- United Kingdom

- /

- Real Estate

- /

- LSE:SRE

Exploring July 2024 Undervalued Small Caps With Insider Actions In The Region

Reviewed by Simply Wall St

As global markets experience a notably broad advance with small-cap stocks like the Russell 2000 Index leading the way, investors are witnessing a dynamic shift in market sentiment. This recent trend highlights an opportune moment to explore undervalued small-cap stocks, particularly those with insider actions that suggest potential unrecognized value amidst current economic conditions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 8.8x | 2.0x | 46.80% | ★★★★★☆ |

| Nexus Industrial REIT | 2.6x | 3.2x | 16.98% | ★★★★☆☆ |

| Ramaco Resources | 14.2x | 1.1x | 10.15% | ★★★★☆☆ |

| Guardian Capital Group | 10.5x | 4.1x | 31.02% | ★★★★☆☆ |

| CVS Group | 20.6x | 1.1x | 42.45% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.4x | -89.31% | ★★★★☆☆ |

| Titan Machinery | 4.2x | 0.1x | 18.98% | ★★★★☆☆ |

| Russel Metals | 9.4x | 0.5x | -9.94% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Freehold Royalties | 15.8x | 6.8x | 47.34% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

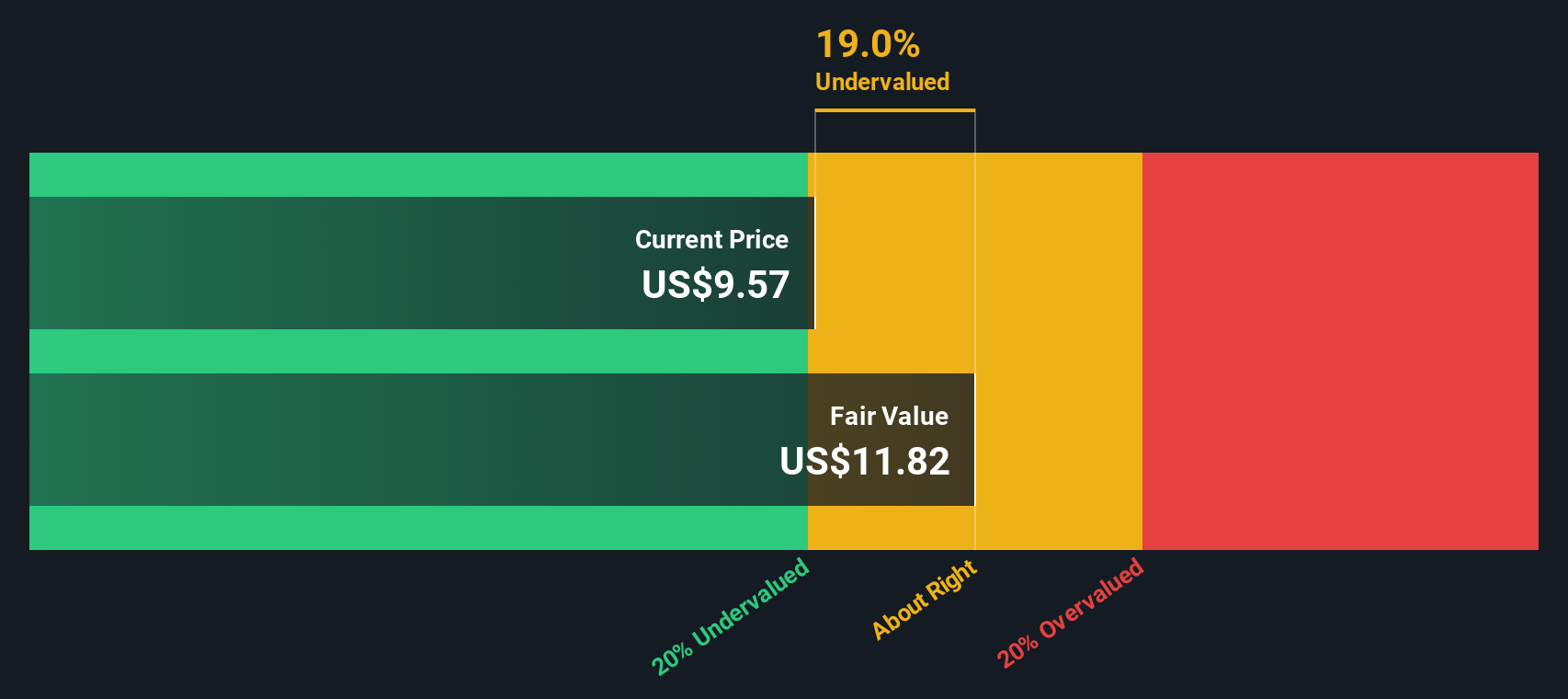

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sirius Real Estate is a company that specializes in owning and operating business parks, offices, and industrial complexes in Germany.

Operations: Property Investment generates €289.40 million in revenue, with a notable gross profit margin of 57.50%. This segment incurs substantial operating expenses, impacting its net income margin which stands at 37.25%.

PE: 16.3x

Recently, Sirius Real Estate has demonstrated significant insider confidence with Craig Hoskins purchasing 218,283 shares, a substantial increase of nearly 94% in their holdings. This move aligns with the company's strategic capital raising activities, including a follow-on equity offering of £152.5 million to bolster its acquisition strategy across Germany and the U.K. Despite facing challenges like a 6.3% annual decline in earnings over the past five years and reliance on higher-risk funding sources, Sirius's recent financial results show resilience with an increase in net income to €107.8 million from €79.6 million year-over-year and an uplift in dividends by 2.35%. These actions underscore a proactive approach to growth and shareholder value enhancement amidst operational hurdles.

Hertz Global Holdings (NasdaqGS:HTZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hertz Global Holdings operates as a vehicle rental company primarily through its two segments, Americas RAC and International RAC, with a market capitalization of approximately $2.15 billion.

Operations: Americas RAC and International RAC generated revenues of $7.73 billion and $1.67 billion respectively, with a gross profit margin peaking at 44.61% in recent quarters. The company's net income has shown significant variability, reaching as high as $2.06 billion in a recent quarter.

PE: 5.9x

Hertz Global Holdings, recently shifted to the Russell 2000 Index, reflecting its smaller market cap and potential for growth. Amidst a challenging landscape with a $392 million Q1 loss and strategic missteps in its EV investments, insider confidence remains evident as they recently purchased shares. This move could signal belief in the company's revamped leadership strategy to streamline operations and enhance profitability. With new executives onboard specializing in commercial strategy and fleet management, Hertz aims to recalibrate its service offerings effectively.

- Click here to discover the nuances of Hertz Global Holdings with our detailed analytical valuation report.

Understand Hertz Global Holdings' track record by examining our Past report.

Leggett & Platt (NYSE:LEG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Leggett & Platt is a diversified manufacturer that produces a variety of engineered components and products, including bedding, specialized products, and furniture, flooring & textile items, with operations spanning multiple market segments.

Operations: The entity generates its revenue from three main segments: Bedding Products, Specialized Products, and Furniture, Flooring & Textile Products, with respective incomes of $1.91 billion, $1.28 billion, and $1.46 billion. Over the observed period, Gross Profit Margin fluctuated between 17.88% and 24.47%.

PE: -10.6x

Leggett & Platt, a company with significant market fluctuations, recently saw insider confidence bolstered by purchases that signal strong belief in its potential. Despite a challenging quarter where net income dropped to US$31.6 million from US$53.5 million year-over-year and a lowered dividend, the firm is actively seeking acquisitions and aiming for strategic growth. With earnings expected to rise by 40% annually and leadership changes positioning Karl G. Glassman at the helm, this entity appears poised for recovery and expansion.

- Click here and access our complete valuation analysis report to understand the dynamics of Leggett & Platt.

Gain insights into Leggett & Platt's past trends and performance with our Past report.

Make It Happen

- Click this link to deep-dive into the 224 companies within our Undervalued Small Caps With Insider Buying screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SRE

Sirius Real Estate

Engages in the investment, development, and operation of commercial and industrial properties in Germany and the United Kingdom.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives