- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

With EPS Growth And More, Property Franchise Group (LON:TPFG) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Property Franchise Group (LON:TPFG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Property Franchise Group

How Fast Is Property Franchise Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Property Franchise Group has grown EPS by 8.8% per year. That's a pretty good rate, if the company can sustain it.

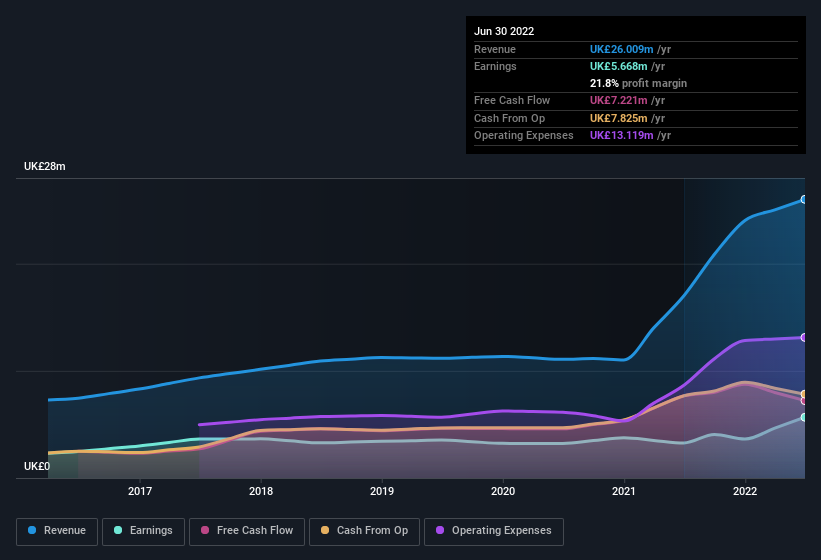

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Property Franchise Group has done well over the past year, growing revenue by 53% to UK£26m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Property Franchise Group isn't a huge company, given its market capitalisation of UK£83m. That makes it extra important to check on its balance sheet strength.

Are Property Franchise Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Property Franchise Group, is that company insiders spent UK£33k acquiring shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. It is also worth noting that it was Independent Non-Executive Director Philip Crooks who made the biggest single purchase, worth UK£14k, paying UK£2.40 per share.

On top of the insider buying, it's good to see that Property Franchise Group insiders have a valuable investment in the business. To be specific, they have UK£22m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 27% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Property Franchise Group To Your Watchlist?

As previously touched on, Property Franchise Group is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Before you take the next step you should know about the 1 warning sign for Property Franchise Group that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Property Franchise Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TPFG

Property Franchise Group

Engages in residential property franchise, and licensing and financial services businesses in the United Kingdom.

Solid track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.