- United Kingdom

- /

- Oil and Gas

- /

- LSE:SEPL

Angling Direct Leads The Charge In UK Penny Stocks

Reviewed by Simply Wall St

In the last week, the UK market has been flat, but it is up 4.0% over the past year with earnings expected to grow by 15% per annum over the next few years. Penny stocks may be a throwback term, but they still offer intriguing opportunities for investors seeking growth at lower price points. By focusing on those with robust financials and a clear growth trajectory, these smaller or newer companies can present valuable prospects without many of the risks often associated with this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.88 | £296.98M | ✅ 5 ⚠️ 1 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.25 | £163M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.36 | $209.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.795 | £427.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.20 | £404.93M | ✅ 2 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.902 | £1.18B | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.978 | £156.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 401 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, with a market cap of £34.78 million, operates in the sale of fishing tackle products and equipment across the United Kingdom, Europe, and internationally.

Operations: The company's revenue is divided into segments with £4.89 million from Europe, £35.71 million from UK Online sales, and £50.74 million from UK Stores.

Market Cap: £34.78M

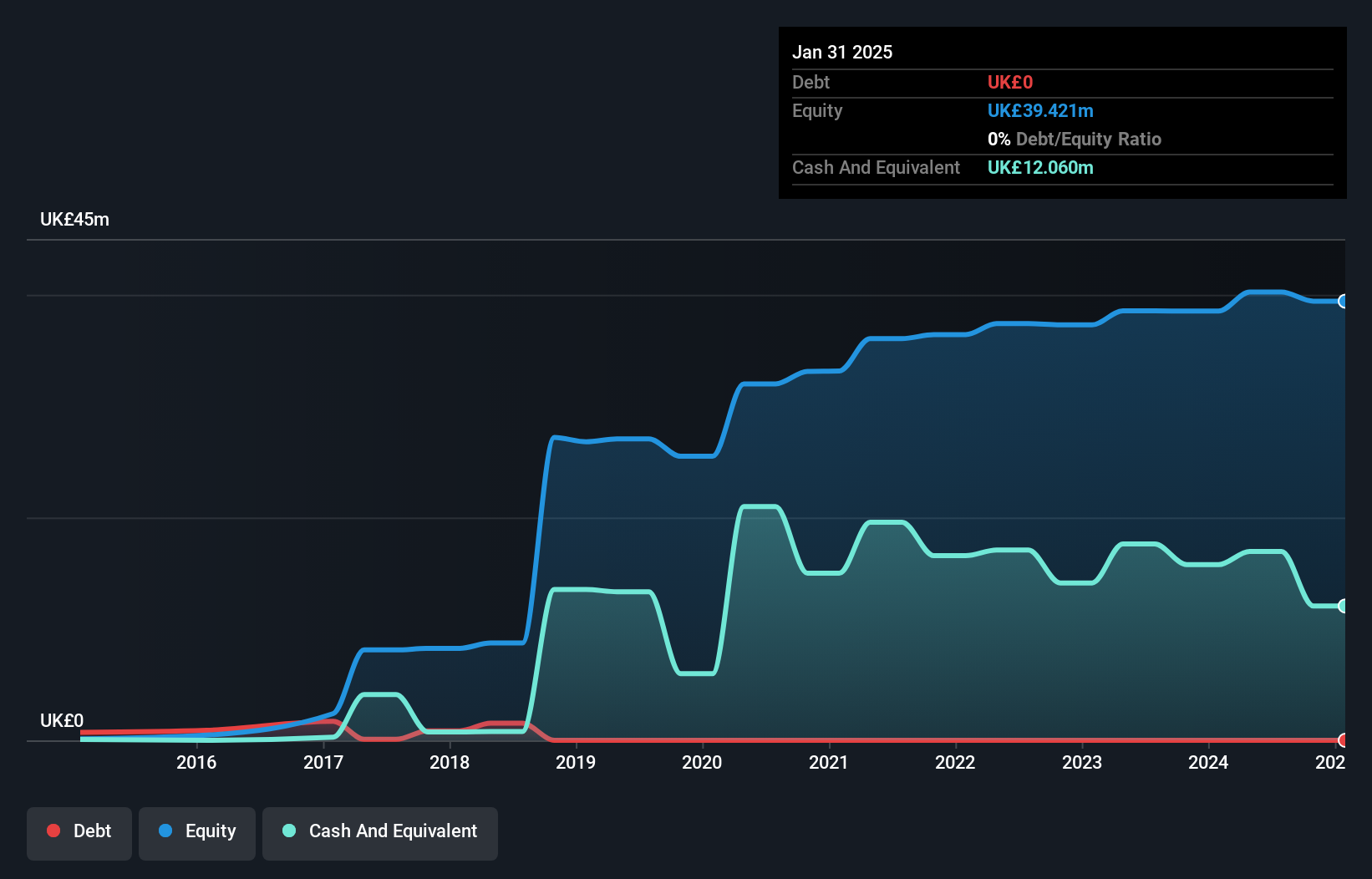

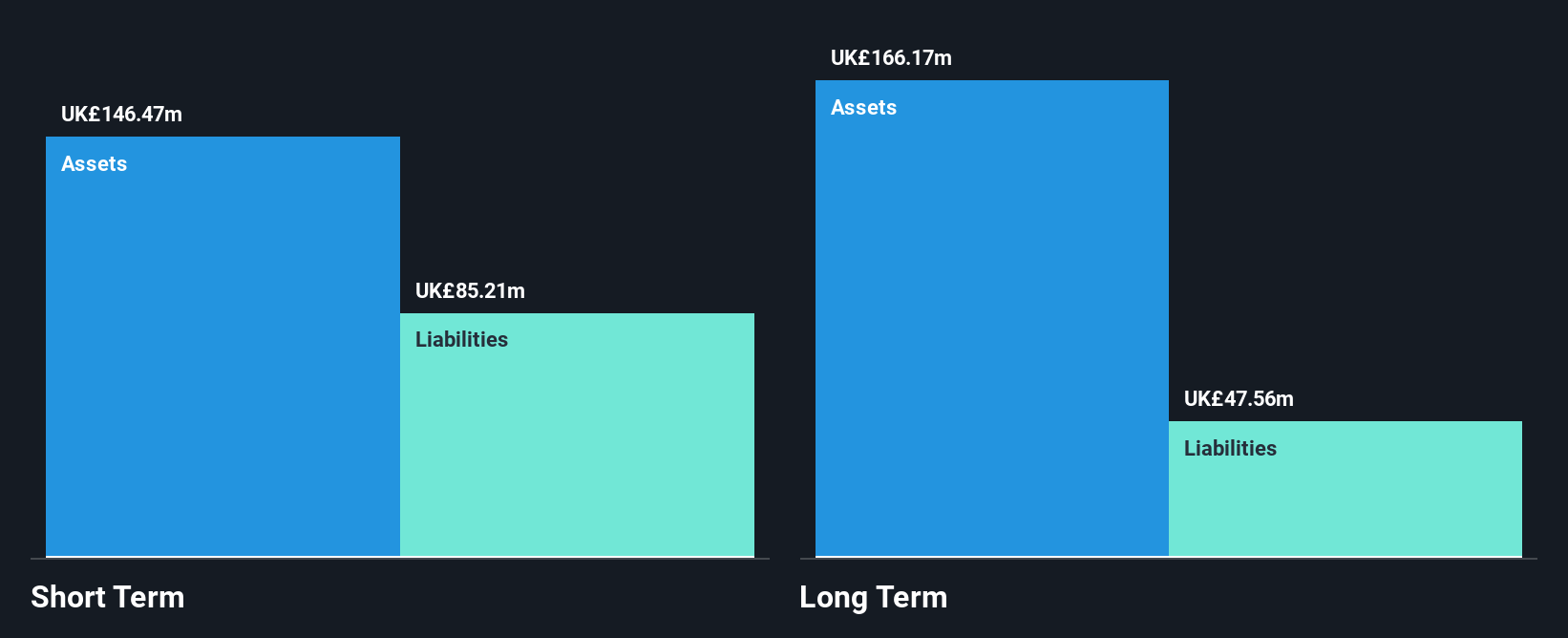

Angling Direct PLC, with a market cap of £34.78 million, shows steady revenue growth and financial stability. The company reported sales of £91.34 million for the year ended January 31, 2025, up from £81.66 million the previous year, with net income rising to £1.43 million. Despite its low Return on Equity of 3.6%, Angling Direct benefits from being debt-free and having short-term assets that cover both short- and long-term liabilities comfortably. Recent board changes include appointing Neil Williams as an Independent Non-Executive Director, adding valuable retail experience to their governance team amidst stable earnings growth trends.

- Unlock comprehensive insights into our analysis of Angling Direct stock in this financial health report.

- Gain insights into Angling Direct's future direction by reviewing our growth report.

ME Group International (LSE:MEGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom with a market cap of £802.70 million.

Operations: The company's revenue from Personal Services - Others amounts to £307.89 million.

Market Cap: £802.7M

ME Group International plc, with a market cap of £802.70 million, demonstrates robust financial health and operational efficiency. The company's return on equity is high at 30.1%, supported by stable earnings growth and improved profit margins from 17% to 17.6%. Its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Despite recent dividend increases to 4.45 pence per share, the dividend coverage by free cash flow remains a concern. However, MEGP's debt is well covered by operating cash flow and interest payments are comfortably managed with EBIT coverage of 38.5 times, reflecting prudent financial oversight amidst competitive industry positioning.

- Jump into the full analysis health report here for a deeper understanding of ME Group International.

- Learn about ME Group International's future growth trajectory here.

Seplat Energy (LSE:SEPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Seplat Energy Plc is an independent energy company involved in oil and gas exploration, production, and gas processing across multiple countries including Nigeria, with a market cap of £1.24 billion.

Operations: The company's revenue is primarily derived from oil, contributing $1.60 billion, and gas operations, which generate $140.44 million.

Market Cap: £1.24B

Seplat Energy Plc, with a market cap of £1.24 billion, has shown significant growth in recent quarters, with first-quarter sales reaching US$809.27 million and net income at US$20.22 million. Despite a low return on equity of 9.1%, the company benefits from high-quality earnings and improved profit margins from 2.9% to 9.9%. The board is experienced, though debt levels have increased over time with a net debt to equity ratio at 39.9%, which remains satisfactory due to strong cash flow coverage of debt obligations (47.3%). Recent dividend announcements reflect an unstable track record but indicate shareholder returns remain a focus amidst operational expansion efforts.

- Dive into the specifics of Seplat Energy here with our thorough balance sheet health report.

- Assess Seplat Energy's future earnings estimates with our detailed growth reports.

Taking Advantage

- Click this link to deep-dive into the 401 companies within our UK Penny Stocks screener.

- Contemplating Other Strategies? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SEPL

Seplat Energy

An independent energy company, engages in the oil and gas exploration and production, and gas processing activities in Nigeria, Bahamas, Italy, Switzerland, England, and Singapore.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives