- United Kingdom

- /

- Food

- /

- AIM:BMK

Benchmark Holdings And 2 Other UK Stocks That May Be Priced Below Their Intrinsic Estimates

Reviewed by Simply Wall St

In the current landscape, the UK market has faced challenges as evidenced by the recent performance of indices like the FTSE 100 and FTSE 250, which have been impacted by weak trade data from China. Despite these hurdles, investors may find opportunities in stocks that appear to be undervalued relative to their intrinsic estimates, such as Benchmark Holdings and others.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.18 | £11.06 | 44.1% |

| Topps Tiles (LSE:TPT) | £0.371 | £0.69 | 46.2% |

| Marlowe (AIM:MRL) | £4.40 | £8.26 | 46.7% |

| LSL Property Services (LSE:LSL) | £3.20 | £5.96 | 46.3% |

| Hostelworld Group (LSE:HSW) | £1.36 | £2.58 | 47.3% |

| Gooch & Housego (AIM:GHH) | £6.10 | £11.32 | 46.1% |

| Franchise Brands (AIM:FRAN) | £1.50 | £2.67 | 43.8% |

| Burberry Group (LSE:BRBY) | £12.58 | £23.62 | 46.7% |

| Benchmark Holdings (AIM:BMK) | £0.248 | £0.45 | 44.5% |

| AstraZeneca (LSE:AZN) | £103.90 | £188.37 | 44.8% |

Let's dive into some prime choices out of the screener.

Benchmark Holdings (AIM:BMK)

Overview: Benchmark Holdings plc, with a market cap of £184.12 million, provides technical services, products, and specialist knowledge to support the development of food and farming industries through its subsidiaries.

Operations: The company's revenue segments include Health (£6.02 million), Genetics (£50.82 million), and Advanced Nutrition (£73.22 million).

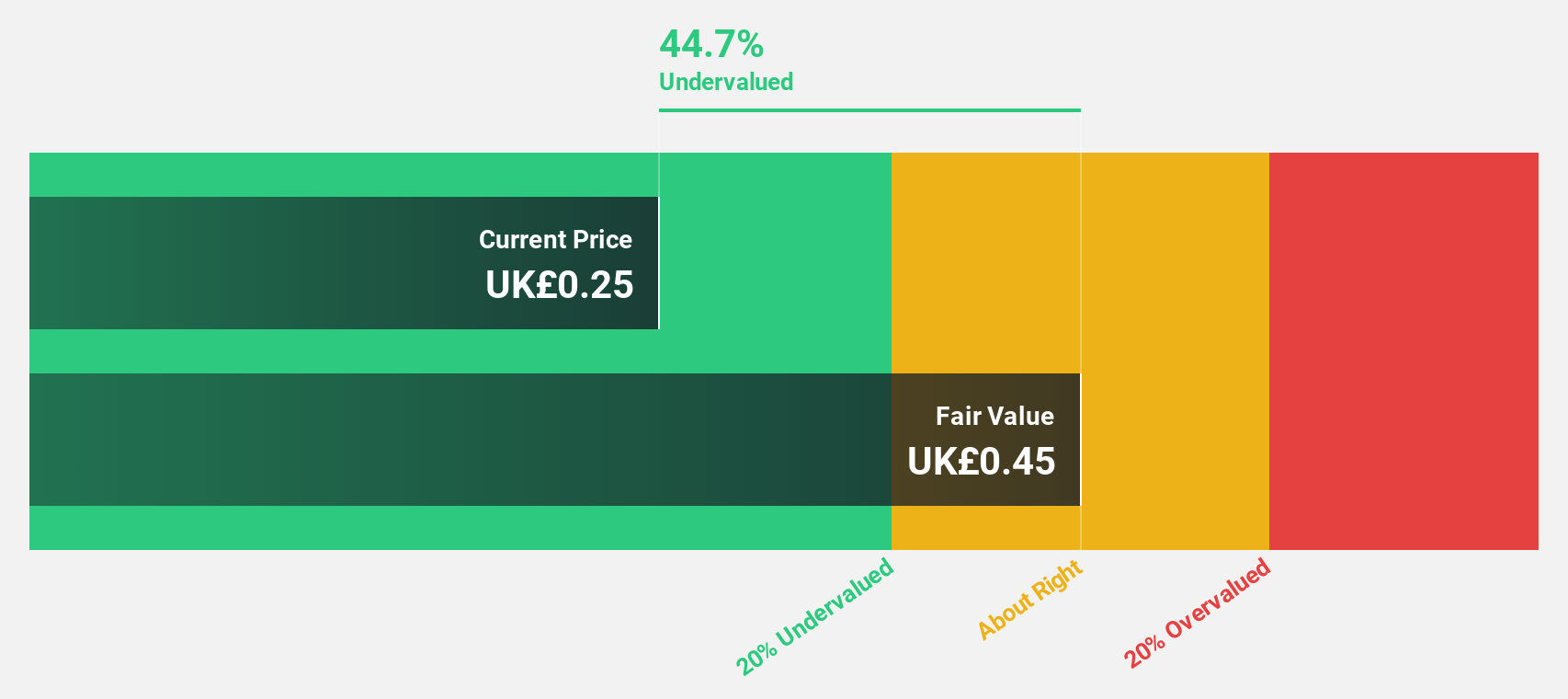

Estimated Discount To Fair Value: 44.5%

Benchmark Holdings is trading at a significant discount, with shares priced at £0.25 against an estimated fair value of £0.45, suggesting undervaluation based on cash flows. Despite low forecasted return on equity, the company is expected to become profitable within three years and outpace UK market revenue growth. Recent developments include plans to delist from AIM and Euronext Growth Oslo following a £95 million return to shareholders from its Genetics Business sale proceeds.

- According our earnings growth report, there's an indication that Benchmark Holdings might be ready to expand.

- Click here to discover the nuances of Benchmark Holdings with our detailed financial health report.

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £259.44 million.

Operations: The company's revenue is derived from three segments: Research & Fintech (£25.40 million), Distribution Channels (£23.80 million), and Intermediary Services (£29.10 million).

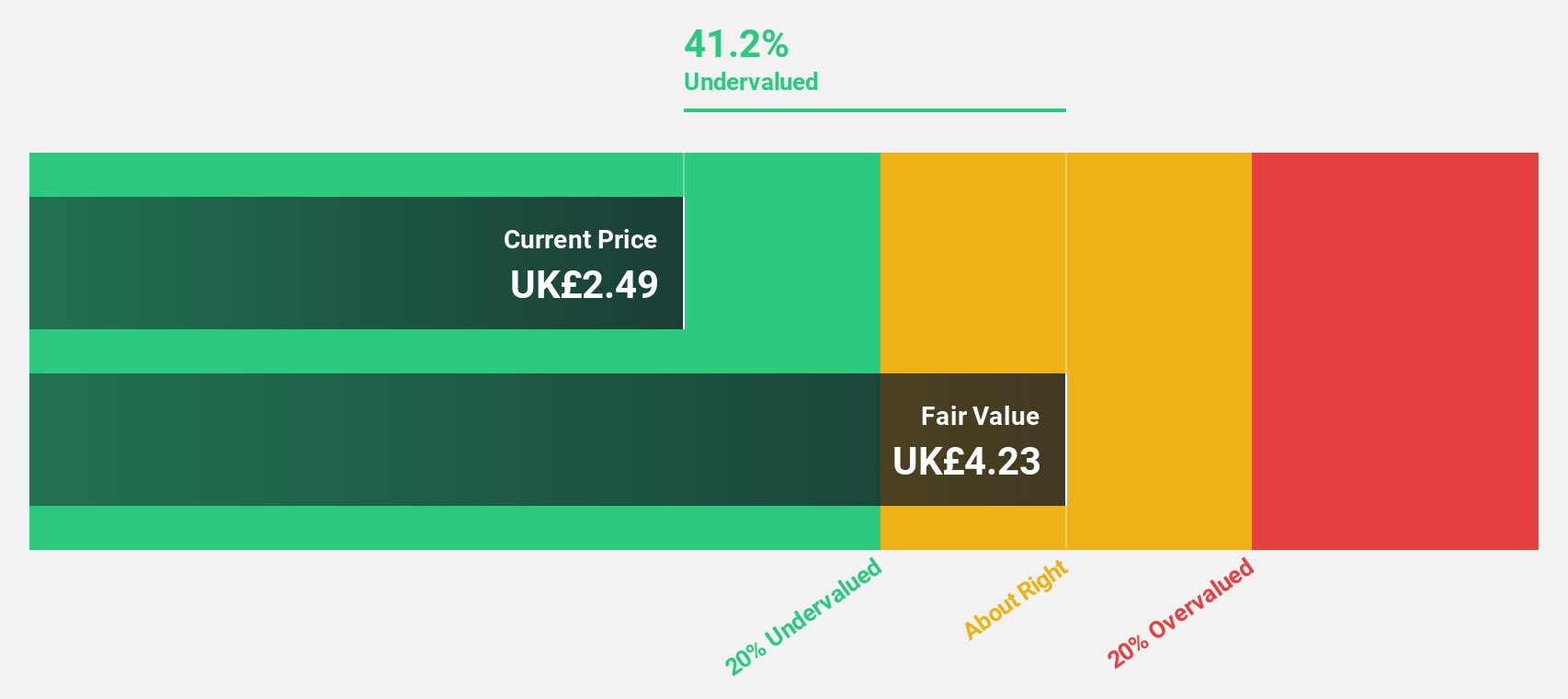

Estimated Discount To Fair Value: 41.2%

Fintel is trading at £2.49, significantly below its estimated fair value of £4.23, indicating undervaluation based on cash flows. While profit margins have decreased from 10.9% to 7.5%, earnings are forecasted to grow 30.15% annually, outpacing the UK market's growth rate of 14.3%. Recent board changes include Ian Pickford's appointment as an independent non-executive director, which may enhance strategic development in digital and core service propositions within the UK advice market.

- Our comprehensive growth report raises the possibility that Fintel is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Fintel.

Savills (LSE:SVS)

Overview: Savills plc, along with its subsidiaries, provides real estate services across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East with a market cap of approximately £1.33 billion.

Operations: The company's revenue segments include Consultancy (£495.50 million), Transaction Advisory (£870 million), Investment Management (£94 million), and Property and Facilities Management (£944.50 million).

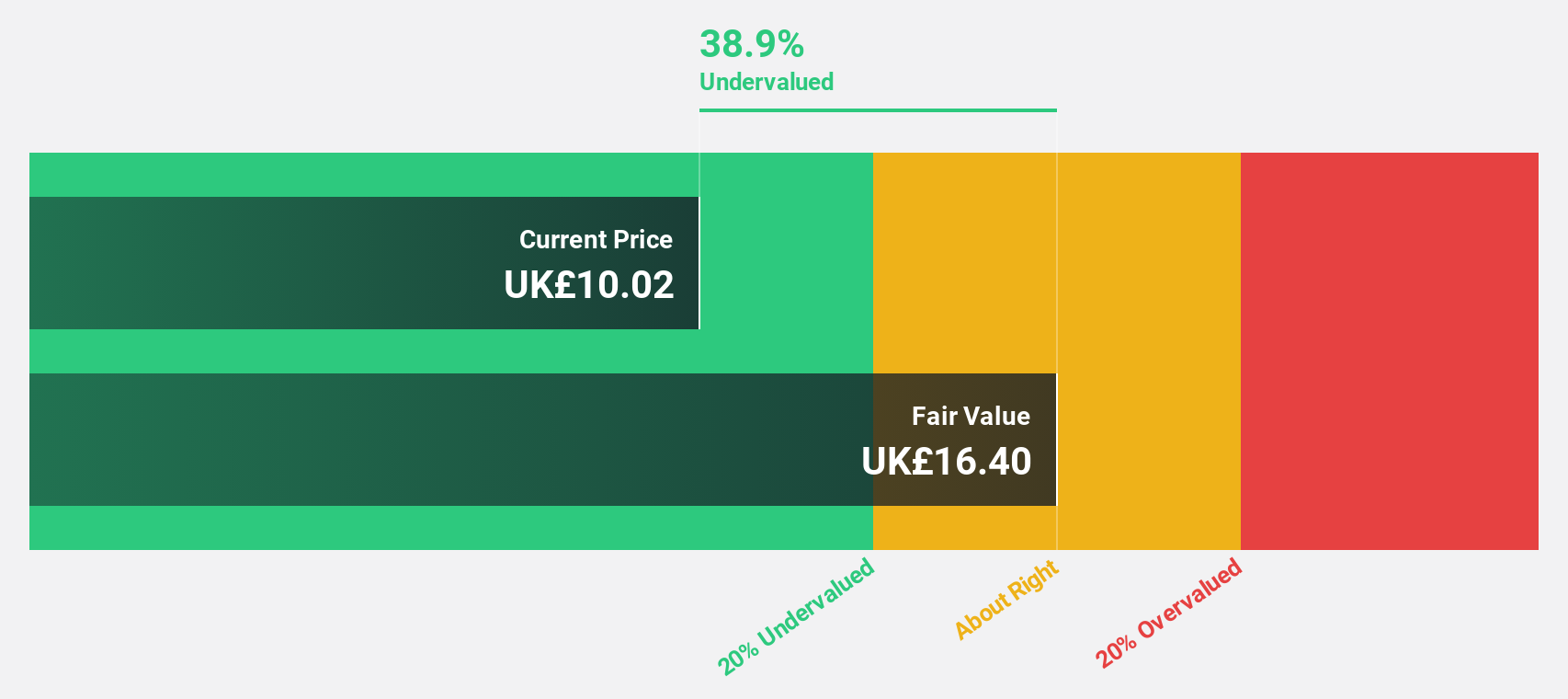

Estimated Discount To Fair Value: 42.4%

Savills is trading at £9.81, considerably below its estimated fair value of £17.02, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 27.82% annually, surpassing the UK market rate of 14.3%. However, insider selling has been significant recently and dividend stability remains a concern. Recent executive changes include Simon Shaw succeeding Mark Ridley as Group Chief Executive from January 2026, possibly impacting strategic direction positively with his financial expertise.

- Upon reviewing our latest growth report, Savills' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Savills' balance sheet health report.

Where To Now?

- Take a closer look at our Undervalued UK Stocks Based On Cash Flows list of 56 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BMK

Benchmark Holdings

Engages in the provision of technical services, products, and specialist knowledge that supports the development of food and farming industries.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives