- United Kingdom

- /

- Real Estate

- /

- LSE:MTVW

We Wouldn't Be Too Quick To Buy Mountview Estates P.L.C. (LON:MTVW) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Mountview Estates P.L.C. (LON:MTVW) is about to go ex-dividend in just three days. This means that investors who purchase shares on or after the 18th of February will not receive the dividend, which will be paid on the 29th of March.

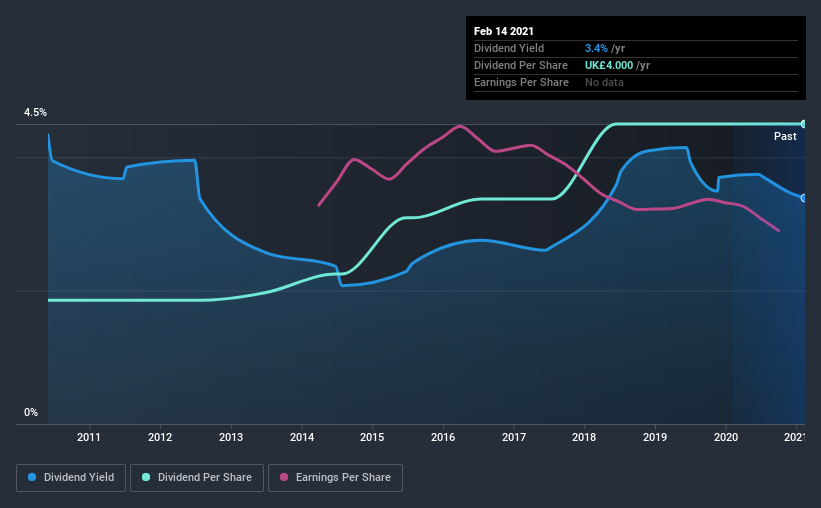

Mountview Estates's upcoming dividend is UK£2.00 a share, following on from the last 12 months, when the company distributed a total of UK£4.00 per share to shareholders. Looking at the last 12 months of distributions, Mountview Estates has a trailing yield of approximately 3.4% on its current stock price of £118. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Mountview Estates

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Mountview Estates is paying out an acceptable 62% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Mountview Estates paid out more free cash flow than it generated - 200%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

Mountview Estates paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Mountview Estates to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit Mountview Estates paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. So we're not too excited that Mountview Estates's earnings are down 4.6% a year over the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Mountview Estates has lifted its dividend by approximately 9.3% a year on average. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

To Sum It Up

Has Mountview Estates got what it takes to maintain its dividend payments? It's definitely not great to see earnings per share shrinking. The company paid out an acceptable percentage of its income, but an uncomfortably high percentage of its cash flow over the past year. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of Mountview Estates don't faze you, it's worth being mindful of the risks involved with this business. Case in point: We've spotted 1 warning sign for Mountview Estates you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Mountview Estates, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:MTVW

Mountview Estates

Engages in the property trading and investment business in the United Kingdom.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives