- United Kingdom

- /

- Residential REITs

- /

- LSE:SOHO

Exploring 3 Undervalued European Small Caps With Insider Action

Reviewed by Simply Wall St

As European markets face a downturn, with the STOXX Europe 600 Index declining by 1.10% amid political turmoil and international trade tensions, investors are increasingly cautious about small-cap stocks. Despite these challenges, identifying promising opportunities in this segment often involves looking at companies with strong fundamentals and notable insider activity, which can signal potential resilience or growth in uncertain times.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 30.88% | ★★★★★★ |

| Speedy Hire | NA | 0.3x | 27.32% | ★★★★★☆ |

| BEWI | NA | 0.5x | 39.78% | ★★★★★☆ |

| Bytes Technology Group | 17.6x | 4.5x | 12.87% | ★★★★☆☆ |

| J D Wetherspoon | 10.0x | 0.3x | 2.40% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.8x | 35.77% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.2x | 4.3x | -199.46% | ★★★★☆☆ |

| Pexip Holding | 34.7x | 5.1x | 43.04% | ★★★☆☆☆ |

| Nyab | 21.3x | 0.9x | 37.88% | ★★★☆☆☆ |

| Fevara | NA | 0.9x | 39.49% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Social Housing REIT (LSE:SOHO)

Simply Wall St Value Rating: ★★★★☆☆

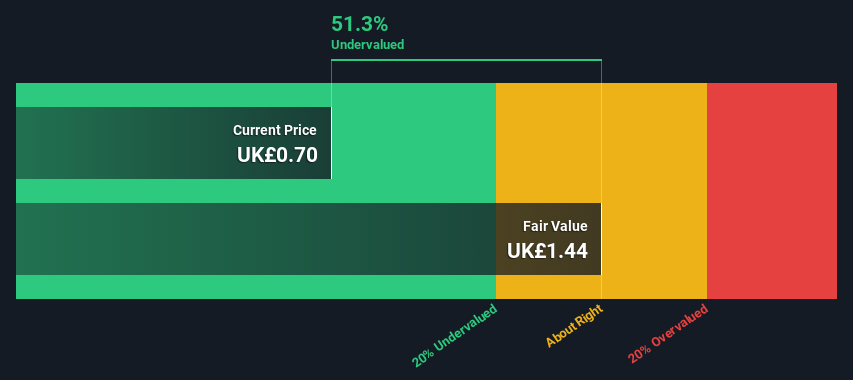

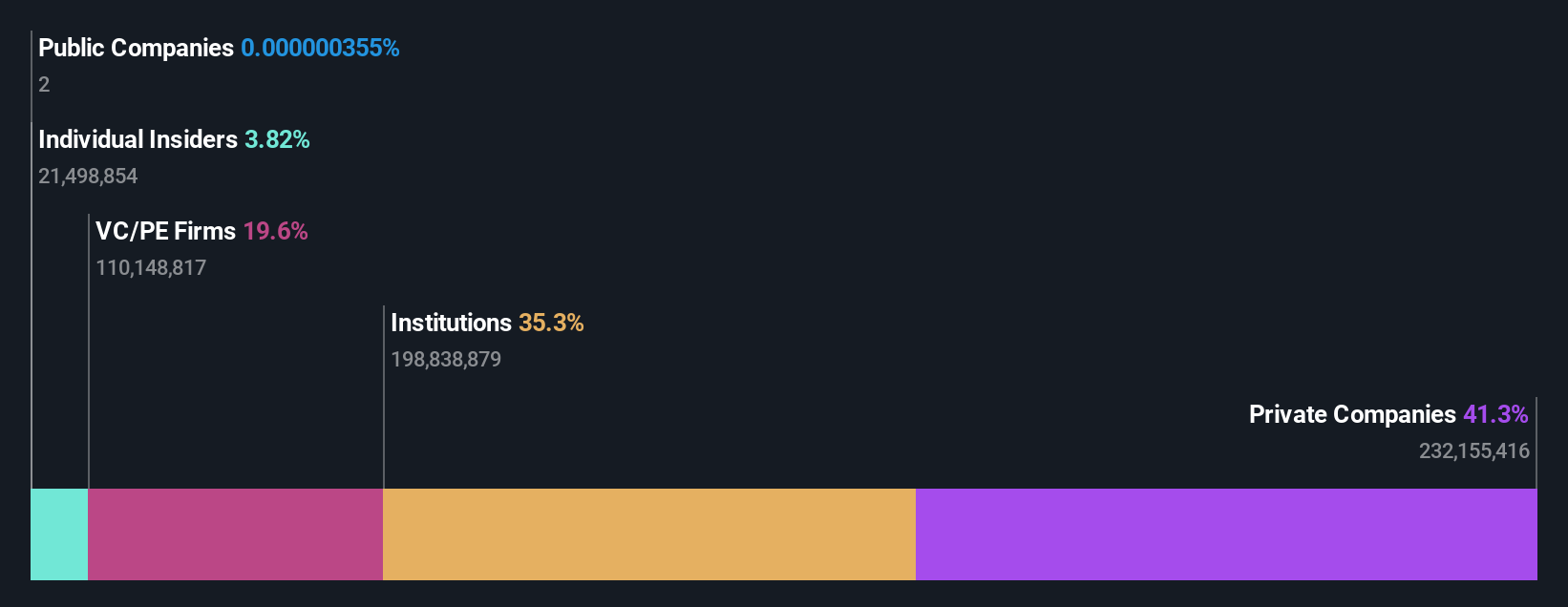

Overview: Social Housing REIT focuses on investing in residential properties for social housing purposes, with a market capitalization of £0.32 billion.

Operations: The company's primary revenue stream is from its residential REIT segment, generating £39.07 million. Over the periods observed, the gross profit margin has shown a notable trend, reaching 88.32% in recent quarters before declining to 81.98%. Operating expenses have varied significantly, with general and administrative expenses being a consistent component of these costs. Non-operating expenses have also fluctuated widely, impacting net income margins which recently turned negative at -114.02%.

PE: -6.0x

Social Housing REIT, a smaller player in the European market, recently declared an interim dividend of £0.014055 per share for Q2 2025, aiming for a total of £0.05622 per share by year-end. Despite reporting a net loss of £2.86 million for H1 2025, revenue rose slightly to £19.82 million from last year’s £19.11 million. Insider confidence is evident with recent share purchases by executives this quarter, suggesting potential optimism despite reliance on external borrowing and declining earnings over the past five years.

- Navigate through the intricacies of Social Housing REIT with our comprehensive valuation report here.

Assess Social Housing REIT's past performance with our detailed historical performance reports.

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning, developing, and managing properties primarily in northern Sweden, with a market capitalization of approximately SEK 7.45 billion.

Operations: The company's revenue is primarily derived from its operations across various regions, with notable contributions from Luleå and Dalarna. Over recent periods, the gross profit margin has shown a rising trend, reaching 69.07% by September 2024. Operating expenses have remained relatively stable around SEK 85 million to SEK 100 million in recent quarters. Non-operating expenses have fluctuated significantly, impacting net income margins considerably over time.

PE: 15.7x

Diös Fastigheter, a property company in Europe, is catching attention for its potential value. Recently, insider confidence was demonstrated when an insider purchased 15,000 shares for SEK 987K. This move signals belief in the company's prospects despite some financial challenges like interest payments not being well covered by earnings and reliance on higher-risk external funding. A recent agreement with AFRY showcases Diös' commitment to sustainable practices, investing SEK 31 million in green office spaces with an attractive yield-on-cost of 8.5%. Earnings are projected to grow at nearly 19% annually, indicating potential future growth despite current financial constraints.

- Click here and access our complete valuation analysis report to understand the dynamics of Diös Fastigheter.

Gain insights into Diös Fastigheter's past trends and performance with our Past report.

Logistea (OM:LOGI A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Logistea is a Swedish company focused on the acquisition, development, and management of logistics properties with a market capitalization of SEK 1.5 billion.

Operations: Logistea's revenue streams are primarily driven by its sales, with significant cost components including the cost of goods sold (COGS) and operating expenses. Over recent periods, the company has experienced a notable increase in gross profit margin, reaching 88.73% as of June 2025. Operating expenses have been relatively controlled compared to revenue growth, contributing to improved profitability metrics.

PE: 13.3x

Logistea, a European small company, is drawing attention with its recent inclusion in the S&P Global BMI Index and strategic property acquisitions. The purchase of Ronnebacken 1 and Ommestorp 1:27 adds significant rental income through long-term leases with AP&T. Insider confidence is evident as Rutger Arnhult acquired over 2.7 million shares, indicating strong belief in the company's potential despite reliance on external borrowing for funding. Earnings are expected to grow by nearly 12% annually, suggesting promising prospects ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Logistea.

Examine Logistea's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Investigate our full lineup of 54 Undervalued European Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SOHO

Social Housing REIT

Social Housing REIT plc (the "Company") is a Real Estate Investment Trust ("REIT") incorporated in England and Wales under the Companies Act 2006 as a public company limited by shares on 12 June 2017.

Good value average dividend payer.

Market Insights

Community Narratives