- United Kingdom

- /

- Real Estate

- /

- AIM:WJG

Time To Worry? Analysts Just Downgraded Their Watkin Jones Plc (LON:WJG) Outlook

Today is shaping up negative for Watkin Jones Plc (LON:WJG) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

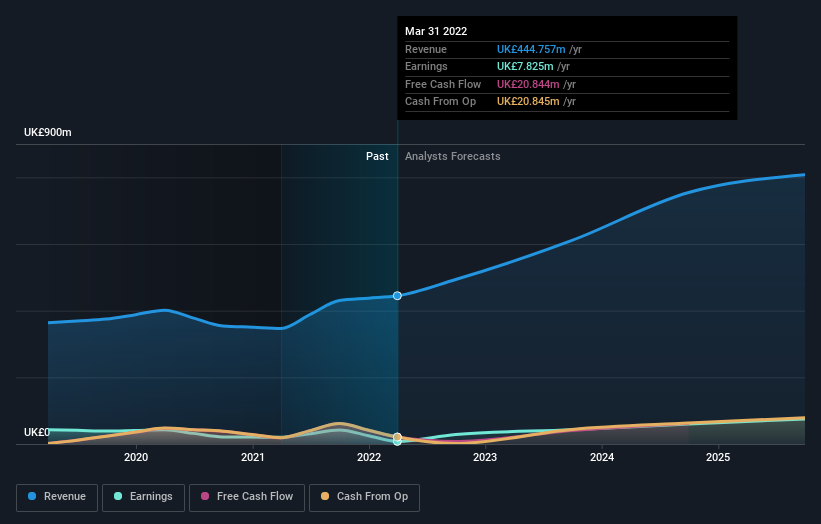

After the downgrade, the six analysts covering Watkin Jones are now predicting revenues of UK£476m in 2022. If met, this would reflect a satisfactory 7.1% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to shoot up 436% to UK£0.17. Previously, the analysts had been modelling revenues of UK£500m and earnings per share (EPS) of UK£0.14 in 2022. Although the analysts have lowered their sales forecasts, they've also made a decent improvement in their earnings per share estimates, which implies there's been something of an uptick in sentiment following the latest consensus updates.

Our analysis indicates that WJG is potentially undervalued!

the analysts have cut their price target 6.9% to UK£2.30 per share, suggesting that the declining revenue was a more crucial indicator than the expected improvement in earnings. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Watkin Jones, with the most bullish analyst valuing it at UK£2.82 and the most bearish at UK£2.25 per share. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Watkin Jones' past performance and to peers in the same industry. The analysts are definitely expecting Watkin Jones' growth to accelerate, with the forecast 15% annualised growth to the end of 2022 ranking favourably alongside historical growth of 7.4% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue shrink 4.5% per year. So it's clear with the acceleration in growth, Watkin Jones is expected to grow meaningfully faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Unfortunately, they also downgraded their revenue estimates, and our data indicates sales are expected to outperform the wider market. Even so, earnings per share are more important to the intrinsic value of the business. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Watkin Jones after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Watkin Jones going out to 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you're looking to trade Watkin Jones, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Watkin Jones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WJG

Watkin Jones

Engages in the development and the management of properties for residential occupation in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives