- United Kingdom

- /

- Real Estate

- /

- AIM:WJG

Watkin Jones'(LON:WJG) Share Price Is Down 29% Over The Past Year.

Watkin Jones Plc (LON:WJG) shareholders should be happy to see the share price up 29% in the last month. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 29% in a year, falling short of the returns you could get by investing in an index fund.

Check out our latest analysis for Watkin Jones

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Watkin Jones share price fell, it actually saw its earnings per share (EPS) improve by 3.1%. It could be that the share price was previously over-hyped.

It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

Watkin Jones managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

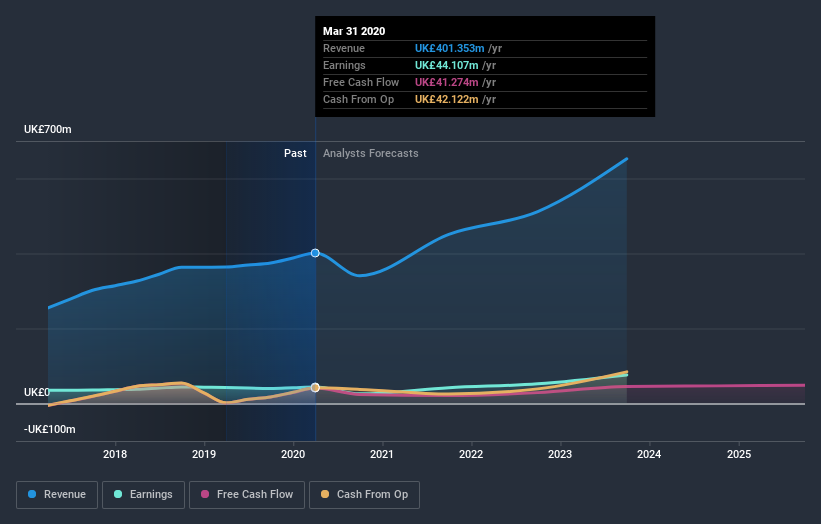

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Watkin Jones

A Different Perspective

The last twelve months weren't great for Watkin Jones shares, which performed worse than the market, costing holders 28%. The market shed around 2.7%, no doubt weighing on the stock price. Shareholders have lost 3% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Watkin Jones is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Watkin Jones, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Watkin Jones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:WJG

Watkin Jones

Engages in the development and the management of properties for residential occupation in the United Kingdom.

Adequate balance sheet and fair value.