- United Kingdom

- /

- REITS

- /

- LSE:PCTN

Does Picton Property Income's (LON:PCTN) CEO Salary Compare Well With Industry Peers?

The CEO of Picton Property Income Limited (LON:PCTN) is Michael Morris, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Note: The company does not report funds from operations, and as a result, we have used earnings per share in our analysis.

Check out our latest analysis for Picton Property Income

Comparing Picton Property Income Limited's CEO Compensation With the industry

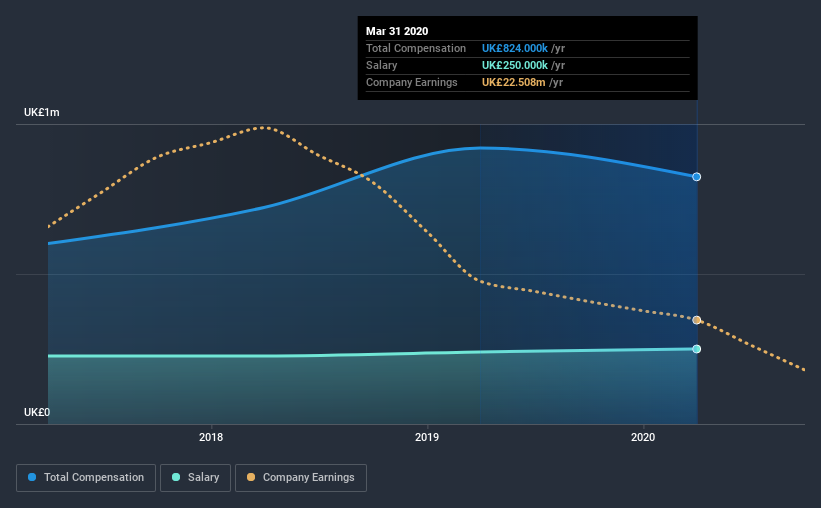

According to our data, Picton Property Income Limited has a market capitalization of UK£449m, and paid its CEO total annual compensation worth UK£824k over the year to March 2020. We note that's a decrease of 10% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£250k.

On examining similar-sized companies in the industry with market capitalizations between UK£293m and UK£1.2b, we discovered that the median CEO total compensation of that group was UK£487k. Accordingly, our analysis reveals that Picton Property Income Limited pays Michael Morris north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£250k | UK£240k | 30% |

| Other | UK£574k | UK£680k | 70% |

| Total Compensation | UK£824k | UK£920k | 100% |

Talking in terms of the industry, salary represented approximately 36% of total compensation out of all the companies we analyzed, while other remuneration made up 64% of the pie. Picton Property Income sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Picton Property Income Limited's Growth

Over the last three years, Picton Property Income Limited has shrunk its earnings per share by 41% per year. In the last year, its revenue is down 5.7%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Picton Property Income Limited Been A Good Investment?

With a total shareholder return of 6.4% over three years, Picton Property Income Limited has done okay by shareholders. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

As we touched on above, Picton Property Income Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. This doesn't look great when you realize that the company has been suffering from negative EPS growth for the last three years. And shareholder returns are decent but not great. So you can understand why we do not think CEO compensation is particularly modest!

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 4 warning signs for Picton Property Income that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Picton Property Income, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:PCTN

Picton Property Income

Established in 2005, Picton is listed on the main market of the London Stock Exchange and is a constituent of a number of EPRA indices including the FTSE EPRA Nareit Global Index.

Undervalued average dividend payer.

Market Insights

Community Narratives