial performance.

- Get an in-depth perspective on Barratt Developments' balance sheet by reading our health report here.

Moonpig Group (LSE:MOON)

Overview: Moonpig Group PLC operates as an online retailer of greeting cards and gifts in the Netherlands and the United Kingdom, with a market cap of £739.82 million.

Operations: The company's revenue is primarily derived from its Moonpig segment at £241.33 million, followed by Greetz at £51.24 million, and Experiences contributing £48.58 million.

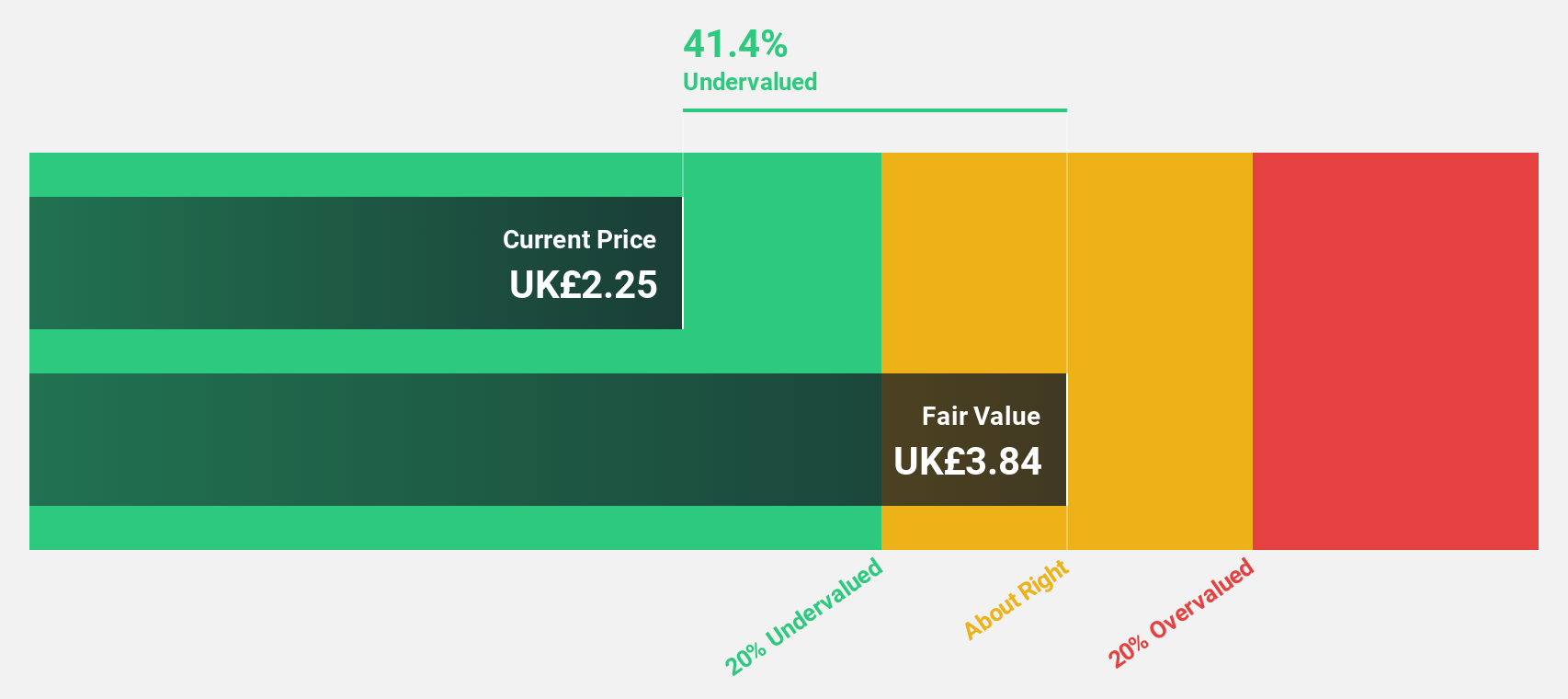

Estimated Discount To Fair Value: 42.1%

Moonpig Group is trading 42.1% below its estimated fair value of £3.71, indicating significant undervaluation based on discounted cash flow analysis. While revenue growth is modest at 7.5% annually, earnings are projected to increase by 18.55%, outpacing the UK market average of 14.2%. Despite a high level of debt, Moonpig's return on equity is forecast to reach a very high level in three years, enhancing its investment appeal amidst financial challenges.

- Our comprehensive growth report raises the possibility that Moonpig Group is poised for substantial financial growth.

- Navigate through the intricacies of Moonpig Group with our comprehensive financial health report here.

Make It Happen

- Click here to access our complete index of 58 Undervalued UK Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Babcock International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAB

Babcock International Group

Engages in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security in the United Kingdom, rest of Europe, Africa, North America, Australasia, and internationally.

Very undervalued with solid track record.