- United Kingdom

- /

- Commercial Services

- /

- AIM:TENG

How Much Did Ten Lifestyle Group's(LON:TENG) Shareholders Earn From Share Price Movements Over The Last Three Years?

Ten Lifestyle Group Plc (LON:TENG) shareholders should be happy to see the share price up 27% in the last quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 41% in the last three years, falling well short of the market return.

View our latest analysis for Ten Lifestyle Group

Ten Lifestyle Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Ten Lifestyle Group grew revenue at 13% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 12% per year, for three years. This implies the market had higher expectations of Ten Lifestyle Group. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

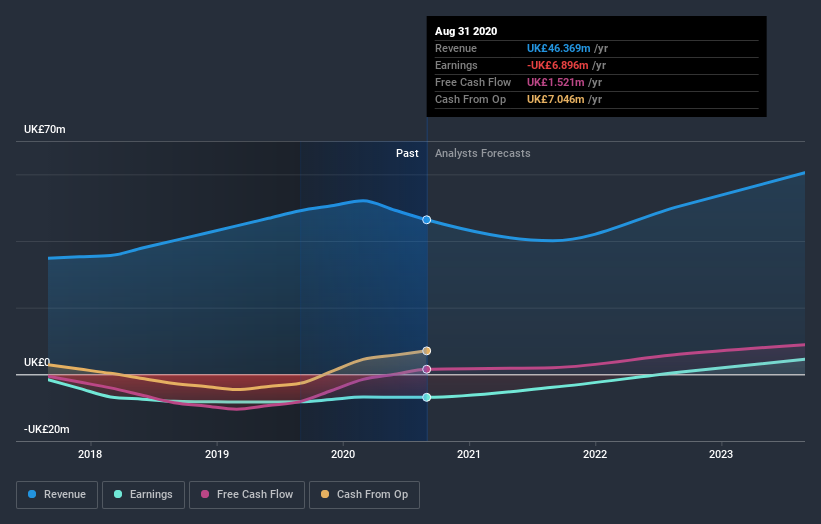

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Ten Lifestyle Group will earn in the future (free profit forecasts).

A Different Perspective

Ten Lifestyle Group shareholders are down 27% for the year, falling short of the market return. Meanwhile, the broader market slid about 5.1%, likely weighing on the stock. The three-year loss of 12% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Ten Lifestyle Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ten Lifestyle Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:TENG

Ten Lifestyle Group

Offers concierge services to private banks, premium financial services, and high-net-worth individuals in Asia, the Middle East, Africa, and the Americas.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026