Stock Analysis

- United Kingdom

- /

- Banks

- /

- LSE:TBCG

July 2024 Insight Into UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The United Kingdom market has shown resilience with a 7.6% increase over the past year, despite remaining flat in the last week. Companies with high insider ownership often reflect a strong commitment by those closest to the business, which can be particularly appealing in a market where earnings are expected to grow annually by 13%.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 36.8% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 46.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Velocity Composites (AIM:VEL) | 27.8% | 173.3% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

Let's uncover some gems from our specialized screener.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc operates globally, offering flexible workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately £1.77 billion.

Operations: The company generates revenue through its segments in the Americas (£1.05 billion), Europe, Middle East, and Africa (£1.32 billion), Asia Pacific (£273 million), and Worka (£319 million).

Insider Ownership: 25.2%

International Workplace Group (IWG) is poised for notable growth with expected annual revenue increases outpacing the UK market average. Despite a low forecasted Return on Equity, analysts project a significant stock price rise, reflecting optimism in its profitability within three years. Recent strategic debt refinancing and insider buying trends underscore management's confidence in IWG's financial strategy, enhancing its appeal among growth-oriented investors seeking companies with high insider ownership.

- Unlock comprehensive insights into our analysis of International Workplace Group stock in this growth report.

- According our valuation report, there's an indication that International Workplace Group's share price might be on the cheaper side.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a technology company specializing in gambling software, services, content, and platform technologies across the globe, with a market capitalization of approximately £1.67 billion.

Operations: The company's revenue is divided into segments, with €684.10 million from Gaming B2B, €946.60 million from Gaming B2C, €18.20 million from HAPPYBET, and €73.40 million from Sun Bingo and other B2C activities.

Insider Ownership: 13.5%

Playtech is positioned for robust earnings growth, significantly outpacing the UK market average. Despite slower revenue growth projections, it trades at a substantial discount to its estimated fair value, suggesting potential upside. Recent strategic partnerships, like the one with MGM Resorts to deliver live casino content, underscore its innovative approach and market expansion efforts. However, its forecasted low Return on Equity indicates some efficiency challenges ahead. Changes in executive roles and board committees reflect ongoing strategic adjustments.

- Navigate through the intricacies of Playtech with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Playtech's share price might be too pessimistic.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a financial entity offering services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.65 billion.

Operations: The company generates revenue through diverse financial services including banking, leasing, insurance, brokerage, and card processing across three countries.

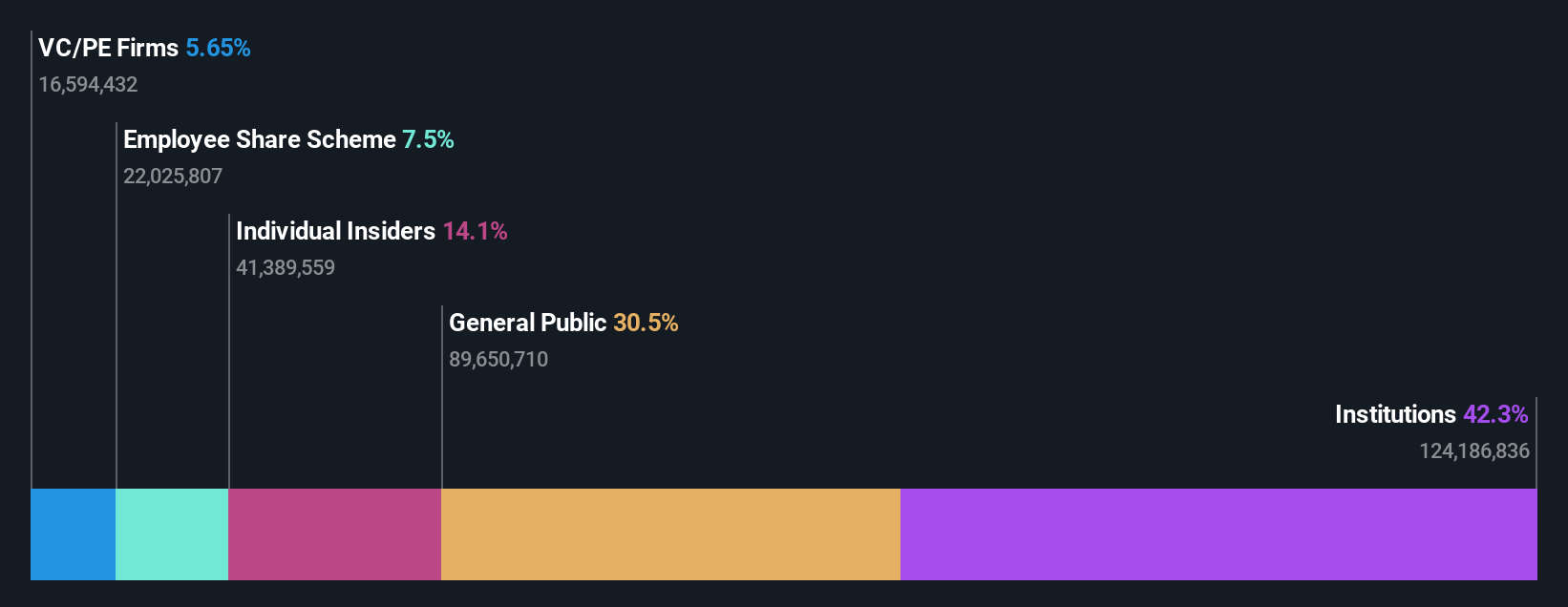

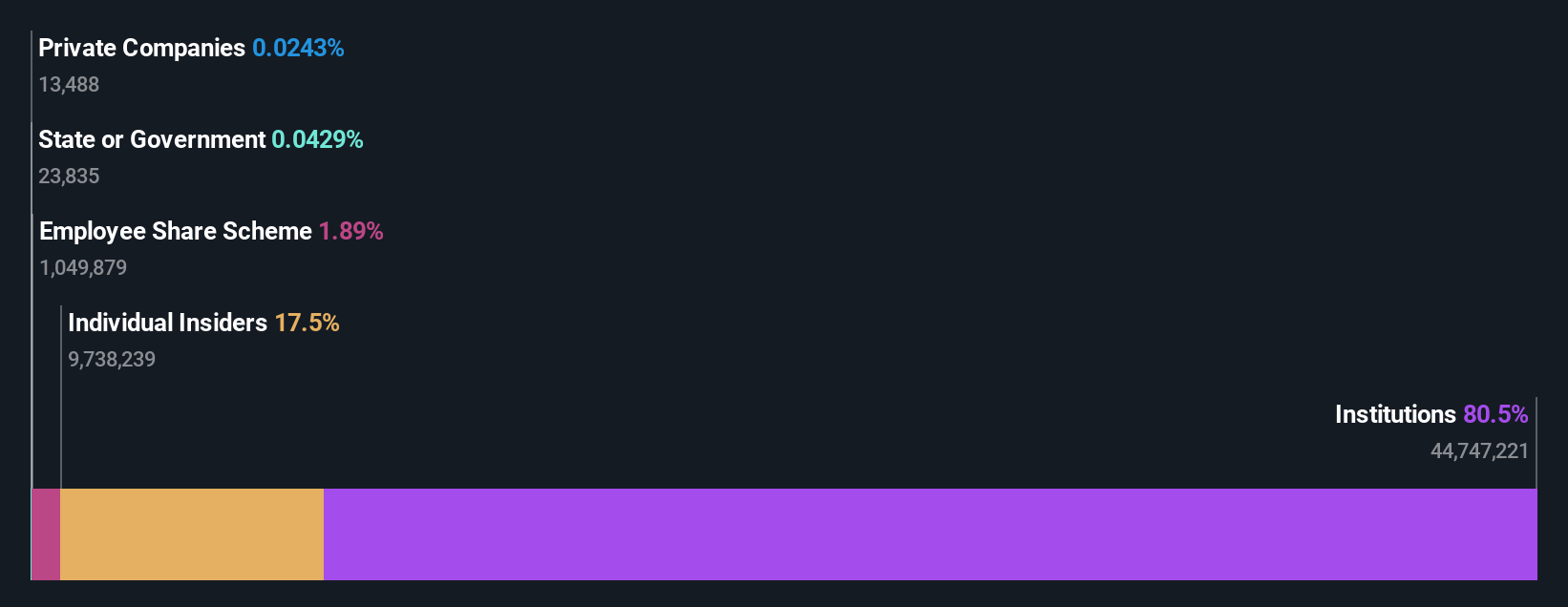

Insider Ownership: 18%

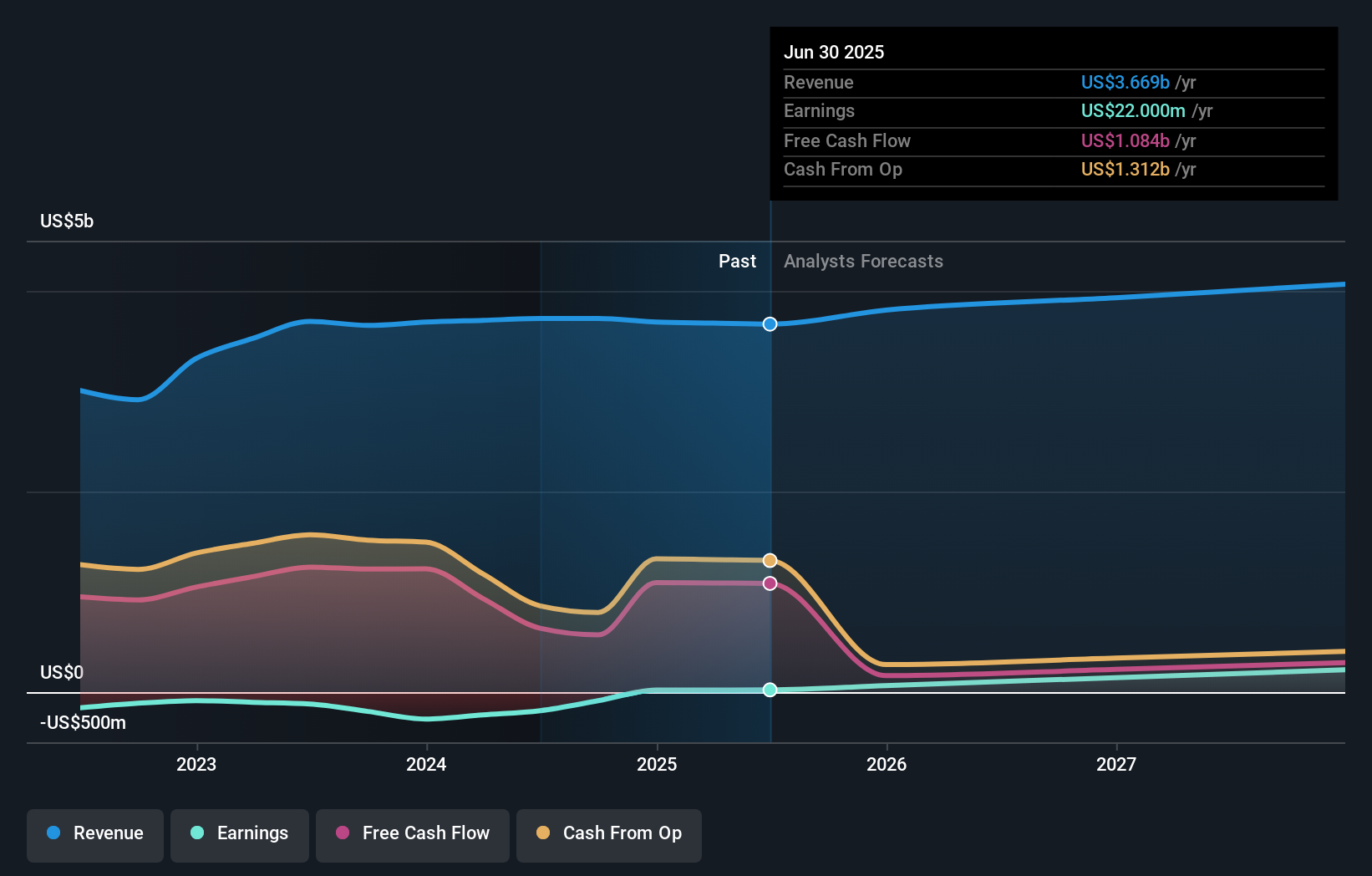

TBC Bank Group's earnings and revenue are set to outpace the UK market, with forecasts showing a 15.2% annual increase in profits and an 18.3% rise in revenue. Despite this growth, the bank faces challenges with a high bad loans ratio of 2.1% and unstable dividends, potentially affecting its financial health. Recent activities include a $38.2 million private placement and a substantial share buyback program aimed at reducing share capital, reflecting active management engagement in enhancing shareholder value.

- Click here and access our complete growth analysis report to understand the dynamics of TBC Bank Group.

- The valuation report we've compiled suggests that TBC Bank Group's current price could be quite moderate.

Key Takeaways

- Investigate our full lineup of 62 Fast Growing UK Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether TBC Bank Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TBCG

TBC Bank Group

Through its subsidiaries, provides banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan.

Undervalued with reasonable growth potential and pays a dividend.