- United Kingdom

- /

- Retail Distributors

- /

- AIM:LIKE

Amidst increasing losses, Investors bid up Likewise Group (LON:LIKE) 11% this past week

This week we saw the Likewise Group Plc (LON:LIKE) share price climb by 11%. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 29% in the last year, significantly under-performing the market.

On a more encouraging note the company has added UK£4.9m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Likewise Group

Given that Likewise Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Likewise Group increased its revenue by 104%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 29% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized.

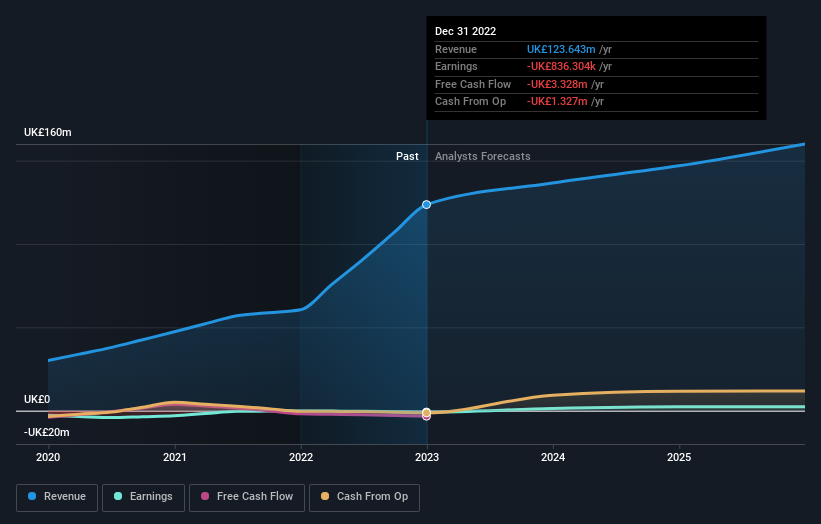

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Given that the market gained 3.1% in the last year, Likewise Group shareholders might be miffed that they lost 28% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 13% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with Likewise Group (including 1 which can't be ignored) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:LIKE

Likewise Group

Likewise Group Plc, together with its subsidiaries, wholesales and distributes floorcoverings, rugs, and matting products for domestic and commercial flooring markets in the United Kingdom and Rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives