- Canada

- /

- Energy Services

- /

- TSX:PSI

Exploring 3 Undervalued Small Caps With Insider Activity In Global Markets

Reviewed by Simply Wall St

As global markets grapple with trade tensions and recession fears, small-cap stocks have faced significant pressure, evident in the recent declines of key indices like the Russell 2000. Despite these challenges, easing inflation offers a glimmer of hope for economic stability, presenting potential opportunities for investors exploring small-cap stocks that exhibit strong fundamentals and insider activity.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Macfarlane Group | 10.5x | 0.6x | 40.64% | ★★★★★★ |

| Nexus Industrial REIT | 5.4x | 2.8x | 25.81% | ★★★★★★ |

| Bytes Technology Group | 22.8x | 5.8x | 11.49% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 22.22% | ★★★★★☆ |

| Minto Apartment Real Estate Investment Trust | 8.4x | 3.4x | 21.82% | ★★★★★☆ |

| Hong Leong Asia | 8.7x | 0.2x | 46.94% | ★★★★☆☆ |

| Gamma Communications | 21.3x | 2.2x | 39.06% | ★★★★☆☆ |

| Sing Investments & Finance | 7.3x | 3.7x | 36.20% | ★★★★☆☆ |

| Optima Health | NA | 1.7x | 41.28% | ★★★★☆☆ |

| Saturn Oil & Gas | 7.1x | 0.5x | -37.57% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

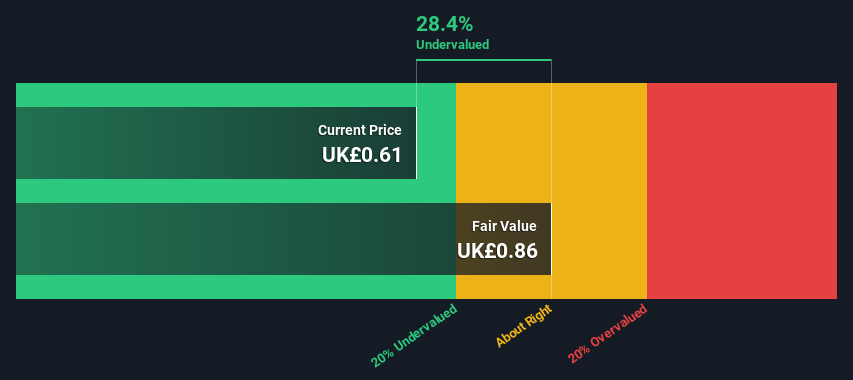

Foxtons Group (LSE:FOXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Foxtons Group is a UK-based real estate agency specializing in property sales, lettings, and financial services with a market capitalization of approximately £0.11 billion.

Operations: The company generates revenue primarily from three segments: Sales (£48.57 million), Lettings (£106.03 million), and Financial Services (£9.33 million). The gross profit margin has shown variability, with a notable decline from 100% in earlier periods to approximately 63.97% in recent years, reflecting changes in cost structures or pricing strategies over time.

PE: 13.9x

Foxtons Group, a small company in the real estate sector, recently reported strong financial performance with sales reaching £163.93 million for 2024, up from £147.13 million the previous year. Net income also rose significantly to £14 million from £5.49 million. Despite relying entirely on external borrowing for funding, which poses higher risk, insider confidence is evident through recent share purchases by management. The proposed dividend increase to 1.17 pence per share reflects positive momentum and growth potential in the market.

- Click to explore a detailed breakdown of our findings in Foxtons Group's valuation report.

Gain insights into Foxtons Group's historical performance by reviewing our past performance report.

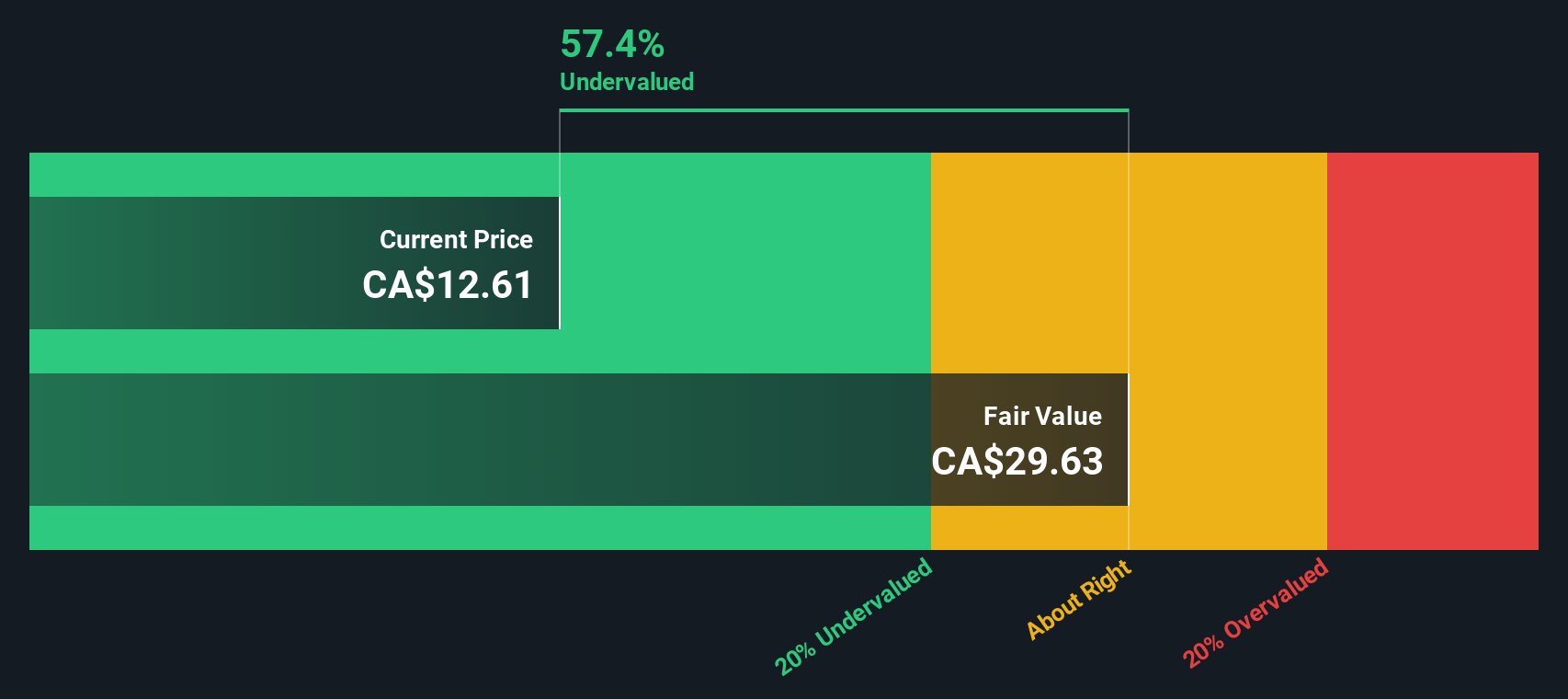

Pason Systems (TSX:PSI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pason Systems is a company that provides specialized data management systems for the oil and gas industry, focusing on drilling operations, with a market capitalization of CA$1.14 billion.

Operations: The company generates revenue primarily from North American Drilling, contributing CA$283.26 million, with additional streams from International Drilling and Completions. Over recent periods, the gross profit margin has shown a varied trend, reaching 65.83% in June 2023 before declining to 59.51% by September 2024. Operating expenses have fluctuated but remain significant relative to revenue figures across the observed periods.

PE: 8.7x

Pason Systems, a smaller company in the market, recently reported annual sales of C$414.13 million, up from C$369.31 million the previous year, with net income rising to C$121.5 million from C$97.54 million. Despite forecasts of declining earnings by 10.1% annually over three years and reliance on external borrowing for funding, insider confidence is evident through share purchases between October and December 2024 totaling 661,200 shares for C$10 million. This reflects potential optimism amid challenges in growth projections and funding risks.

- Get an in-depth perspective on Pason Systems' performance by reading our valuation report here.

Review our historical performance report to gain insights into Pason Systems''s past performance.

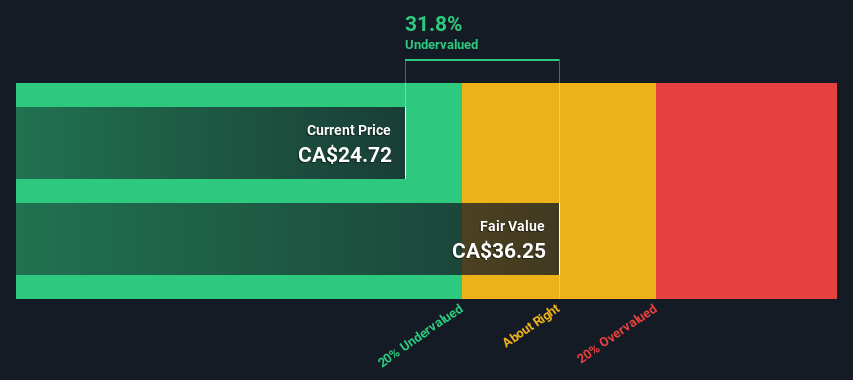

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Westshore Terminals Investment operates as a key player in the transportation infrastructure sector, specializing in coal export services, with a market capitalization of CA$2.01 billion.

Operations: Westshore Terminals Investment generates revenue primarily from its transportation infrastructure segment, with a recent quarterly revenue of CA$404.73 million. The company has experienced fluctuations in its gross profit margin, which reached 48.99% in the latest quarter ending December 2024. Operating expenses and non-operating expenses are notable components affecting net income, with operating expenses recorded at CA$20.89 million and non-operating expenses at CA$62.14 million for the same period.

PE: 13.3x

Westshore Terminals, a smaller company in the terminal operations sector, recently projected 2025 volumes at 26.5 million tonnes with an average loading charge of $13.55. Despite stable earnings per share of CAD 1.86 for 2024 and increased revenue to CAD 404.73 million, net income slightly dipped to CAD 115.25 million from the previous year. Insider confidence is evident with recent share purchases, although future earnings are expected to decline by an average of 1.7% annually over the next three years due to reliance on external borrowing for funding rather than customer deposits or other lower-risk sources.

Make It Happen

- Gain an insight into the universe of 140 Undervalued Global Small Caps With Insider Buying by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PSI

Pason Systems

Provides instrumentation and data management systems for oil and gas drilling in Canada, the United States, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)