- United Kingdom

- /

- Specialty Stores

- /

- AIM:BWNG

Such Is Life: How N Brown Group (LON:BWNG) Shareholders Saw Their Shares Drop 63%

N Brown Group plc (LON:BWNG) shareholders will doubtless be very grateful to see the share price up 32% in the last quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 63% during that time. Some might say the recent bounce is to be expected after such a bad drop. Of course, this could be the start of a turnaround.

See our latest analysis for N Brown Group

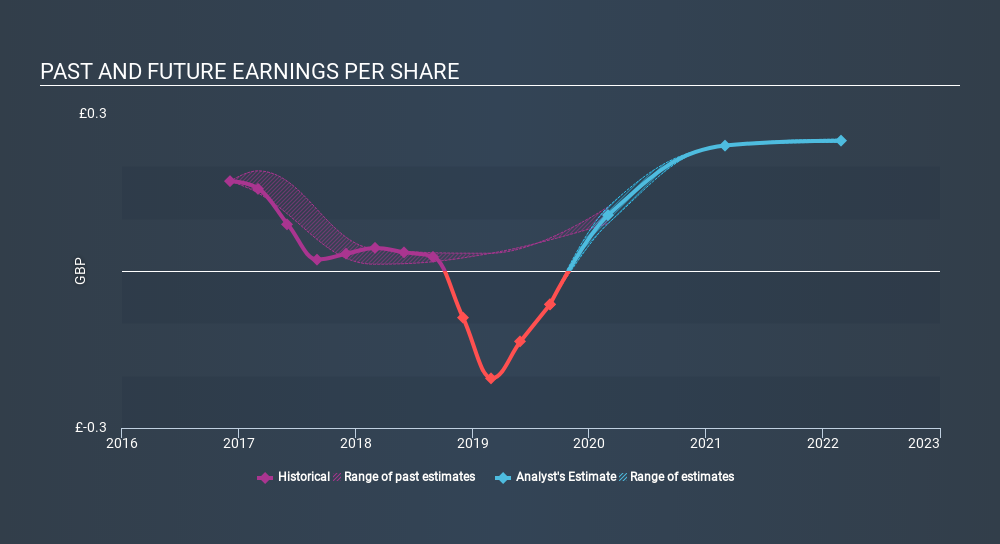

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over five years N Brown Group's earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, N Brown Group's TSR for the last 5 years was -50%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that N Brown Group shareholders have received a total shareholder return of 57% over the last year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 13% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for N Brown Group (of which 1 is major) which any shareholder or potential investor should be aware of.

We will like N Brown Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:BWNG

N Brown Group

Operates as a clothing and footwear digital retailer in the United Kingdom.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives