- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

3 UK Growth Stocks With High Insider Ownership Growing Earnings Up To 87%

Reviewed by Simply Wall St

In the current UK market landscape, the FTSE 100 has faced challenges due to weak trade data from China, reflecting broader global economic uncertainties. Amidst these conditions, identifying growth stocks with high insider ownership can be appealing as they often indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 74.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 88.2% |

| Manolete Partners (AIM:MANO) | 35.6% | 38.1% |

| Kainos Group (LSE:KNOS) | 20.5% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Foresight Group Holdings (LSE:FSG) | 34.7% | 20.1% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| Afentra (AIM:AET) | 37.7% | 31.6% |

Let's review some notable picks from our screened stocks.

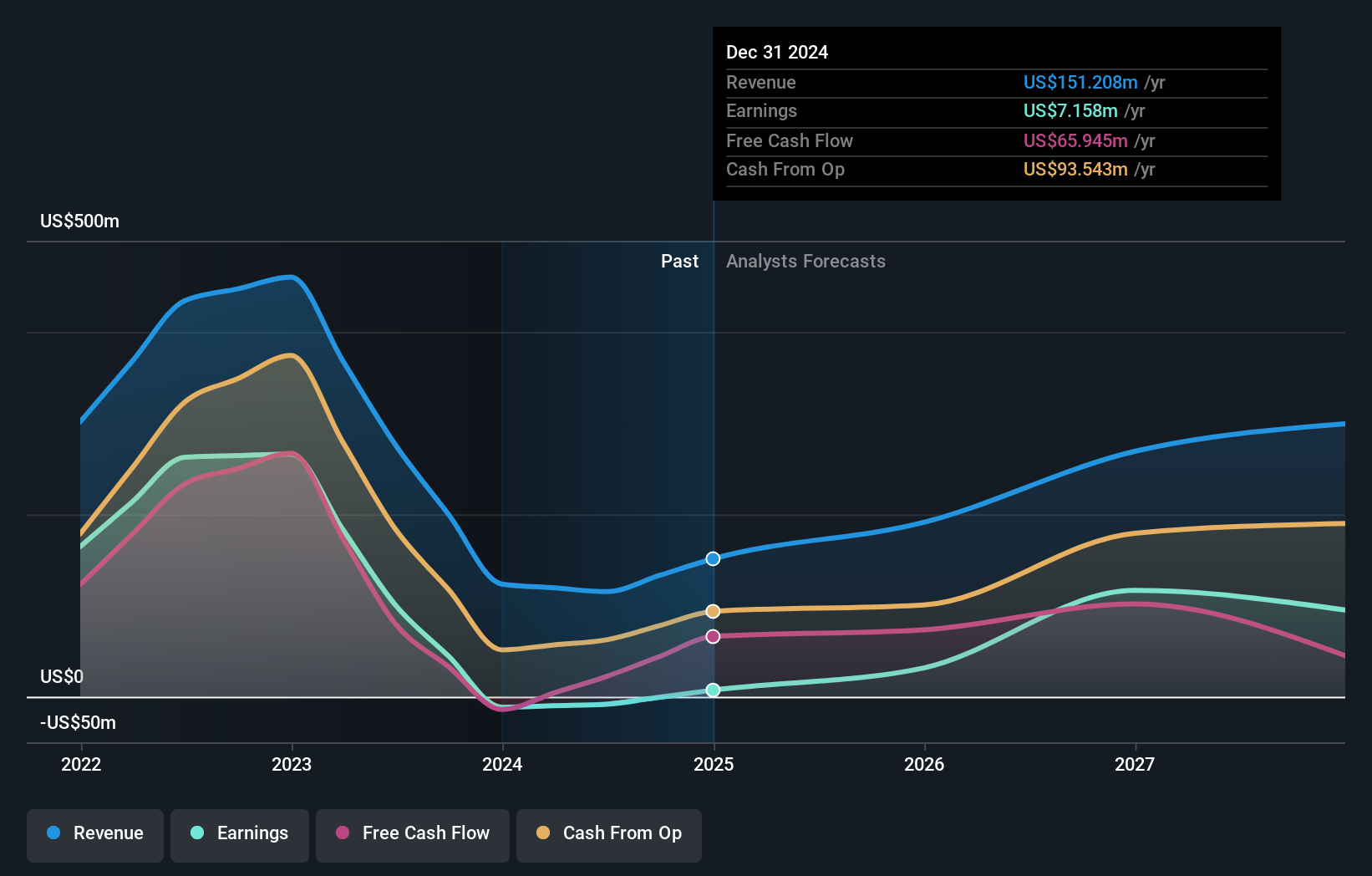

Funding Circle Holdings (LSE:FCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market cap of £373.96 million.

Operations: The company generates revenue through its FlexiPay service in the United Kingdom, amounting to £26.40 million, and from Term Loans in the United Kingdom, which contribute £146.90 million.

Insider Ownership: 15%

Earnings Growth Forecast: 60.8% p.a.

Funding Circle Holdings, with significant insider ownership, has seen its earnings and revenue grow faster than the UK market. Despite some insider selling recently, the company remains on a growth trajectory, supported by robust financial partnerships. Recent deals include a £300 million agreement with TPG Angelo Gordon and Barclays and a £750 million commitment from Waterfall Asset Management. The company expects at least £200 million in revenue for 2026 while continuing share buybacks.

- Click to explore a detailed breakdown of our findings in Funding Circle Holdings' earnings growth report.

- The analysis detailed in our Funding Circle Holdings valuation report hints at an inflated share price compared to its estimated value.

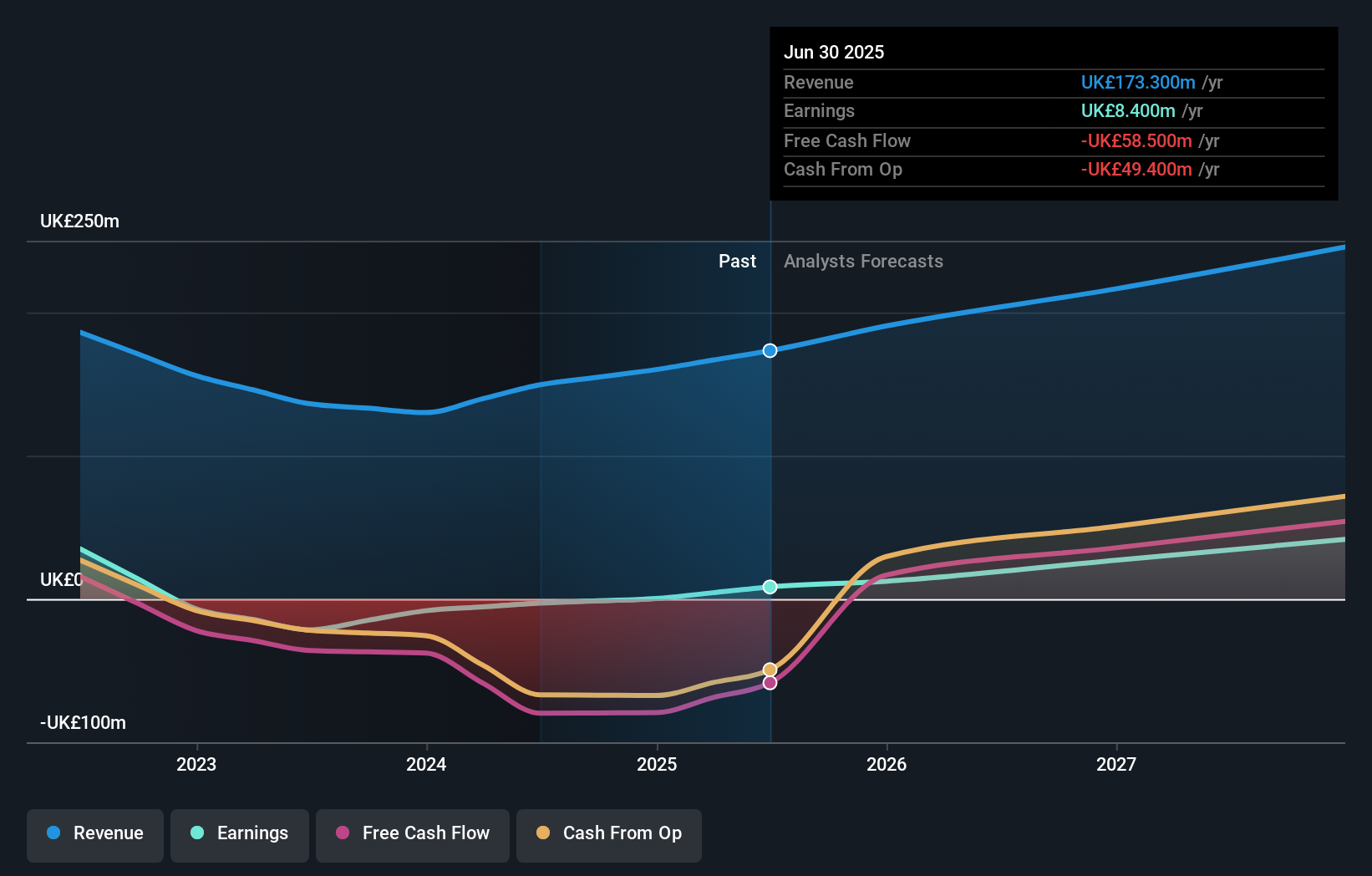

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gulf Keystone Petroleum Limited focuses on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of approximately £376.11 million.

Operations: The company's revenue is primarily derived from its exploration and production activities in the oil and gas sector, amounting to $163.17 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 87.8% p.a.

Gulf Keystone Petroleum's growth potential is bolstered by significant insider ownership, with revenue forecast to grow 18.8% annually, outpacing the UK market. Expected profitability within three years highlights its growth trajectory despite a challenging dividend sustainability due to earnings coverage issues. Recent agreements with the Kurdistan Regional Government and Federal Government of Iraq for crude exports may enhance financial stability, improving realised prices to over $30/bbl during an interim period as international export routes resume.

- Navigate through the intricacies of Gulf Keystone Petroleum with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Gulf Keystone Petroleum is priced higher than what may be justified by its financials.

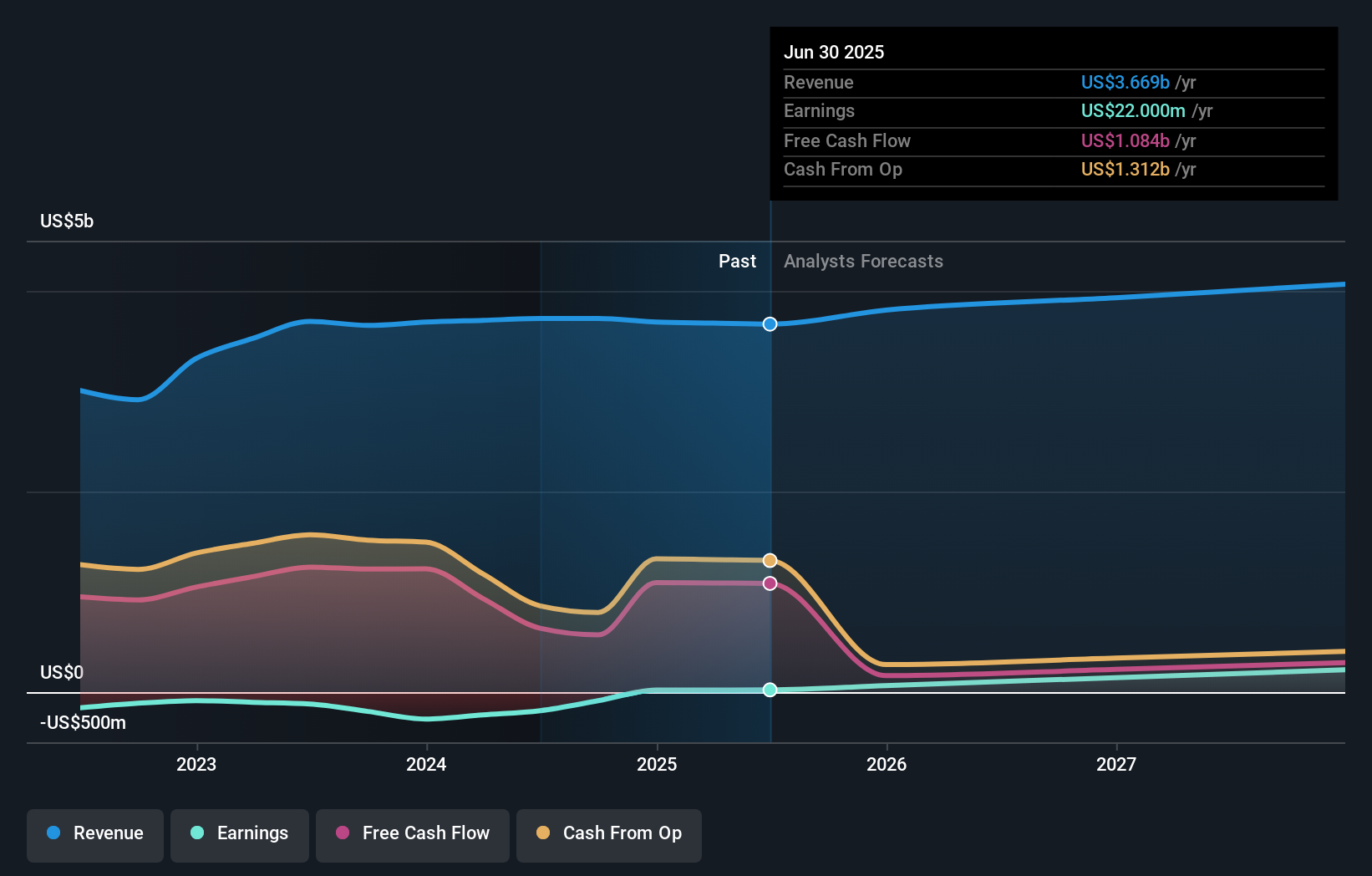

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of £2.23 billion.

Operations: The company's revenue segments include Digital and Professional Services, which generated $373 million.

Insider Ownership: 25.6%

Earnings Growth Forecast: 71.5% p.a.

International Workplace Group's growth prospects are driven by high insider ownership and a forecasted 71.5% annual earnings growth, significantly outpacing the UK market's 14.5%. Despite slower revenue growth at 3.6% annually, analysts expect a stock price increase of 22.6%. Recent profitability marks progress, yet negative shareholder equity and insufficient interest coverage pose financial challenges. The Q3 sales statement on November 4, 2025, provides further insights into its performance trajectory.

- Click here to discover the nuances of International Workplace Group with our detailed analytical future growth report.

- Our expertly prepared valuation report International Workplace Group implies its share price may be too high.

Summing It All Up

- Gain an insight into the universe of 59 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success