- United Kingdom

- /

- Specialty Stores

- /

- LSE:CARD

Card Factory (LON:CARD) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Card Factory plc (LON:CARD) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Card Factory

What Is Card Factory's Net Debt?

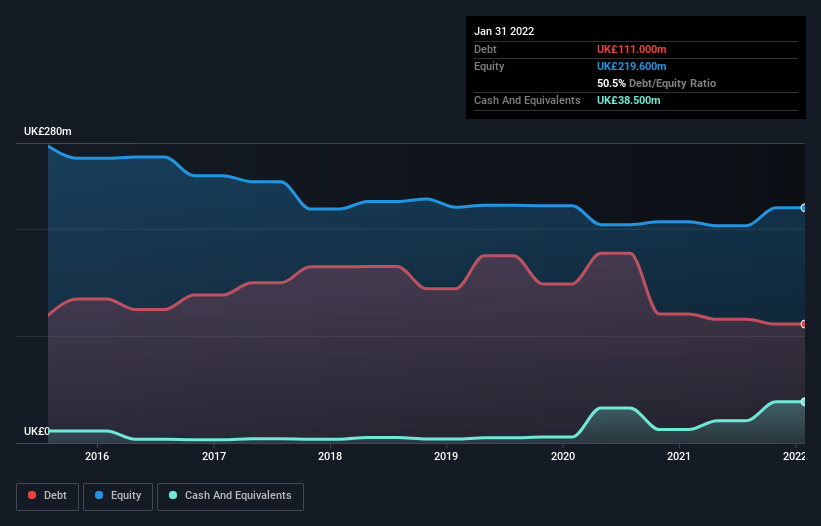

As you can see below, Card Factory had UK£111.0m of debt at January 2022, down from UK£120.3m a year prior. However, it also had UK£38.5m in cash, and so its net debt is UK£72.5m.

How Healthy Is Card Factory's Balance Sheet?

We can see from the most recent balance sheet that Card Factory had liabilities of UK£152.2m falling due within a year, and liabilities of UK£164.2m due beyond that. Offsetting these obligations, it had cash of UK£38.5m as well as receivables valued at UK£3.00m due within 12 months. So it has liabilities totalling UK£274.9m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of UK£193.4m, we think shareholders really should watch Card Factory's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Card Factory has a quite reasonable net debt to EBITDA multiple of 1.9, its interest cover seems weak, at 1.5. This does suggest the company is paying fairly high interest rates. Either way there's no doubt the stock is using meaningful leverage. We also note that Card Factory improved its EBIT from a last year's loss to a positive UK£30m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Card Factory's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Card Factory actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Card Factory's level of total liabilities left us tentative about the stock, and its interest cover was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Card Factory stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. Given our hesitation about the stock, it would be good to know if Card Factory insiders have sold any shares recently. You click here to find out if insiders have sold recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CARD

Card Factory

Operates as a specialist retailer of cards, gifts, and celebration essentials in the United Kingdom, South Africa, Republic of Ireland, the United States, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.