- United Kingdom

- /

- Residential REITs

- /

- LSE:CSH

If You Had Bought Civitas Social Housing (LON:CSH) Shares A Year Ago You'd Have Earned 13% Returns

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the Civitas Social Housing PLC (LON:CSH) share price is up 13% in the last year, clearly besting the market decline of around 9.4% (not including dividends). That's a solid performance by our standards! Having said that, the longer term returns aren't so impressive, with stock gaining just 2.5% in three years.

See our latest analysis for Civitas Social Housing

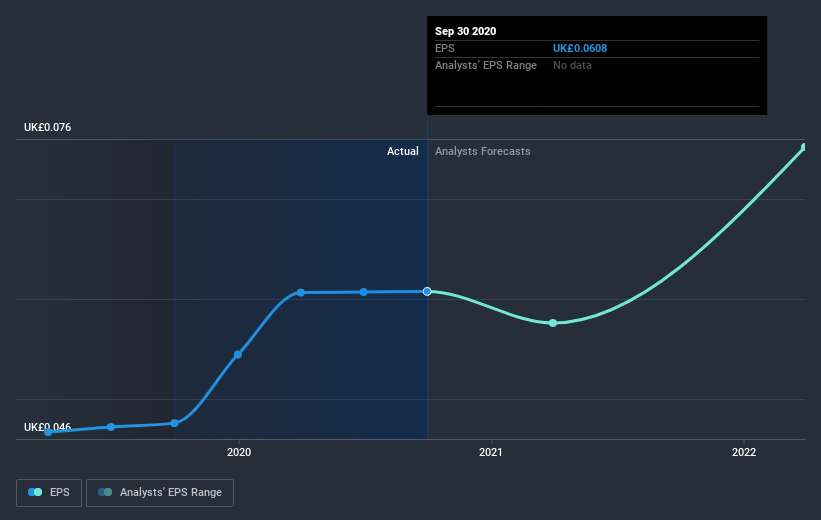

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Civitas Social Housing grew its earnings per share (EPS) by 27%. This EPS growth is significantly higher than the 13% increase in the share price. Therefore, it seems the market isn't as excited about Civitas Social Housing as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Civitas Social Housing has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Civitas Social Housing the TSR over the last year was 17%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Pleasingly, Civitas Social Housing's total shareholder return last year was 17%. That's including the dividend. That's better than the annualized TSR of 6% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. It's always interesting to track share price performance over the longer term. But to understand Civitas Social Housing better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Civitas Social Housing (of which 1 makes us a bit uncomfortable!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Civitas Social Housing or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Civitas Social Housing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CSH

Civitas Social Housing

Civitas Social Housing PLC (CSH) was created in 2016 by Civitas Investment Management Limited as the first dedicated London listed REIT to raise long-term, sustainable, institutional capital to invest in care-based social homes and healthcare facilities across the UK.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives