- United Kingdom

- /

- Beverage

- /

- LSE:CCR

Gamma Communications And 2 More Undervalued Small Caps On UK Exchange With Insider Buying

Reviewed by Simply Wall St

The United Kingdom's market has recently been impacted by weak trade data from China, causing the FTSE 100 and FTSE 250 indices to close lower as global economic concerns weigh heavily on investor sentiment. In this challenging environment, identifying small-cap stocks with potential for growth can be particularly appealing, especially when there is insider buying activity suggesting confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.3x | 5.2x | 20.82% | ★★★★★★ |

| 4imprint Group | 16.9x | 1.4x | 32.61% | ★★★★★☆ |

| Stelrad Group | 11.6x | 0.6x | 19.45% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 26.26% | ★★★★★☆ |

| NCC Group | NA | 1.2x | 26.08% | ★★★★★☆ |

| Telecom Plus | 17.8x | 0.7x | 26.58% | ★★★★☆☆ |

| Gamma Communications | 22.5x | 2.3x | 35.37% | ★★★★☆☆ |

| CVS Group | 28.2x | 1.1x | 39.45% | ★★★★☆☆ |

| Franchise Brands | 39.6x | 2.1x | 24.32% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 44.99% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Gamma Communications (AIM:GAMA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gamma Communications is a telecommunications service provider specializing in unified communications and connectivity solutions, with a market cap of approximately £1.23 billion.

Operations: Gamma Communications generates revenue primarily from its Gamma Business and Gamma Enterprise segments, with significant contributions from the European market. The company experienced a notable increase in gross profit margin, reaching 51.42% by June 2024. Operating expenses are largely driven by general and administrative costs, which have shown an upward trend over the periods observed.

PE: 22.5x

Gamma Communications, a small company in the UK, is capturing attention due to its potential for growth. With earnings projected to climb 14% annually, it shows promise despite relying solely on external borrowing for funding. Recent insider confidence is evident as they purchased shares from January to March 2024. This activity suggests belief in future prospects. While not without risks, Gamma's growth outlook and insider actions hint at promising opportunities ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Gamma Communications.

Assess Gamma Communications' past performance with our detailed historical performance reports.

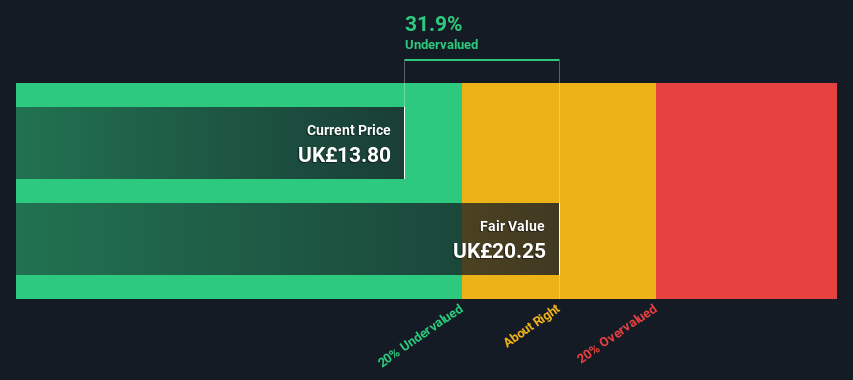

C&C Group (LSE:CCR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: C&C Group is a leading manufacturer, marketer, and distributor of branded cider, beer, wine, spirits, and soft drinks with a market capitalization of approximately €1.36 billion.

Operations: The company's revenue streams have shown fluctuations, with a notable increase from €548.2 million in February 2018 to €1.65 billion by August 2024. Gross profit margin experienced a significant decline from 53.38% in November 2017 to around 6.67% by May 2019, before stabilizing around the low twenties percentage range from February 2020 onwards. Operating expenses consistently impact profitability, with general and administrative expenses being a substantial component of these costs over the years observed.

PE: -5.8x

C&C Group, a small company in the UK, is drawing attention due to its growth potential and recent insider confidence. Ralph Findlay's purchase of 66,183 shares for £99,003 signals belief in the company's prospects. Despite relying solely on external borrowing for funding, which carries higher risk, earnings are forecasted to grow by 87% annually. Recent leadership changes include Roger White as CEO and Ralph Findlay resuming as Non-Executive Chair from March 2025. These strategic shifts may position C&C for future success in the dynamic drinks sector.

- Navigate through the intricacies of C&C Group with our comprehensive valuation report here.

Review our historical performance report to gain insights into C&C Group's's past performance.

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sirius Real Estate is a property investment company focused on owning and operating business parks, industrial complexes, and office spaces across Germany and the UK, with a market capitalization of approximately €1.23 billion.

Operations: The company generates revenue primarily from property investment, with the latest reported revenue at €306.60 million. The gross profit margin has shown variability, recently reaching 58.15%. Operating expenses have been increasing over recent periods, impacting net income margins which stood at 42.92% in the most recent report.

PE: 11.0x

Sirius Real Estate, a nimble player in the U.K.'s property sector, has been actively expanding its portfolio with strategic acquisitions like Earl Mill in Oldham for £5.7 million and a business park in Reinsberg, Germany for €20.4 million. These purchases offer substantial potential to enhance value through increased occupancy and operational synergies. Insider confidence is evident with recent share purchases, suggesting belief in the company's growth trajectory. With earnings projected to grow 18% annually, Sirius appears well-positioned despite relying on external borrowing for funding.

- Dive into the specifics of Sirius Real Estate here with our thorough valuation report.

Examine Sirius Real Estate's past performance report to understand how it has performed in the past.

Where To Now?

- Unlock our comprehensive list of 35 Undervalued UK Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CCR

C&C Group

Manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the United Kingdom, the Republic of Ireland, Great Britain, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives