- United Kingdom

- /

- Retail REITs

- /

- LSE:HMSO

Top 3 Undervalued Small Caps In United Kingdom With Insider Buys For September 2024

Reviewed by Simply Wall St

The UK market has been experiencing turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic challenges. Despite these headwinds, there are opportunities to be found in the small-cap sector, particularly among companies that insiders are buying into. Identifying undervalued small caps with strong insider buying can provide a promising avenue for investors looking to navigate these uncertain times.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 23.5x | 5.3x | 16.36% | ★★★★★☆ |

| Domino's Pizza Group | 14.9x | 1.7x | 36.00% | ★★★★★☆ |

| Essentra | 800.7x | 1.6x | 40.64% | ★★★★★☆ |

| GB Group | NA | 2.9x | 36.35% | ★★★★★☆ |

| Genus | 164.8x | 1.9x | 0.28% | ★★★★★☆ |

| CVS Group | 23.3x | 1.3x | 38.89% | ★★★★☆☆ |

| Norcros | 7.9x | 0.5x | -1.39% | ★★★☆☆☆ |

| NWF Group | 8.9x | 0.1x | 35.14% | ★★★☆☆☆ |

| Alpha Group International | 9.7x | 4.5x | -20.33% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -1422.61% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company specializing in animal genetics, with operations in bovine and porcine breeding, and a market cap of approximately £2.50 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with the latter contributing £352.50 million. The company has experienced fluctuations in gross profit margin, reaching a peak of 68.02% as of March 31, 2024. Operating expenses have varied significantly over the periods analyzed, impacting overall profitability.

PE: 164.8x

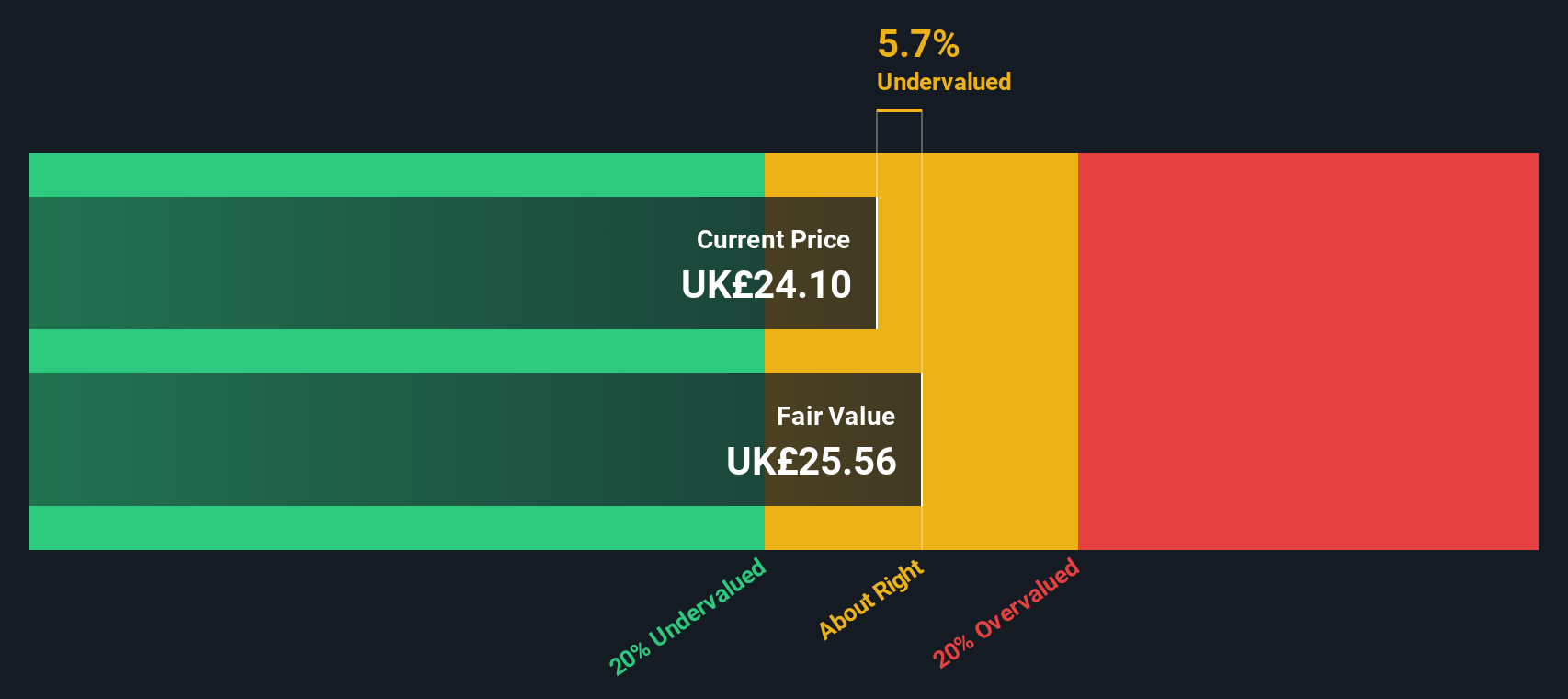

Genus, a UK-based small cap, recently reported full-year sales of £668.8 million, down from £689.7 million last year. Net income also dropped to £7.9 million from £33.3 million previously. Despite this, earnings are forecasted to grow 39.4% annually moving forward. The company proposed a final dividend of 21.7 pence per share, maintaining consistency with the previous year’s payout and reflecting insider confidence in its future prospects despite current lower profit margins and reliance on external borrowing for funding.

- Take a closer look at Genus' potential here in our valuation report.

Explore historical data to track Genus' performance over time in our Past section.

Hammerson (LSE:HMSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammerson is a real estate investment company focused on managing and developing flagship retail destinations in the UK, France, and Ireland with a market cap of approximately £0.14 billion.

Operations: The company generates revenue primarily from its flagship destinations in the UK, France, and Ireland, with additional contributions from developments. The gross profit margin has shown variability, peaking at 87.12% and dipping to 79.90% over the observed periods.

PE: -35.4x

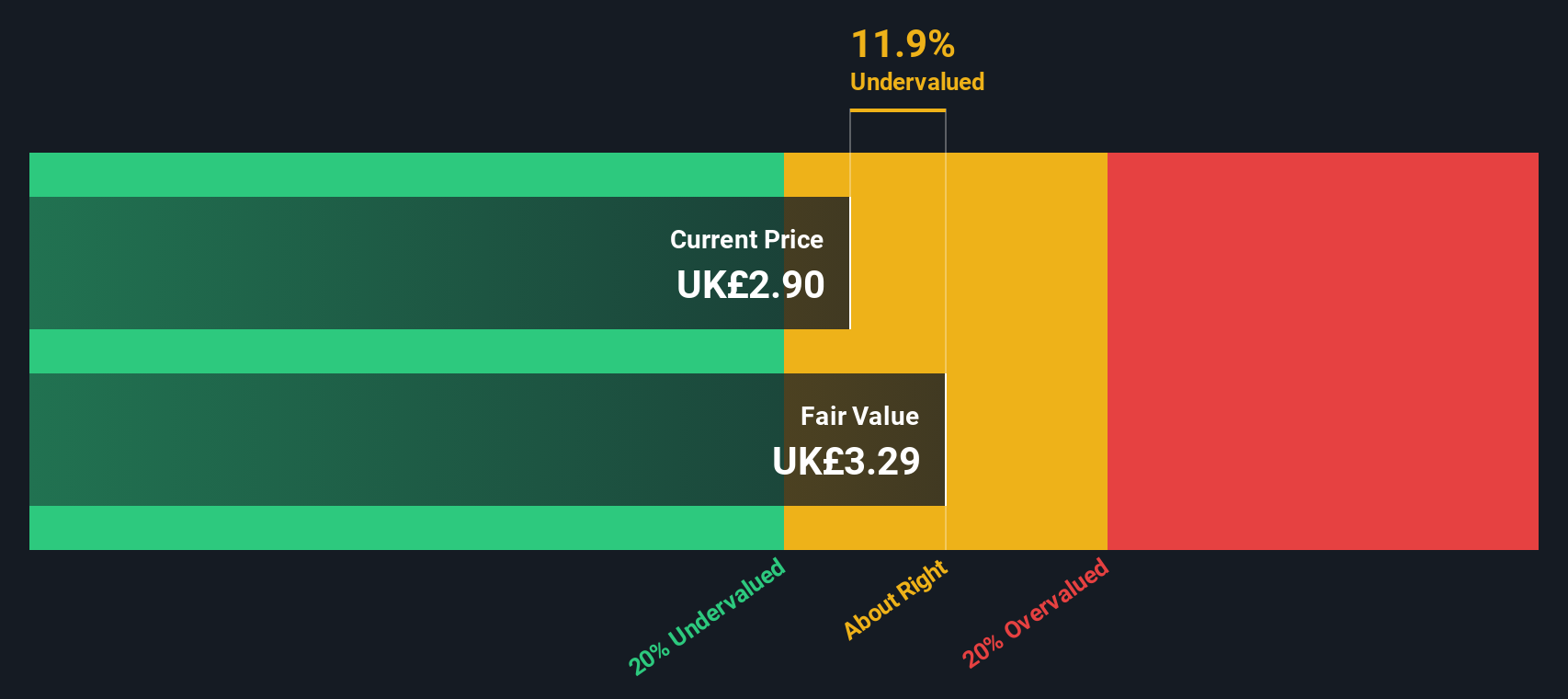

Hammerson, a UK-based company, has recently secured a €175 million share of a €350 million non-recourse term loan for Dundrum Town Centre in Dublin, extending its average debt maturity to 2.9 years. Despite reporting a net loss of £516.7 million for H1 2024 and sales dropping to £40.1 million from £47.9 million the previous year, insider confidence is evident with recent stock purchases by executives within the past six months. The interim dividend increased to 0.756 pence per share, payable on September 30th, reflecting management's commitment to shareholder returns amidst financial restructuring efforts.

- Navigate through the intricacies of Hammerson with our comprehensive valuation report here.

Understand Hammerson's track record by examining our Past report.

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sirius Real Estate is a property investment company specializing in the acquisition and management of business parks across Germany and the UK, with a market cap of approximately €1.30 billion.

Operations: The company generates revenue primarily from property investments, with a recent figure of €289.40 million. Its cost of goods sold (COGS) stands at €123 million, resulting in a gross profit margin of 57.50%. Operating expenses are €47.90 million, and the net income margin is 37.25%.

PE: 16.7x

Sirius Real Estate recently completed a £152.5 million follow-on equity offering, issuing 159.6 million shares at £0.94 each to fund acquisitions in Germany and the U.K., showcasing strong insider confidence with executives purchasing shares during the capital raise in July 2024. The company has reported ten consecutive years of annualised rental growth above 5% and dividend increases, aiming for a €150 million annual FFO target medium-term. Despite high external borrowing risks, earnings are projected to grow by 16.13% annually, indicating potential undervaluation among U.K.'s smaller stocks.

Where To Now?

- Click here to access our complete index of 26 Undervalued UK Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammerson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HMSO

Hammerson

Hammerson is the largest UK-listed, pure-play owner and manager of prime retail and leisure anchored city destinations across the UK, France and Ireland.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives