- United Kingdom

- /

- Capital Markets

- /

- LSE:MGCI

Top UK Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

The UK market has faced recent challenges, with the FTSE 100 index closing lower due to weak trade data from China and a sluggish global economic recovery. Despite these headwinds, dividend stocks remain an attractive option for investors seeking steady income amidst market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.85% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 7.34% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.67% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.12% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.77% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.43% | ★★★★★☆ |

| Epwin Group (AIM:EPWN) | 5.71% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.79% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.48% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc, with a market cap of £2.45 billion, operates as a retailer of homewares in the United Kingdom.

Operations: Dunelm Group plc generates £1.68 billion in revenue from retailing homewares in the United Kingdom.

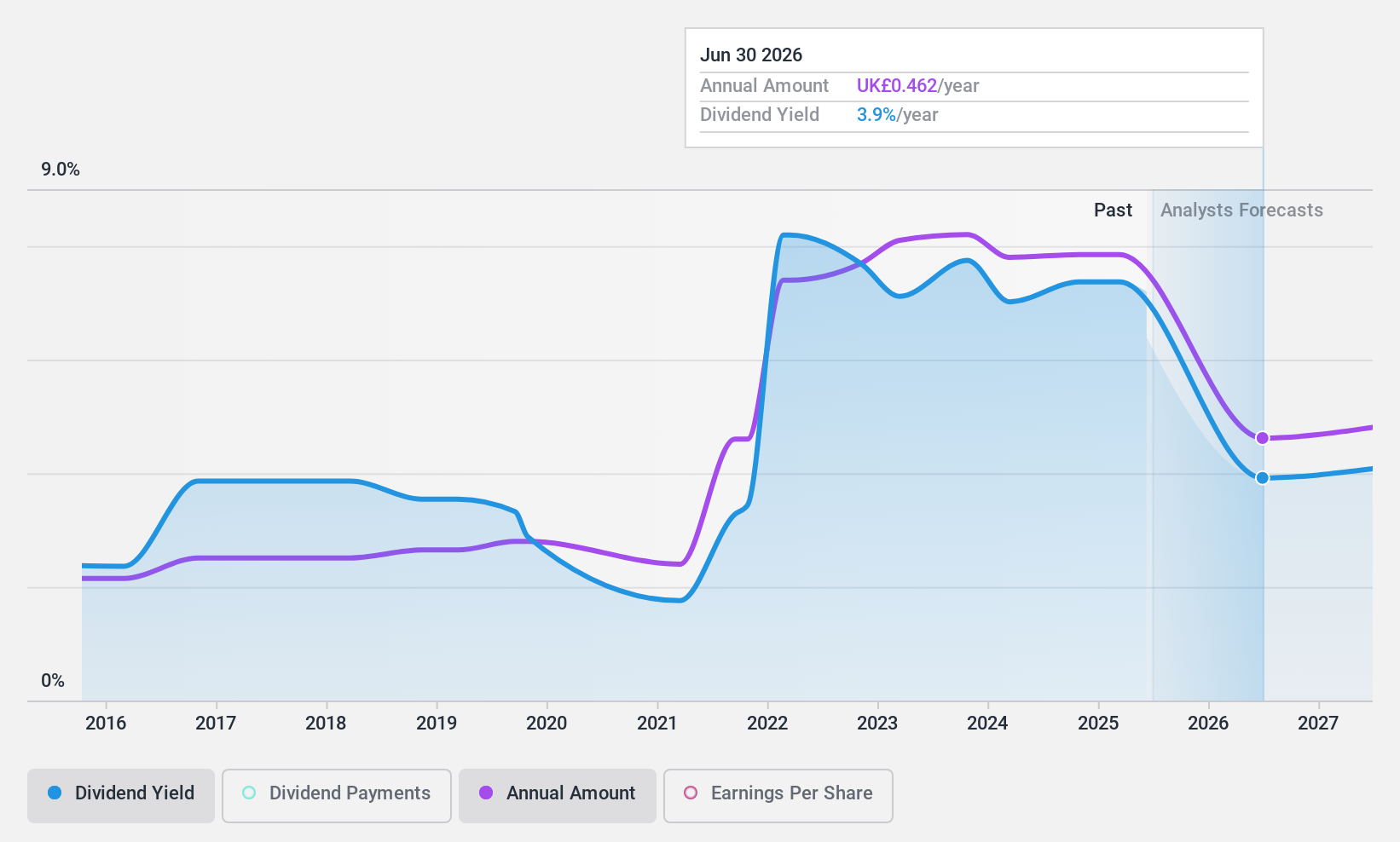

Dividend Yield: 6.4%

Dunelm Group's dividend payments have been volatile over the past decade, though they are currently covered by both earnings (58.1% payout ratio) and cash flows (74.8% cash payout ratio). Despite trading at 25.7% below estimated fair value, recent board changes and stable sales growth (£1.71 billion for the year ending June 2024) highlight ongoing organizational shifts. The dividend yield of 6.43% places it in the top quartile of UK dividend payers, but its unstable track record warrants caution.

- Click here to discover the nuances of Dunelm Group with our detailed analytical dividend report.

- Our expertly prepared valuation report Dunelm Group implies its share price may be lower than expected.

M&G Credit Income Investment Trust (LSE:MGCI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M&G Credit Income Investment Trust plc focuses on investing in a diversified portfolio of public and private debt and debt-like instruments, with a market cap of £139.79 million.

Operations: M&G Credit Income Investment Trust plc generates £15.36 million from its financial services segment, specifically through closed-end funds.

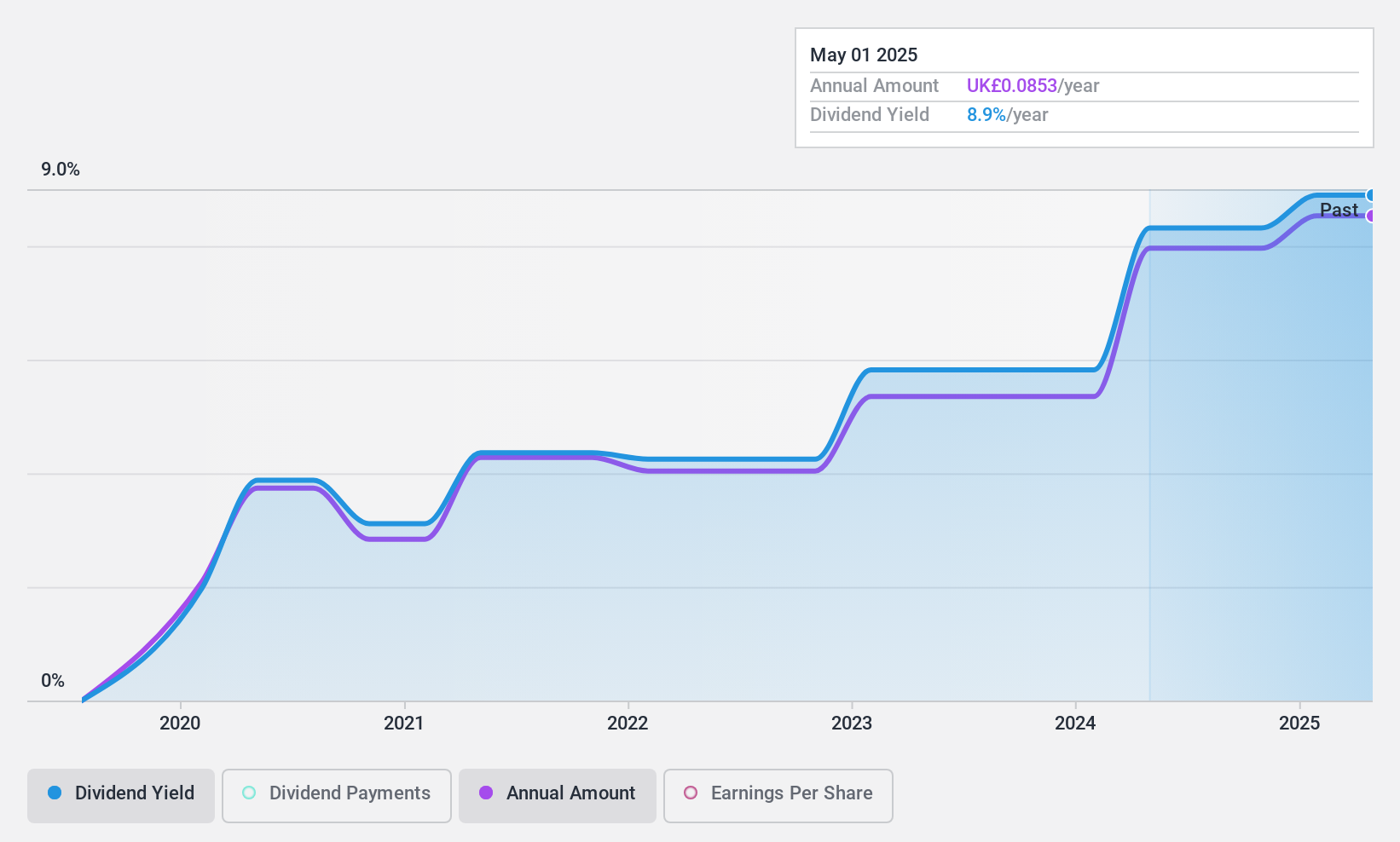

Dividend Yield: 8.1%

M&G Credit Income Investment Trust's dividend yield of 8.12% ranks it in the top 25% of UK dividend payers, although its payments have been volatile over the past five years. The company's dividends are covered by both earnings (84.8% payout ratio) and cash flows (57.8% cash payout ratio). Recently, MGCI affirmed an interim dividend payment of £0.0215 per share for Q2 2024, payable on August 23rd to shareholders registered by August 2nd.

- Delve into the full analysis dividend report here for a deeper understanding of M&G Credit Income Investment Trust.

- Insights from our recent valuation report point to the potential overvaluation of M&G Credit Income Investment Trust shares in the market.

TBC Bank Group (LSE:TBCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TBC Bank Group PLC, with a market cap of £1.64 billion, offers banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan through its subsidiaries.

Operations: TBC Bank Group PLC generates revenue from its Uzbekistan operations (GEL 236.42 million) and segment adjustments (GEL 2132.38 million).

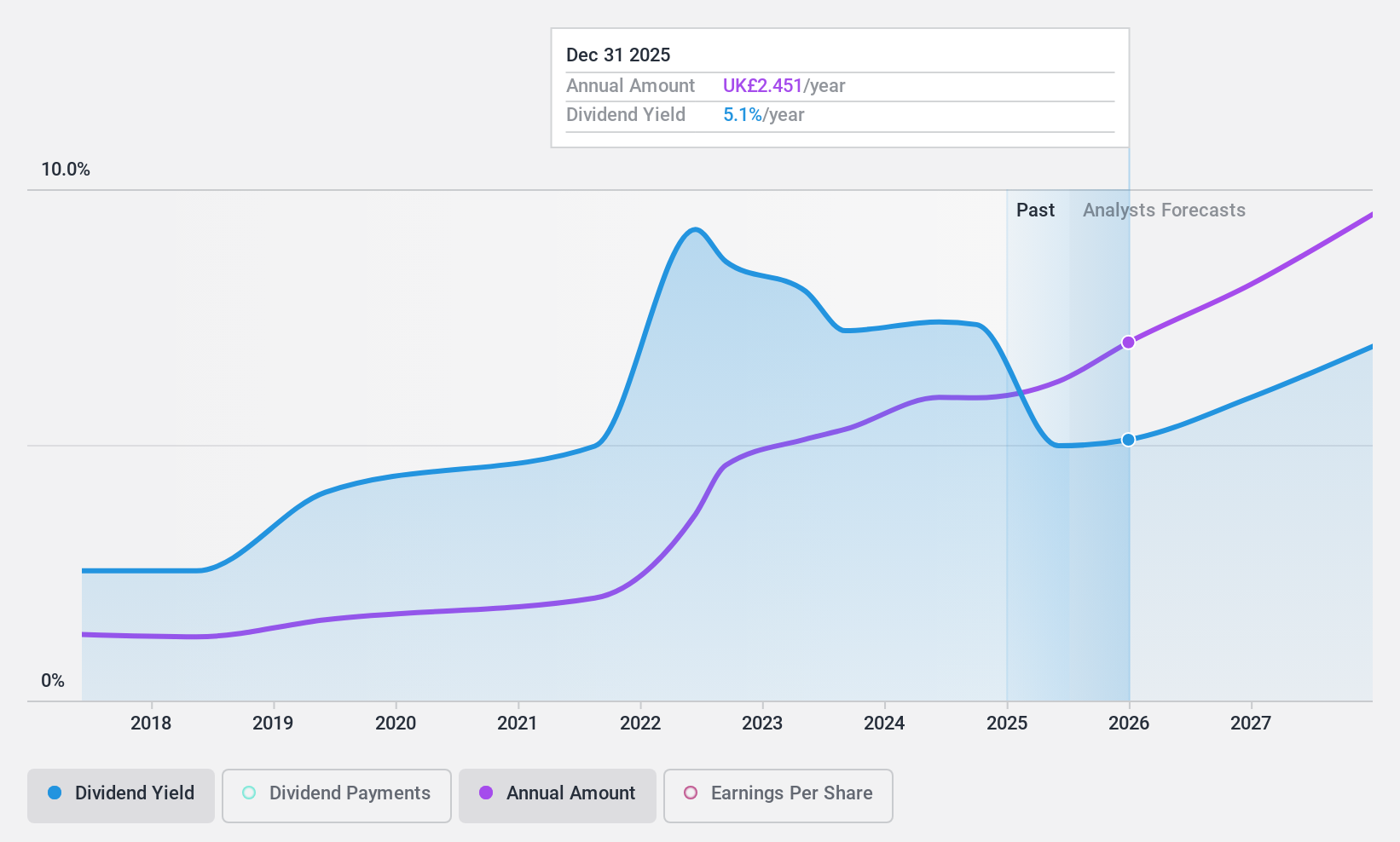

Dividend Yield: 7.0%

TBC Bank Group PLC's recent earnings report showed net interest income of GEL 862.2 million and net income of GEL 617.4 million for H1 2024, up from last year. The Board declared an interim dividend of GEL 2.55 per share, with a payout ratio of 32.6%, indicating strong coverage by earnings. Despite a relatively short dividend history, TBCG’s dividends are growing and stable, placing its yield in the top quartile among UK dividend payers.

- Get an in-depth perspective on TBC Bank Group's performance by reading our dividend report here.

- Our valuation report here indicates TBC Bank Group may be undervalued.

Seize The Opportunity

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 55 more companies for you to explore.Click here to unveil our expertly curated list of 58 Top UK Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MGCI

M&G Credit Income Investment Trust

Engages in investment in a portfolio of public and private debt and debt-like instruments.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives