- United Kingdom

- /

- Basic Materials

- /

- LSE:BREE

3 European Undervalued Small Caps With Insider Action To Watch

Reviewed by Simply Wall St

Amidst renewed concerns about inflated AI stock valuations, European markets have experienced a decline, with the pan-European STOXX Europe 600 Index falling by 2.21% recently. This environment of cautious sentiment presents an opportunity to explore small-cap stocks that may be overlooked yet hold potential due to insider activity and other compelling factors.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.6x | 0.7x | 42.87% | ★★★★★☆ |

| Cairn Homes | 12.5x | 1.6x | 27.46% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 42.34% | ★★★★★☆ |

| Senior | 23.6x | 0.7x | 30.82% | ★★★★★☆ |

| Eurocell | 16.0x | 0.3x | 41.07% | ★★★★☆☆ |

| Pexip Holding | 30.7x | 4.9x | 27.43% | ★★★☆☆☆ |

| Kendrion | 29.4x | 0.7x | 40.55% | ★★★☆☆☆ |

| Eastnine | 12.0x | 7.6x | 48.63% | ★★★☆☆☆ |

| J D Wetherspoon | 11.2x | 0.4x | -4.76% | ★★★☆☆☆ |

| CVS Group | 45.1x | 1.3x | 27.81% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

boohoo group (AIM:DEBS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Boohoo Group is a UK-based online fashion retailer focusing on a diverse range of brands, with operations spanning multiple segments including Karen Millen, Youth Brands, and Debenhams & Labels; the company has a market cap of approximately £0.46 billion.

Operations: The company generates revenue primarily from its Youth Brands, contributing £514.1 million, followed by Debenhams & Labels at £208.4 million and Karen Millen at £67.8 million. Operating expenses have consistently exceeded gross profit in recent periods, with sales and marketing being a significant cost component, reaching up to £346.5 million in some quarters. The net income margin has shown a declining trend, turning negative in the most recent periods, indicating challenges in profitability despite maintaining substantial revenue figures.

PE: -1.0x

Boohoo Group, a key player in the European small-cap sector, has faced significant share price volatility over the past three months. Currently unprofitable and not expected to achieve profitability within three years, it operates with less than one year of cash runway and relies on external borrowing for funding. Despite these challenges, insider confidence is evident from recent share purchases in September 2025. The introduction of AI solutions by Debenhams Group aims to enhance operational efficiency during peak shopping periods, potentially boosting Boohoo's market position amidst evolving retail dynamics.

- Get an in-depth perspective on boohoo group's performance by reading our valuation report here.

Examine boohoo group's past performance report to understand how it has performed in the past.

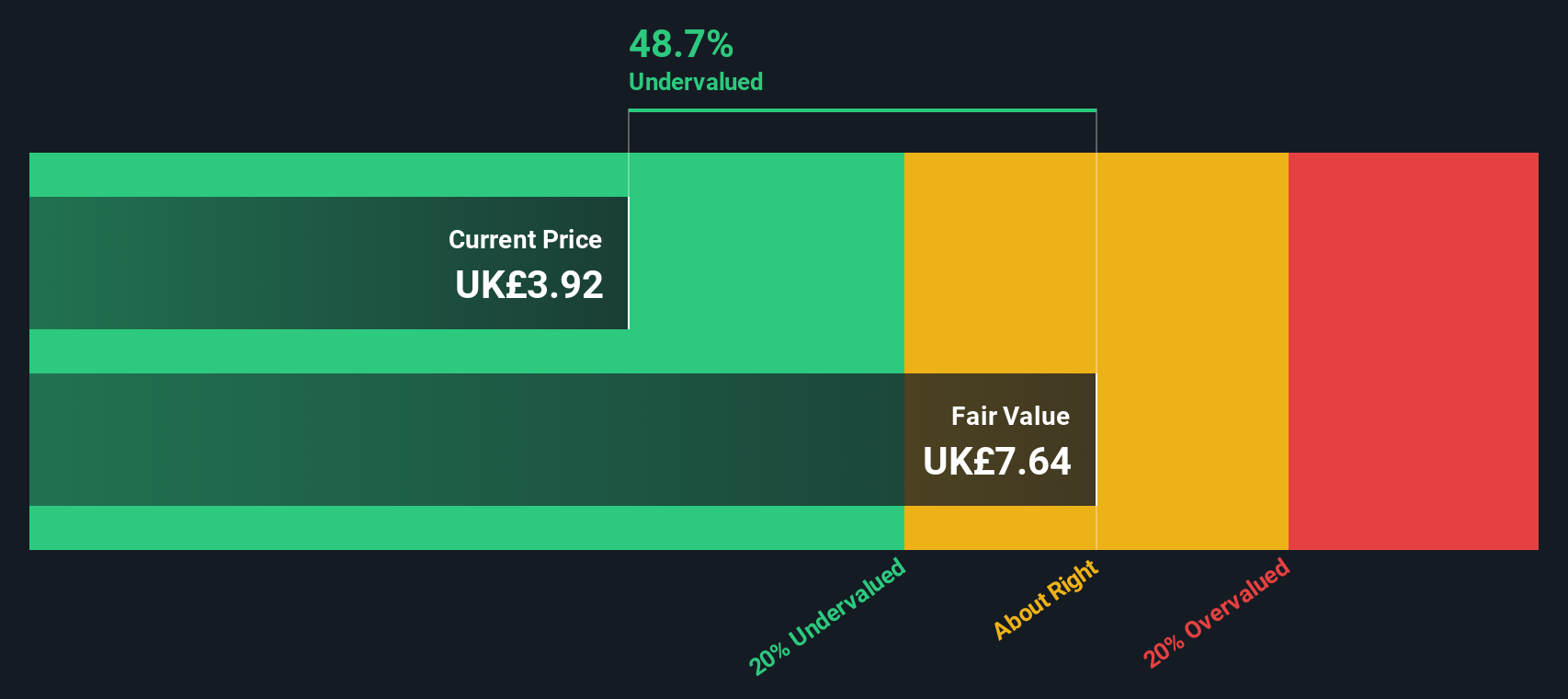

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★★★★

Overview: Breedon Group is a construction materials company operating in sectors such as cement and aggregates, with a market capitalization of £1.36 billion.

Operations: Breedon Group generates revenue primarily from its operations in Great Britain (£985.70 million), Cement (£302.50 million), Ireland (£225.20 million), and the United States (£206.70 million). The company's gross profit margin has shown significant variation, peaking at 82.31% as of December 2024, reflecting changes in cost management and operational efficiency over time. Operating expenses include substantial allocations for sales and marketing, which have fluctuated significantly in recent periods, impacting overall profitability metrics such as net income margin.

PE: 12.9x

Breedon Group is attracting attention in the European small-cap space, with recent insider confidence bolstered by share purchases in the past six months. Despite carrying significant debt, its revenue and earnings are projected to grow 11% annually. The company relies entirely on external borrowing for funding, which could pose risks. A recent sales statement highlighted steady performance up to October 2025, suggesting potential for future growth amidst cautious optimism within their industry context.

- Click here and access our complete valuation analysis report to understand the dynamics of Breedon Group.

Evaluate Breedon Group's historical performance by accessing our past performance report.

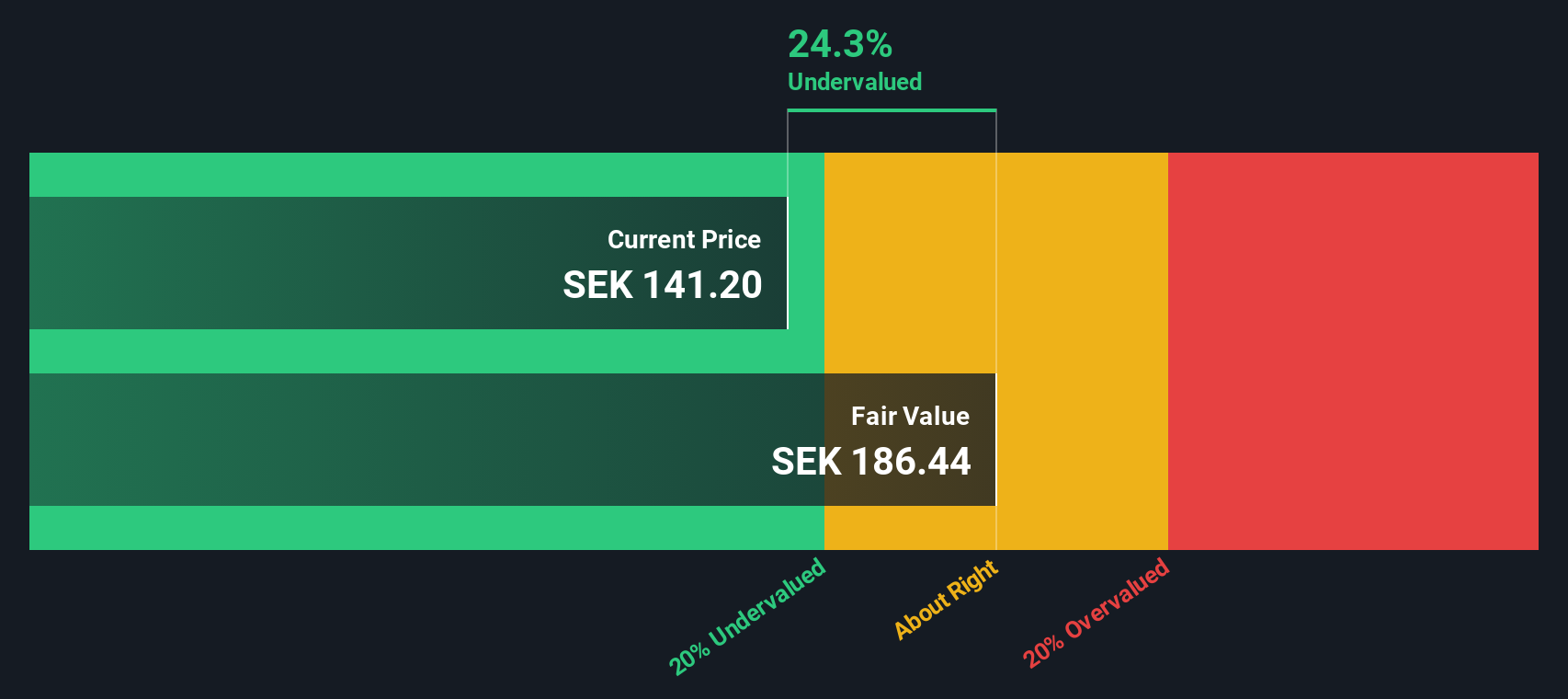

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alimak Group specializes in providing vertical access solutions for various industries, including construction and industrial sectors, with a market capitalization of SEK 6.82 billion.

Operations: The company's revenue is primarily derived from its Facade Access and Construction segments, contributing SEK 1.997 billion and SEK 1.553 billion, respectively. The gross profit margin has shown an upward trend, reaching 40.41% by the end of September 2025. Operating expenses include significant allocations towards Sales & Marketing and General & Administrative activities, with recent figures indicating SEK 911 million and SEK 719 million, respectively.

PE: 22.4x

Alimak Group, a small European industrial company, is attracting attention for its potential value. Despite a slight dip in third-quarter sales to SEK 1,658 million from SEK 1,742 million last year and net income falling to SEK 133 million from SEK 155 million, the company shows promise with earnings projected to grow by over 12% annually. Insider confidence is evident as President Ole Jodahl recently purchased shares worth approximately SEK 1.45 million in November. This move suggests optimism about future prospects despite reliance on external borrowing for funding.

- Unlock comprehensive insights into our analysis of Alimak Group stock in this valuation report.

Assess Alimak Group's past performance with our detailed historical performance reports.

Seize The Opportunity

- Delve into our full catalog of 74 Undervalued European Small Caps With Insider Buying here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Breedon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BREE

Breedon Group

Engages in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.